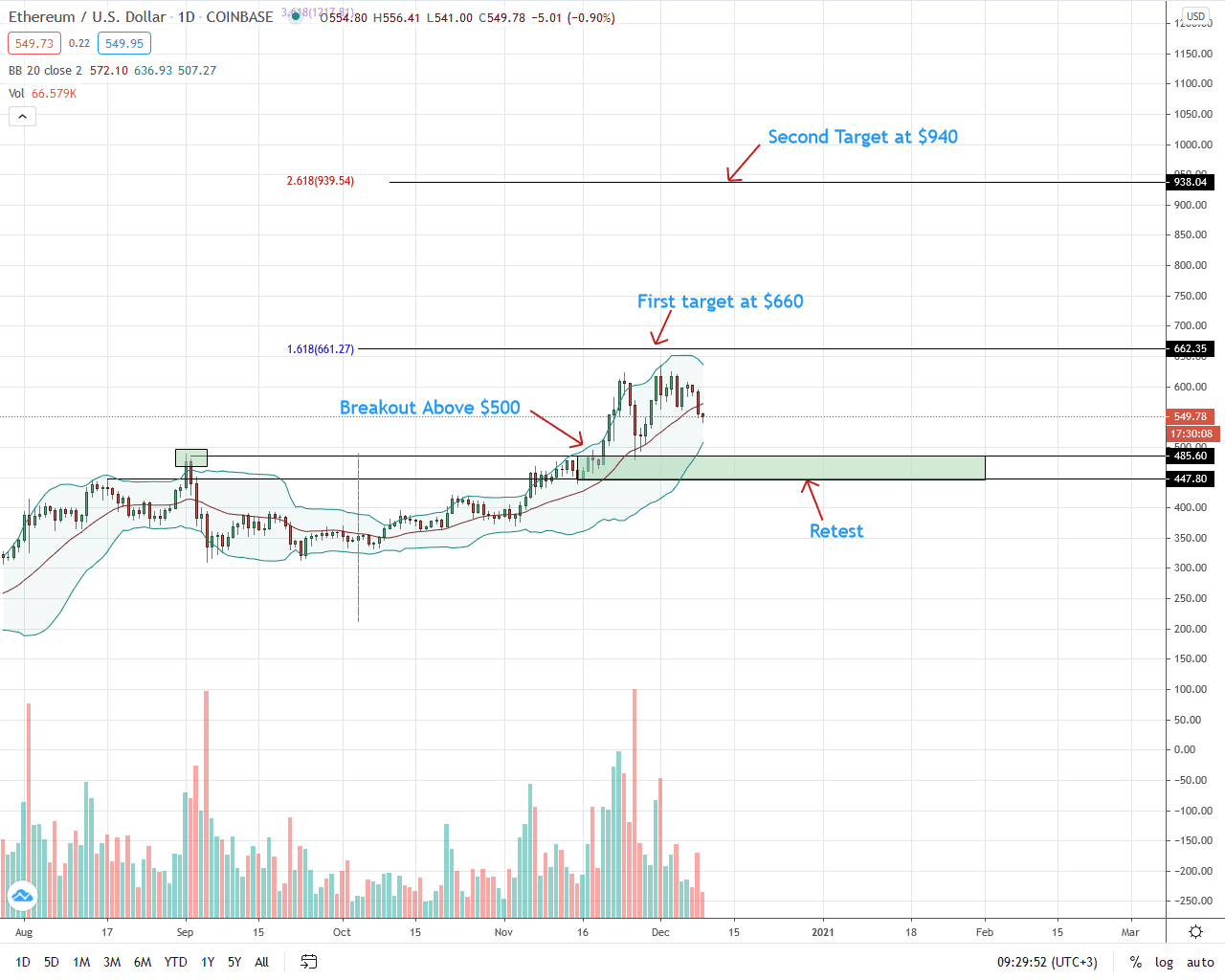

The Ethereum price is wavy, bouncing in a narrow $90 channel in lower time frames. Technically, every high is a selling opportunity for aggressive traders as long as prices oscillate below $640. It is 2020 highs and a strong liquidation level in the medium term, assuming bulls drive prices higher, blasting above critical sell walls.

Staking Translates to a Supply Shock

On the fundamental front, validators are mopping up excess ETH, locking them up in the Beacon Chain mainnet.

With every coin withdrawn from circulation, the remaining ETH remain on demand digital assets since it is a utility within the broader Ethereum network.

From DeFi, gaming, art, and gambling, all transactions are settled in Gas denominated in ETH. Therefore, as Eth2 becomes more decentralized it translates to more buy pressure, supporting bulls aiming for $640 and $660 in the short term.

According to Vitalik Buterin, over one percent of the network’s total supply is locked in the official deposit contract. It doesn’t account those coins locked in “ETH sinks” like yETH and those used as collateral for borrowing loans in lending platforms like Maker, and others.

Some Investors are “Ethereum Only” Says Grayscale

Meanwhile, a Grayscale Investment executive has revealed that the maturing crypto space is breeding new type of investors who are “Ethereum only.”

The regulated New York-based firm is a conduit for institutional grade investors seeking exposure in cryptocurrencies and in this case, ETH.

Owing to the coin’s performance, eclipsing Bitcoin’s despite the most valuable network halving in May, institutions are training their eyes on Ethereum considering its potential now that it is transiting, keen on doing away with the high transaction fees plaguing Eth1.

Ethereum Price Forecast

At the time of writing, the Ethereum price is down six percent versus the greenback on the last day of trading and week-to-date, respectively.

The immediate support line is the 20-day moving average and $550 on the downside. After yesterday’s slide and retest of the middle BB, further losses below the flexible support level could see the ETH/USD price slide back towards $500 or $480 (September and August 2020 highs) in a retest.

This will confirm the Dec 1 bear bar and signal the beginning of a reversal set in motion by Nov 26 bear bar.

Of note, prices are still oscillating inside Dec 1 bear bar. With light trading volumes, sellers are in control unless there is a break above $640 at the back of high trading volumes exceeding those of Nov 26 (Coinbase data).

In this case, the probability of the ETH price rallying to $660—the 161.8 percent Fibonacci extension level of July to September 2020 trade range will be high.

On the flip side, if today’s bar closes below the middle BB—as it is the case, the ETH/USD price could trickle to $500 in a retest.

Chart Courtesy of Trading View

Disclosure: Opinions Expressed Are Not Investment Advice. Do Your Research.

If you found this article interesting, here you can find more Ethereum News