Extreme fear grips the crypto market after June 8 losses. Amid the market-wide drawdown, Ethereum wasn’t spared.

The coin plunged roughly 11 percent shrinking to as low as $2.3k as bears press their liquidation pedal, compounding the misery for HODLers.

Still, many are optimistic, expecting the coin to steady at spot rates and flourish specifically against Bitcoin.

Proponents of Ethereum cites its inherent programmability and incoming changes as prime factors that will thrust ETH/USD prices higher in the days ahead.

The selling pressure, pushing the coin to new lows in a correction, could be the pullback of a catapult, ahead of a mega ride high towards $4.5k—or better.

ETH/BTC Daily Chart Shows No Fear in The Crypto Market

Expressly, according to Delphi Digital, the ETH/BTC daily chart, despite technical candlestick arrangement suggesting fragilities, doesn’t point to general fear in the market.

At present, what’s needed is for Ethereum to decouple from Bitcoin.

Ethereum supporters expect this decoupling to take place in the next few weeks, especially after the activation of the London hard fork, integrating proposals of EIP-1559.

If the shift isn’t consequential to price action, ETH prices will rely on BTC’s performance in the short term.

ETH could rely on Bitcoin’s Performance

Visible from the chart, Bitcoin is under pressure as traders take profit.

Triggers of BTC’s sell-off include comments from Elon Musk about the network’s energy efficiency and rumors of government crackdowns.

Combined, these weigh down BTC which in turn causes a dump-down across the board.

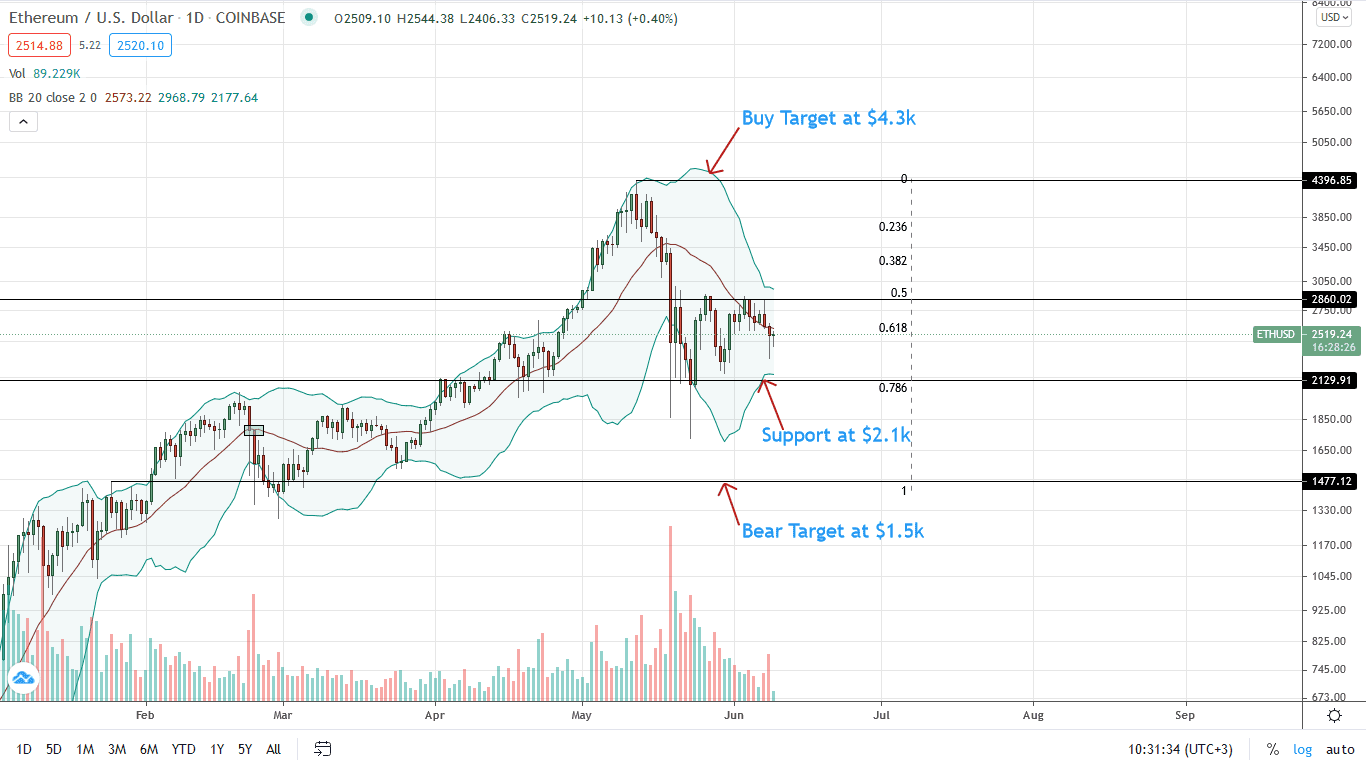

Ethereum Price Analysis

The ETH price is stable on the last trading day.

From the daily chart, ETH/USD contracted from $2.9k, printing lower and below the middle BB.

Even though prices are within May 24 bull bar, the May 19 bear bar defines the medium-term price action and carries more weight, according to chartists.

As such, bears stand a chance as we advance. However, if bulls clear $2.9k, rewinding losses of June 8, odds of a bull trend continuation towards $3.4k—May 19 highs—could be on the table.

On a more pessimistic analysis, confirmation of early this week’s losses is enough to push ETH back towards May 2021 lows of around $2.1k.

Further losses could trigger another wave of sellers, angling for $1.5k.

Chart Courtesy of Trading View

Disclosure: Opinions Expressed Are Not Investment Advice. Do Your Research.

If you found this article interesting, here you can find more Ethereum News