TL;DR

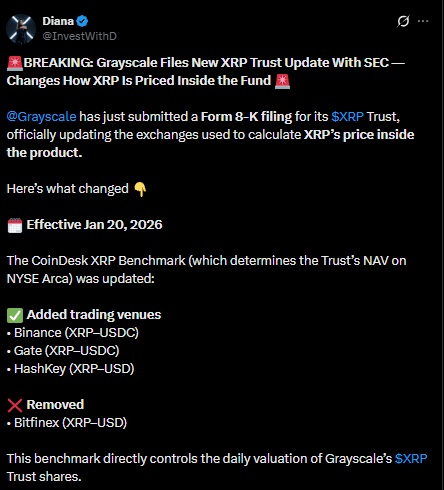

- Grayscale filed an update with the SEC that adjusts the pricing calculation for its XRP Trust; the change has been in effect since January 20, 2026.

- The revision centers on the CoinDesk XRP Benchmark, which adds Binance, Gate, and HashKey to better reflect current liquidity and removes Bitfinex from the index.

- The new framework alters the daily formation of the NAV and the market value of the shares for both institutional and retail investors.

Grayscale submitted a formal update to the SEC that modifies the pricing methodology for its XRP Trust. The change became effective on January 20, 2026, and directly affects the daily determination of the fund’s net asset value (NAV), which is listed on NYSE Arca.

Grayscale Removes Bitfinex From the Index

The update focuses on the CoinDesk XRP Benchmark, the index used to set the reference price for the trust’s shares. Grayscale adjusted the list of exchanges included in the benchmark to more accurately reflect liquidity and trading activity in the XRP market. The new framework adds high-volume platforms such as Binance, Gate, and HashKey, while removing Bitfinex from the set of venues considered.

The CoinDesk XRP Benchmark operates by aggregating prices from multiple exchanges to establish a uniform daily valuation for the trust. By changing the data sources used, the update affects how the fund’s NAV is calculated and, as a result, the price at which the shares trade in the secondary market.

According to market analysts cited in the filing, the update may lead to variations in the daily NAV by altering the relative weight of different trading venues within the index. These changes affect both institutional and retail investors with indirect exposure to XRP through Grayscale’s product.

The Importance of the CoinDesk XRP Benchmark

The SEC filing falls within the periodic adjustments that regulated financial vehicles make to maintain consistency between reference prices and actual market conditions. In this case, the focus was on aligning the benchmark with the liquidity centers that currently dominate XRP trading.

The CoinDesk XRP Benchmark is a core input for the trust’s valuation. The accuracy of the NAV depends on the quality and representativeness of the underlying data, making exchange selection a decisive factor in the product’s structure.

The Grayscale XRP Trust is one of the main institutional instruments linked to XRP in the U.S. market. Its listing on NYSE Arca provides a regulated avenue for exposure to Ripple’s token for investors who do not trade directly in spot markets