TL;DR

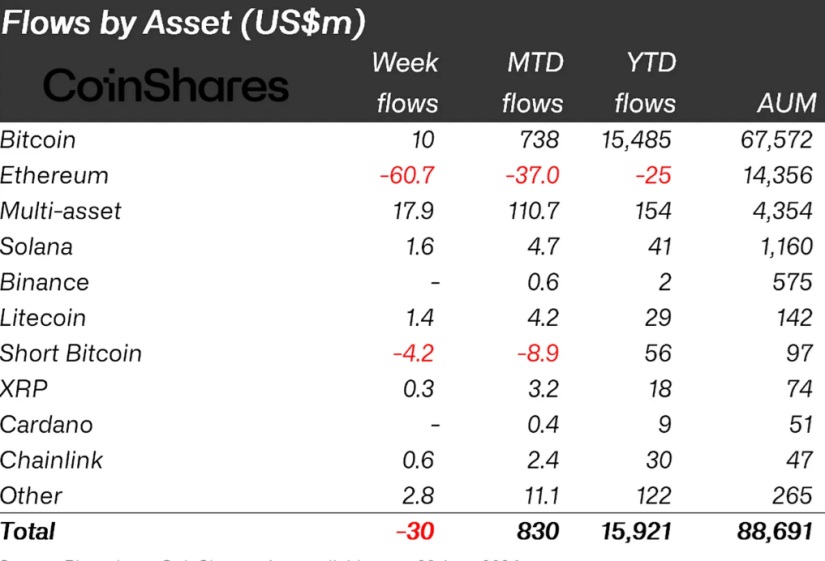

- Digital asset investment products experienced significant fluctuations in their capital flows, with a general trend of net outflows totaling $30 million.

- Ethereum saw outflows of $61 million in the last week and $119 million over the past two weeks, positioning it as the worst-performing asset of the year.

- Regionally, the United States, Brazil, and Australia were the main beneficiaries of capital inflows, while Germany, Hong Kong, Canada, and Switzerland faced significant outflows.

In recent weeks, digital asset investment products have experienced significant fluctuations in their capital flows. The general trend has been net outflows, totaling $30 million in the third consecutive week of outflows. However, last week showed a considerable reduction in outflows, which could indicate an imminent change in trend.

Ethereum, in particular, has recorded the largest outflows since August 2022, reaching $61 million in the last week and accumulating a total of $119 million over the past two weeks. This behavior has positioned Ethereum as the worst-performing asset of the year in terms of net flows, showing a possible loss of confidence among investors.

In contrast, multi-asset investment products and Bitcoin ETPs led capital inflows with $18 million and $10 million, respectively. The positive flow towards BTC, along with the increase in outflows from short Bitcoin investment products totaling $4.2 million, suggests a change in sentiment towards this cryptocurrency, turning towards optimism. Other digital assets have also experienced significant fluctuations; altcoins like Solana and Litecoin recorded inflows of $1.6 million and $1.4 million, respectively.

Ethereum Suffers Despite Optimism

Regionally, the United States, Brazil, and Australia have been the main beneficiaries of capital inflows, with $43 million, $7.6 million, and $3 million, respectively. However, not all markets followed the same path. Germany, Hong Kong, Canada, and Switzerland faced significant outflows, losing $29 million, $23 million, $14 million, and $13 million, respectively. These data reflect a mixed sentiment in the global cryptocurrency and digital asset market.

The trading volume of digital assets grew by 43% last week, reaching $6.2 billion. Despite this increase, trading volumes are still below the weekly average of $14.2 billion recorded so far this year. This means that although there was a significant increase in trading activity, the market has not yet fully recovered its usual pace.

Regarding blockchain-related stocks, the situation is also complicated. Despite the optimism in the industry this year, blockchain company stocks have suffered outflows of $545 million, approximately 19% of assets under management (AuM).