TL;DR

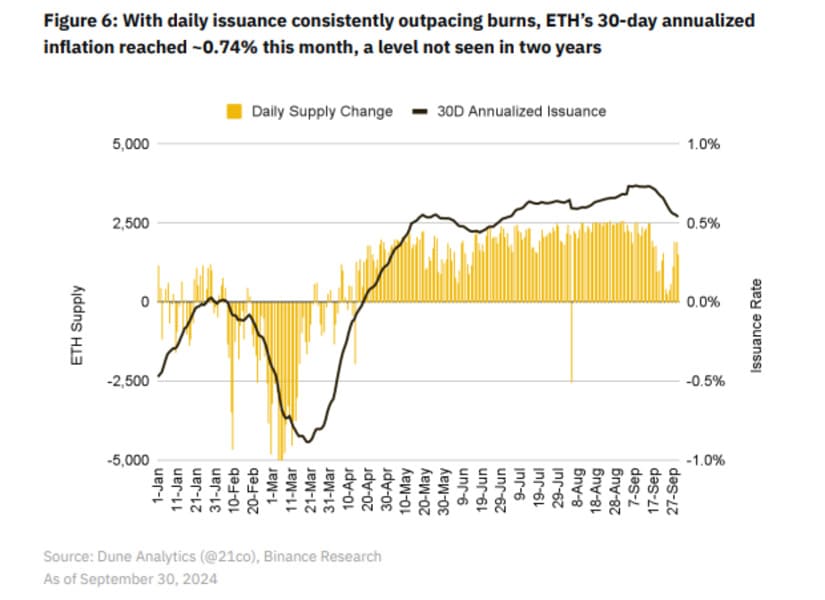

- Ethereum’s inflation has reached 0.74%, the highest level in two years, raising doubts about its status as “ultrasound money.”

- The adoption of layer 2 solutions like Arbitrum and Optimism has reduced gas fees, limiting the burning of ETH and affecting the total supply.

- Vitalik Buterin supports a reduction of the minimum deposit for solo staking, from 32 ETH to a range of 16 to 25 ETH, to encourage participation in the network.

Ethereum’s inflation rate has reached its highest level in the last two years, standing at 0.74%, according to a recent report from Binance Research.

This increase raises questions about Ethereum’s ability to maintain its status as “ultrasound money,” an idea that promotes ETH as a deflationary asset. The increase in the cryptocurrency’s supply has generated concern among analysts, who point out that the reduction in activity on the main network has limited the impact of ETH burning, a key mechanism for controlling its inflation.

Layer 2 Solutions and the Reduction of Gas Fees

One of the most important factors behind this phenomenon is the growing adoption of layer 2 solutions, such as Arbitrum and Optimism. These networks allow transactions to be processed outside of Ethereum’s main blockchain, significantly reducing gas fees.

However, the decrease in fees also results in a lower amount of ETH burned through transactions, affecting the network’s ability to maintain a limited supply. Ethereum Improvement Proposal (EIP) 1559, introduced in 2021, implemented a mechanism to burn a portion of transaction fees, with the goal of keeping inflation under control, but the decline in network activity has made this mechanism less effective in recent months.

Ethereum Inflation Expected to Decrease

Additionally, the increase in ETH issuance has outpaced the burn rates, resulting in a net increase in total supply. With this ongoing consolidation trend, the idea that ETH can continue to be a deflationary cryptocurrency in the near future is called into question, especially if current market conditions persist. Despite this, Binance pointed out that Ethereum’s inflation remains below 1% and does not view this change as necessarily negative. In fact, during periods of higher network activity, inflation is expected to decrease again.

More Stakers for More Activity

On the other hand, Ethereum co-founder Vitalik Buterin has expressed support for a proposal to reduce the amount of ETH required for users to participate in solo staking. Currently, validators must lock up 32 ETH to operate a node, but Buterin advocates for reducing this minimum to a range of 16 to 25 ETH, which could incentivize greater participation in the network and potentially counteract some of the current inflationary effect by increasing the amount of ETH locked in staking