TL;DR

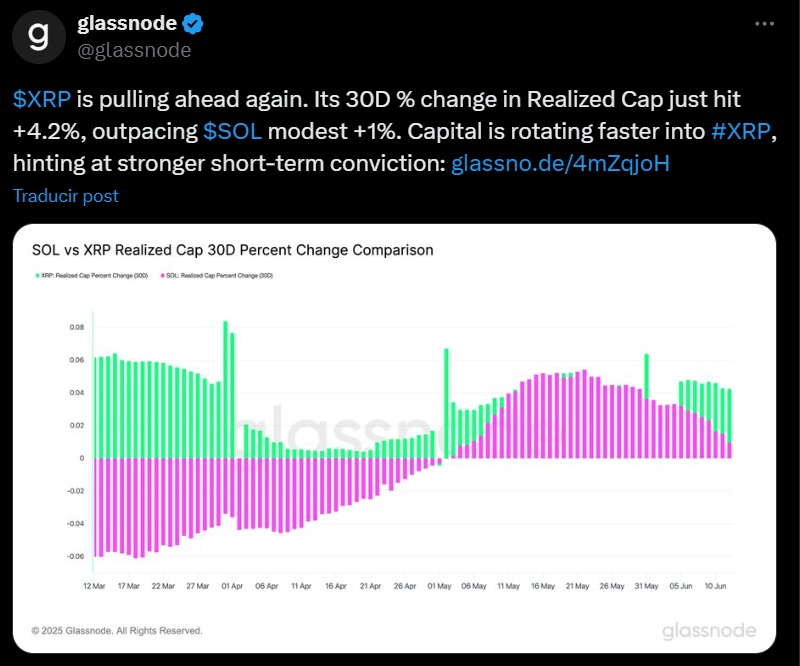

- XRP’s Realized Cap jumped 4.2% in 30 days, far surpassing Solana’s 1%, with faster capital rotation reflecting stronger short-term appetite.

- Companies like Webus, VivoPower, and Wellgistics allocated over $470 million to XRP for their corporate treasuries, with Trident set to add another $500 million.

- Solana dropped 9% in 24 hours, now trading at $145.8, amid a profit-taking wave that triggered $1.18 billion in market liquidations.

XRP regained momentum in the market after clearly outperforming Solana. According to Glassnode, the Realized Cap of Ripple’s token rose 4.2% over the past 30 days, well ahead of Solana’s 1% increase.

This metric measures the market value based on the last price at which each token moved, offering a precise estimate of the wealth stored in an asset. The data suggests capital is rotating into XRP at a faster pace, driven by traders and investors betting on short-term price appreciation.

XRP Begins to Emerge as a Reserve Asset

While Solana drew attention for a potential spot ETF and steady growth in its developer ecosystem, XRP quietly advanced with solid on-chain performance. Its current price hovers around $2.13, and at the same time, several companies have started adding it to their corporate treasury strategies. Webus International, VivoPower, and Wellgistics collectively allocated over $470 million to the token, showing its value as a reserve asset in corporate balance sheets.

Additionally, Trident, a Nasdaq-listed software firm, announced plans to raise $500 million to allocate to its treasury in XRP. These moves confirm the growing interest among companies seeking to modernize and diversify their reserves with highly liquid, large-cap digital assets.

Solana Falls 9%

On the legal front, Ripple and the SEC jointly filed to dissolve the current injunction and cancel the $125 million civil penalty. This agreement could bring an end to one of the longest and most contentious regulatory disputes in the crypto industry, setting an important precedent for the market’s future.

Meanwhile, Solana is in a correction phase. After five consecutive days of gains that pushed it to $168 on June 11, SOL has now posted three straight days of losses. At the time of writing, it’s trading at $145.8, down 9% in the last 24 hours, amid a wave of profit-taking that triggered $1.18 billion in liquidations across the market.