The Ethereum price revival continues as the coin inches closer to $2k and back to Feb 2021 highs.

The Recovery of ETH Prices

As of writing on Mar 10, the second most valuable digital currency is trading above $1.8k, adding 19 percent on the last week alone. Most notably for traders is the confidence among investors. More investors are willing to invest in the digital asset, holding the coin as part of its reserve, supplementing cash.

This is because Ethereum is one of the most actively developed platforms in the top-10 that’s widely adopted, solving real-world problems.

Presently, the focus is addressing the high Gas fee problem. Because of expensive Gas, it is hard for ordinary people to use DeFi, taking advantage of the opportunities presented by open finance.

Accordingly, developers reckon that a timely resolution will have a knock-out effect, sparking the use of Ethereum in the long term, a positive for the network, miners, and ETH as a facilitating agent.

London Hard Fork and EIP-1559

EIP-1559, despite the resistance from miners, is to streamline how they work to prioritize the well-being of the community over their bottom line.

Because of the shift and overhaul of the first-auctioning system for a base fee that’s destroyed, causing ETH supply (inflation) to reduce gradually, network users will be in charge of proceeding.

In return, miners would earn block reward, network-wide reasonable transaction fees, and a miner tip for users who would want their transactions prioritized.

Altogether, the eventual resolution through this proposal’s activation via London Hard fork may cause prices to edge even higher.

Ethereum Price Prediction

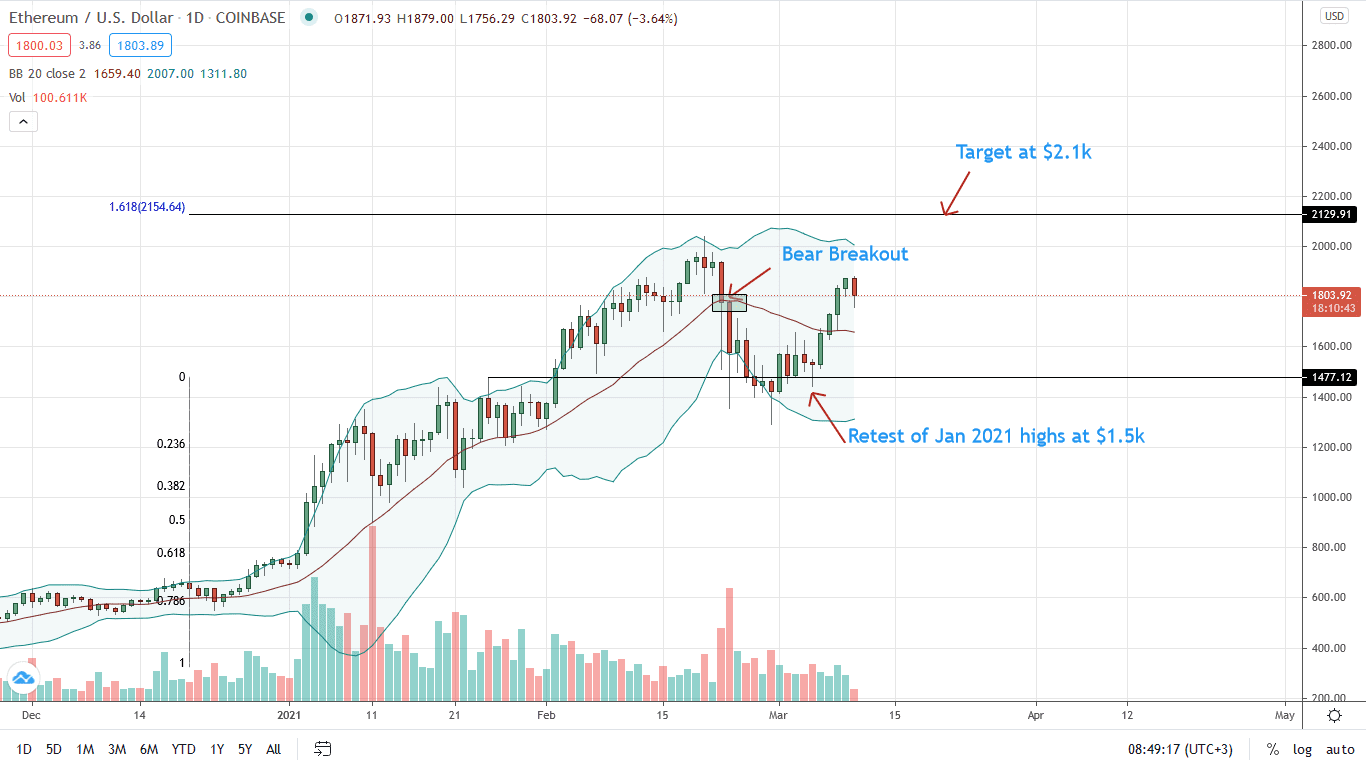

The Ethereum price is stable on the last day, adding 19 percent week-to-date.

ETH/USD bulls are back in contention from the daily chart, shaking off determined sellers of the last few days.

The confirmation of Feb 28 and Mar 1 double-bar bullish reversal pattern at the back of decent trading volumes could prime ETH buyers aiming for $2k and $2.1k in the medium term.

Technically, from an Effort-versus-Result perspective, the reversal of Feb 22-23 losses is with lower trading volumes. Therefore, the uptrend may not be firm.

While aggressive traders may find an opportunity, confirmation of Mar 9 bulls and a breakout above $2k with relatively higher trade volumes could pump ETH/USD to higher valuation beyond $2.1k to $3.2k—the 2.618 Fibonacci extension level of the Dec to January 2021 trade range.

Chart Courtesy of Trading View

Disclosure: Opinions Expressed Are Not Investment Advice. Do Your Research.

If you found this article interesting, here you can find more Ethereum News