TL;DR

- Gary Gensler concludes his tenure at the SEC with a decisive rejection of Solana spot ETFs, reinforcing his reputation for systematically obstructing crypto innovation.

- The SEC has maintained a political and restrictive stance, blocking financial products related to cryptocurrencies without clear justification or regulatory consistency.

- Gensler’s administration leaves a legacy of endless litigation and a stifled crypto market in the United States.

Gary Gensler’s tenure as chairman of the United States Securities and Exchange Commission (SEC) is coming to an end, but he seems determined to make it as disastrous as possible until his final day.

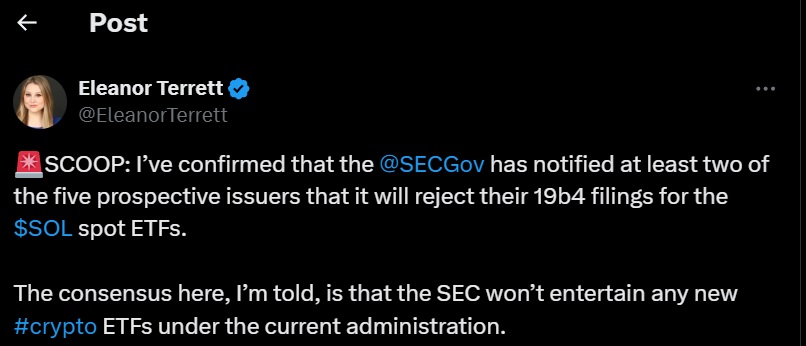

The latest controversy surrounding Gensler involves the SEC’s decision to reject applications for spot exchange-traded funds (ETFs) based on Solana (SOL). This represents one last rejection by the agency before it presumably adopts new guidelines under the leadership of Donald Trump’s incoming team.

The SEC’s refusal surprised no one, as the regulatory body and its chairman have been a constant headache for the crypto industry. During Gensler’s tenure, the agency adopted a nearly immovable stance against any spot cryptocurrency ETFs.

According to reports, at least two of the five issuers seeking to list Solana ETFs have been notified that their proposals will be rejected. The agency operates under an implicit policy of stalling the development of financial products related to cryptocurrencies—a strategy many see as more political than regulatory.

This recurrent behavior of blocking any progress in the sector highlights that under Gary Gensler’s leadership, the SEC has deliberately focused on maintaining the financial status quo, limiting investors’ access to new tools.

The lack of clear justification for these decisions is alarming. While Bitcoin and Ethereum futures-based ETFs have been approved, assets like Solana have encountered regulatory barriers built on inconsistent arguments. The SEC justifies its stance by claiming that SOL and other assets lack regulated futures markets that minimize manipulation risks, deliberately ignoring the sector’s significant advances in transparency and security.

Gary Gensler and the SEC Have Caused Lasting Damage

The animosity is evident, and no exhaustive analysis is needed to see it. Gensler and the current SEC leadership have chosen to place one obstacle after another. This was once again demonstrated when they classified Solana (SOL) as an unregistered security in multiple lawsuits.

The crypto industry has not hesitated to call out the hypocrisy of Gensler and his administration. Under his leadership, the SEC has prioritized endless litigation—such as lawsuits against Ripple and Binance—over working with the sector to establish a regulatory framework that fosters innovation. This hostile stance has stifled cryptocurrency growth in the United States and jeopardized the country’s competitiveness in a sector that could be crucial for its economic future.

The possibility of a political shift in 2025, bringing leadership more open to cryptocurrencies, fuels hope that this era of regulatory blockades may come to an end. However, the damage caused by Gensler’s administration could have long-term repercussions, leaving the United States lagging behind more progressive markets.