TL;DR

- Evernorth, a newly formed Nevada-based crypto firm backed by Ripple, raised over $1 billion to buy XRP on the open market.

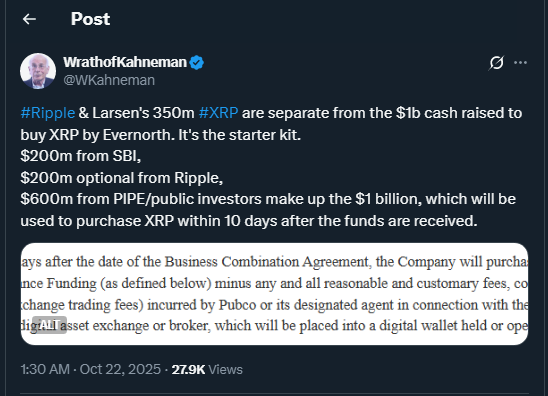

- Ripple Labs and SBI Holdings lead the funding round, contributing $400 million collectively.

- XRP purchases will start within 10 days and will be held in regulated, insured, and audited custody. Ripple and co-founder Chris Larsen’s 350 million XRP remain separate from this fund, ensuring independence.

Evernorth Holdings has revealed plans to deploy a $1 billion fund to acquire XRP from the open market within 10 days. The initiative aims to create one of the largest publicly held XRP treasuries, providing institutional investors with regulated and audited exposure to the cryptocurrency. The firm is structured to operate under U.S. and international financial rules, with XRP stored in fully insured and independently audited custody accounts. The company also plans to explore partnerships with additional exchanges and trading platforms to ensure liquidity and minimize market impact.

Strategic Funding Led by Ripple and SBI Holdings

The $1 billion funding mix includes $200 million from SBI Holdings, Ripple’s longtime Asian partner, and an optional $200 million commitment from Ripple Labs and its foundation, Rippleworks. The remaining $600 million comes from a PIPE and public investors managed via Armada Acquisition Corp II, the SPAC supporting Evernorth’s upcoming Nasdaq listing. SBI confirmed that its contribution will directly fund XRP acquisitions, aiming to strengthen the Evernorth platform and support broader ecosystem growth. Evernorth executives also emphasized that the fund will help drive educational initiatives and market transparency for institutional participants.

Evernorth Purchases Separate from Ripple and Larsen Holdings

Despite Ripple’s involvement, the $1 billion fund is entirely independent from Ripple and co-founder Chris Larsen’s 350 million XRP holdings, which remain on Ripple’s balance sheet and Larsen’s personal accounts. Analysts note that this open-market acquisition could become one of the largest institutional XRP purchases in history, comparable to major Bitcoin acquisitions in prior bull markets. Following the announcement, XRP briefly surged and is currently trading near $2.40, signaling strong market interest. Market participants are watching closely as this fund could influence trading volumes and set new benchmarks for institutional digital asset strategies.

Looking Ahead for Nasdaq Listing

Evernorth’s platform is expected to begin trading on Nasdaq under the ticker XRPN in early 2026, offering both institutional and retail investors exposure to XRP through a regulated, transparent vehicle. This strategic move highlights increasing institutional adoption of digital assets and further strengthens the XRP market without drawing directly from Ripple or Larsen’s personal holdings.