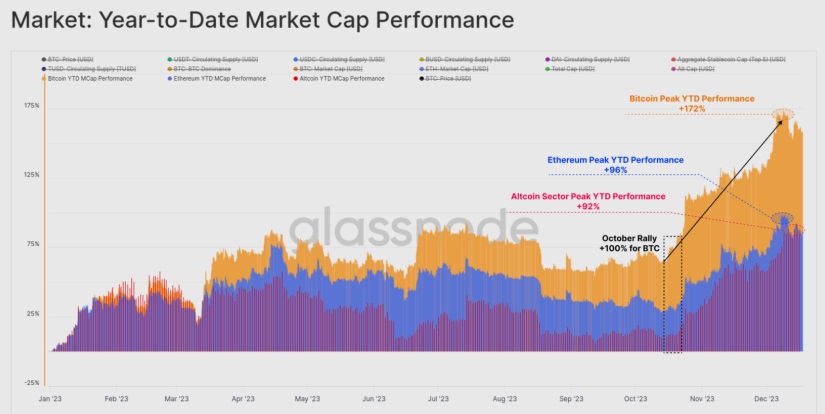

Glassnode’s annual on-chain review for 2023 highlights an exceptional year for digital assets, with Bitcoin leading the way after experiencing an impressive 172% surge. Ethereum and other altcoins also performed well, recording a 90% growth in their market capitalizations.

A notable aspect of the Glassnode’s report was the remarkable lack of depth in price corrections throughout the year. Historically, bullish and recovery phases in the Bitcoin market were often accompanied by significant corrections, often exceeding 25%. However, in 2023, the deepest correction was limited to 20%, suggesting a favorable balance between supply and demand.

The cryptocurrency market surpassed multiple on-chain technical and price models throughout the year. A key milestone was breaking through the psychological level of $30,000 in October, marking a crucial turning point for institutional capital flows.

The introduction of inscription transactions on the BTC network also had a notable impact. These transactions embed data such as text files and images in transaction signatures, leading to a significant increase in miner revenues, surpassing even block rewards.

2023 Was a Highly Positive Year, and 2024 Looks Very Promising

Ethereum, while experiencing slower growth compared to BTC, witnessed positive developments. The Shanghai upgrade and the increase in Layer 2 activity demonstrated steady progress in the network’s maturity.

Long-term holders maintain a substantial portion of Bitcoin off exchanges, indicating a trend toward long-term retention. Furthermore, the majority of coins are now in profitable territory, thanks to the rapid recovery since October.

In the derivatives space, options markets surpassed futures markets in size, signaling growing institutional interest. The Chicago Mercantile Exchange (CME) overtook Binance in open interest in futures, reflecting a shift toward institutional participation in these markets.

The Glassnode’s report also emphasized the crucial role of stablecoins, which, after a decline, experienced growth from October. Tether reaffirmed its dominance as the largest stablecoin, surpassing others in terms of market capitalization.

Undoubtedly, 2023 was a positive year for digital assets, characterized by strong performance, significant technical advancements, and increased institutional participation in derivative markets. With upcoming events such as the potential approval of a U.S.-based ETF and the next Bitcoin halving in April 2024, an intriguing and promising scenario is set for the next year in the cryptocurrency space.