TL;DR

- Evernorth reached a reserve of 261,819,198 XRP valued at $625.7 million — more than half of its $1 billion target.

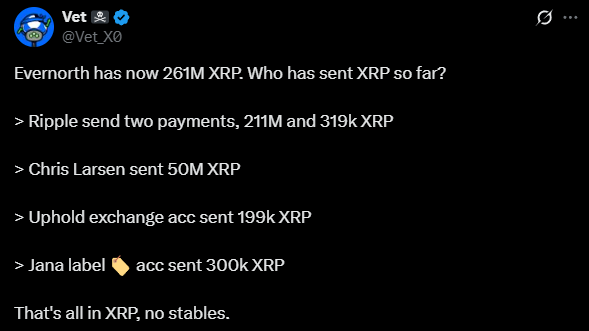

- Ripple, Chris Larsen, Uphold, and Jana Label participated in the initial transfers, aimed at funding product expansion and treasury governance.

- The firm plans to integrate the RLUSD stablecoin to enable regulated DeFi services and expects to complete its Nasdaq listing under the ticker XRPN.

Evernorth, the institutional vehicle backed by Ripple to strengthen XRP adoption, has reached a reserve of 261,819,198 tokens, equivalent to $625.7 million.

This amount represents more than half of the company’s $1 billion goal, set to create the largest public XRP treasury and list on Nasdaq under the ticker XRPN.

A Structure Dedicated to XRP

The project, presented as the first institutional framework focused exclusively on XRP, aims to enhance the token’s liquidity and offer regulated exposure to its ecosystem. Evernorth emerged from institutional interest in native assets from mature blockchain networks and seeks to become a bridge between traditional capital and the on-chain economy of the XRP Ledger.

According to a report from the validator known as Vet, Ripple transferred two installments of 211 million and 319,000 XRP, while its cofounder and chairman, Chris Larsen, contributed 50 million. Uphold added 199,000 XRP, and Jana Label contributed 300,000 XRP. These allocations are part of a broader funding plan designed to support product expansion, treasury governance, and the development of new on-chain use cases.

Evernorth to Integrate RLUSD

Evernorth plans to integrate Ripple USD (RLUSD) as an on-ramp for DeFi services within the XRP Ledger ecosystem. The use of RLUSD will enable non-custodial liquidity and credit instruments tailored for institutional investors.

The company also announced a business combination agreement designed to raise more than $1 billion in gross proceeds, with completion expected in Q1 2026. The objective is to establish a public company focused on XRP treasury management, featuring an open governance structure and the highest regulatory standards, comparable to exchange-traded funds (ETFs).

If completed as planned, Evernorth will become the largest corporate custodian of XRP and a key component in the integration of tokenized assets and stablecoins within the ecosystem