Ethereum bulls are rampant. The price on a tear, and traders greedy. Leading crypto assets are trending at new 2020 levels. While Bitcoin has nearly recouped 2018 losses, Ethereum is half-way through the journey.

At the time of writing, the coin was trading a few dollars below $600. Impressively, the coin has more than doubled and up over 4.5X from Jan 1 reading. The extent of the bull stretch points to an active network propped by valid activity, a divergence away from events of late 2017 when Ethereum and other smart contracting platforms were pinned as sources for scammy ICO projects with glitzy whitepapers and nothing else to show.

Pumping Ethereum prices is based on success. A few days back it appeared untenable and odds too insurmountable.

However, in a FOMO-driven four days, not only did whales and companies issue a rallying call for the timely launch of the Beacon Chain mainnet and Eth2, but it shows the community’s determination not to disappoint and postpone the activation of yet another milestone upgrade. For reference, there were glitches and dumping delays in most of the Metropolis-phase hard fork.

At the time of writing, the target has been reached (and surpassed) with satisfactory validator distribution. On Dec 1, 2020, at 12 PM UTC, the Beacon Chain mainnet will launch.

Although there were opportunity cost concerns and whatnots pinned on mouth-watering DeFi APRs, staking and locking up ETH (possible for over a year) is for the good of the community. For their commitment, early adopters receive 22 percent APR as rewards with the APR sliding as more coins are staked.

Ethereum Price Analysis

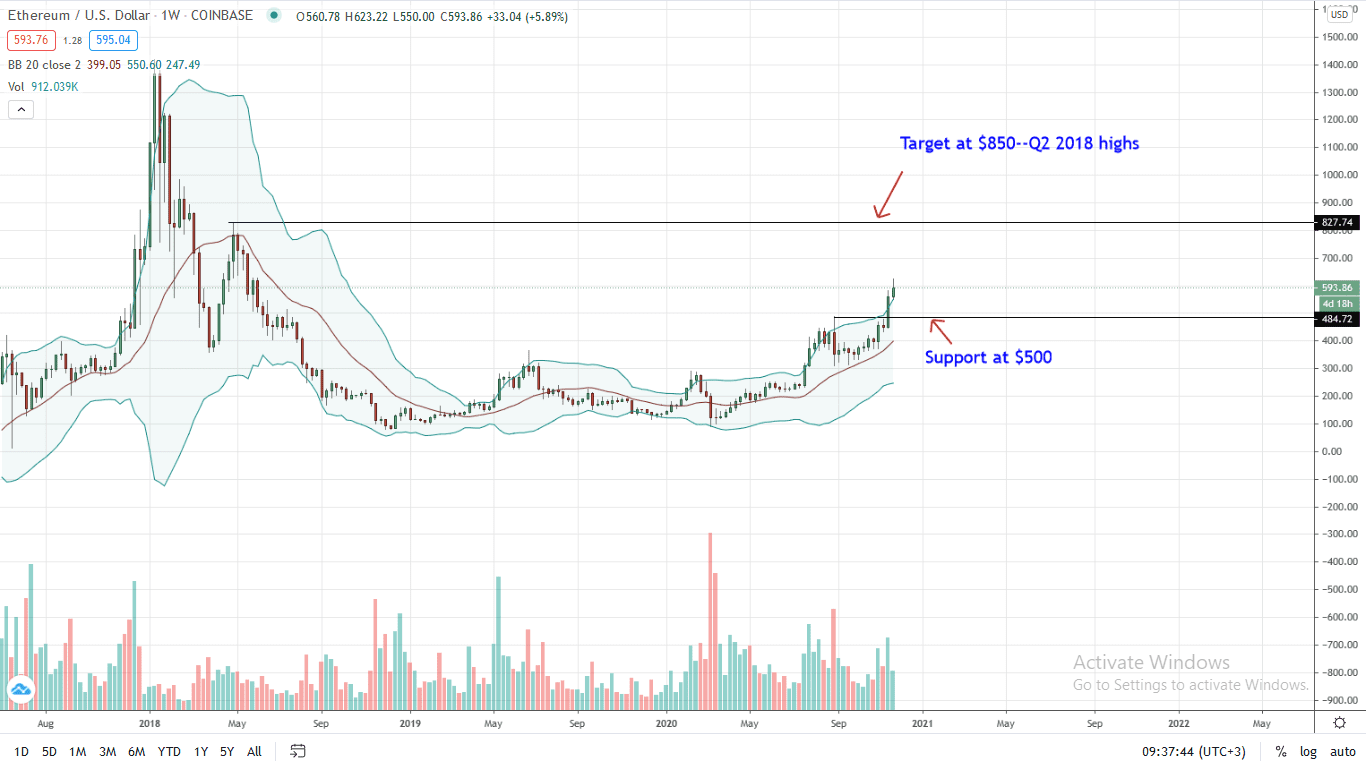

In the weekly chart, the uptrend is firm. The ETH price is up 24 percent week-to-date, but contracting in the last 24 hours.

Regardless, buyers are in the driving seat. Technically, every low is a buying opportunity.

From the weekly chart, the first level of support is $500, or Aug 2020 highs. A level lower, another support level is $300 or June 2019 highs.

Candlesticks are banding along with the upper BB hinting at a possible trend continuation. If ETH and BTC prices are positively correlated, the coin may be undervalued. There may be hints to justify this position.

Accompanying this week’s uptick were average trading volumes paling in comparison to those recorded in March 2020 and not anywhere those of Q3 and 4 2017. As such, there may be a chance that FOMO hasn’t set in, pushing prices to Q2 2018 highs of $850.

Chart courtesy of Trading View

Disclaimer: Views expressed are those of the author and are not investment advice. Do your research.

If you found this article interesting, here you can find more Ethereum News