TL;DR

- Cryptocurrency adoption remains stable in the US, UK, France, and Singapore, according to Gemini’s report.

- 57% of cryptocurrency owners feel comfortable incorporating cryptocurrencies into their investments.

- Crypto ETFs, especially in the US, have driven adoption and attracted institutional investment.

Cryptocurrency adoption remains stable in key countries for the industry, such as the United States, the United Kingdom, France, and Singapore, according to the “Global State of Crypto 2024” report by Gemini.

Despite the market ups and downs over the past two years, the study shows that cryptocurrency ownership has not undergone significant changes in these nations. This indicates a persistent confidence among investors in the potential of cryptocurrencies as part of their portfolios.

The Gemini report notes that the majority of cryptocurrency owners, 57%, feel comfortable including cryptocurrencies in their investments, reflecting a positive perception of them as a long-term option.

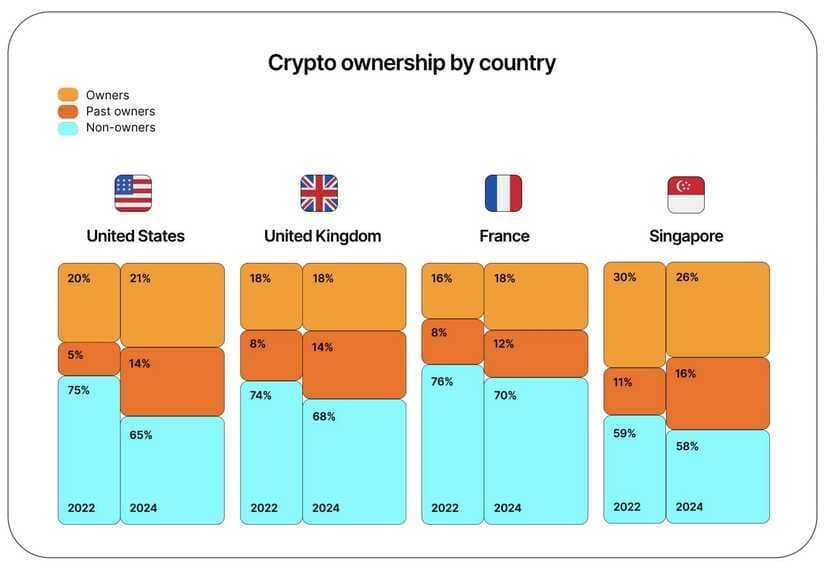

Users by Country

In the United States, 21% of respondents own cryptocurrencies, a figure that has remained constant since 2022. In the UK, this figure stands at 18%, while in France, there has been a slight increase from 16% to 18%. Singapore, however, saw a slight decrease, from 30% to 26% in the past two years.

One of the most significant factors in Gemini’s report is the growing acceptance of cryptocurrency ETFs, particularly in the United States, where nearly 37% of users are linked to the industry through these financial products. This trend has been driven by the approval of Bitcoin and Ethereum spot ETFs, which have attracted significant institutional investment flows and reinforced their adoption.

However, the report also highlights existing challenges to achieving mass adoption. Lack of regulatory clarity remains a barrier for many potential investors. In the United States and the UK, around 38% of non-cryptocurrency owners indicated that regulatory concerns hinder their entry into the market, while in Singapore, this percentage rises to almost half of the respondents.

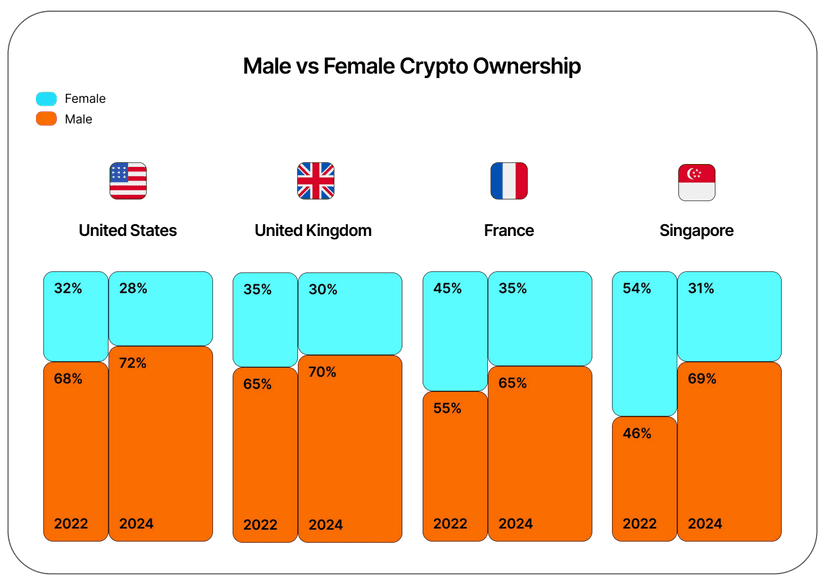

Gemini Addresses Gender gap and Politics in the Industry

Another relevant aspect of Gemini’s report is the persistent gender gap in cryptocurrency ownership. In 2024, only 31% of cryptocurrency owners are women, a decrease from 42% in 2022. There is still work to be done to balance female participation in the industry.

Additionally, the influence of cryptocurrencies now extends into the political realm, especially in the United States, where the majority of owners plan to consider candidates’ digital asset policies in the upcoming presidential elections.

Despite regulatory challenges and market fluctuations, cryptocurrency adoption continues to show signs of resilience and growth, driven by new investment opportunities and increasing interest from investors.