There is an erring similarity between the dot com bubble and the current state of crypto prices, billionaire Mark Cuban notes. Most, he continues, will fail, leaving but a few to thrive. Among those that may find strong roots, sail off with utility as tailwinds are Bitcoin, Ethereum, and a select few.

Ethereum May Survive the Purge

A big chunk of the over 4,500 crypto projects, nonetheless, will fail. Mark has not shied away from showing his disapproval of Bitcoin and crypto in general. At one point in time, he said, he would rather hold bananas—and eat them when hungry, than Bitcoin, which he said had no intrinsic value.

However, from his tweet, it appears that the billionaire is thawing, saying that a few of them, like Ethereum, actually stand a chance.

A shift from his previous stance, the billionaire’s subtly support of the project is when an increasing number, including millionaires and hedge funds, prefer being open to the idea of crypto as a development layer that may power the next revolution.

Solutions for High Fees as Ethereum is the Home of DeFi

Ethereum, more like Bitcoin, enjoys a first-mover advantage, and many investors are training their eyes on the project.

Developers are at work, creating solutions to resolve the outrageously high Gas fees and launch another consensus algorithm replacing miners blamed for the unacceptably high fees; the network is also emerging as the home of DeFi.

There was over $20 billion worth of assets under management by different DeFi protocols as of writing. Given its prospects, ETH is quickly shaking off Jan 11 losses and is steady above $1k.

Ethereum Price Prediction

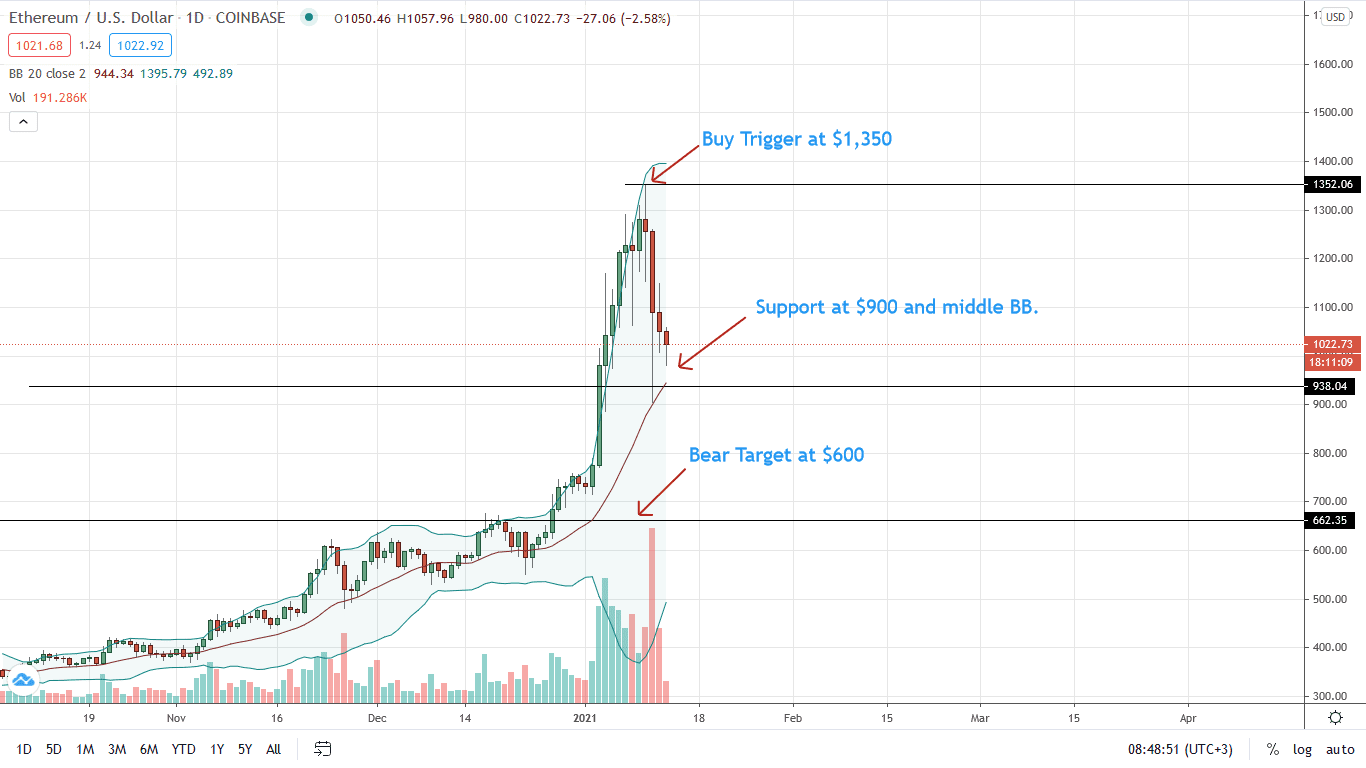

The ETH/USD price is down five percent in the last week.

Although traders are confident, expecting even more gains, the path of least resistance in the immediate term is bearish. Bulls appear exhausted and have failed to shake off the losses of Jan 11. The result is a confirmation of losses and a flag off for sellers to dump on pullbacks.

However, the ETH price’s medium-term trajectory depends on the state of price action by the close of this week. A bear bar will complete a double bar bear pattern, a signal that the bull trend is over and sellers are angling for $600 or worse.

In the immediate term, every high within Jan 11 trade range is an opportunity for sellers to unload with first targets at $900 and later $660. The $900 mark is around the middle BB, while $660 is around the highs of December 2020.

A slide to $600 will confirm a retest, and only then, the ETH/USD price may recover.

Sharp gains above $1250—Jan 11 high, will nullify this projection.

Chart Courtesy of Trading View

Disclosure: Opinions Expressed Are Not Investment Advice. Do Your Research.

If you found this article interesting, here you can find more Ethereum News