The Ethereum price is hovering below $600 less than 12 hours of Eth2 launching. It is monumental for the network, ushering in a period of better usability and efficiency.

Eth2 launch marks the activation of a project that has been worked on for over six years. The transition from the Homestead to Metropolis, and now the Beacon Chain mainnet points at how deep Ethereum is and how developer dense the project is.

Unlike Bitcoin, Ethereum is more than a transactional layer. Its native currency can be used to pay fees and send value but can also be merged with other processes.

The rise of DeFi points to one of its advantages. In less than a year, DeFi dApps now lock over $14 billion.

As it is and with changes being made at the protocol layer to enhance the network and integrate new features, the eventual scalability of Ethereum will rid the high Gas fees trouble and truly make finance open.

At the height of the DeFi craze back in September, Gas fees shot to as high as $14, benefiting farmers but at the expense of other facets of the network like gaming and more.

While Eth2 is live, the revamped network is also set to be the most decentralized. At the time of writing, the Beacon Chain mainnet is secured by over 21k validators.

Like miners, they play a crucial part in validating transactions. For their participation, validators who locked up 32 ETHs ahead of Genesis will receive 22 percent in APR.

Ethereum Price Analysis

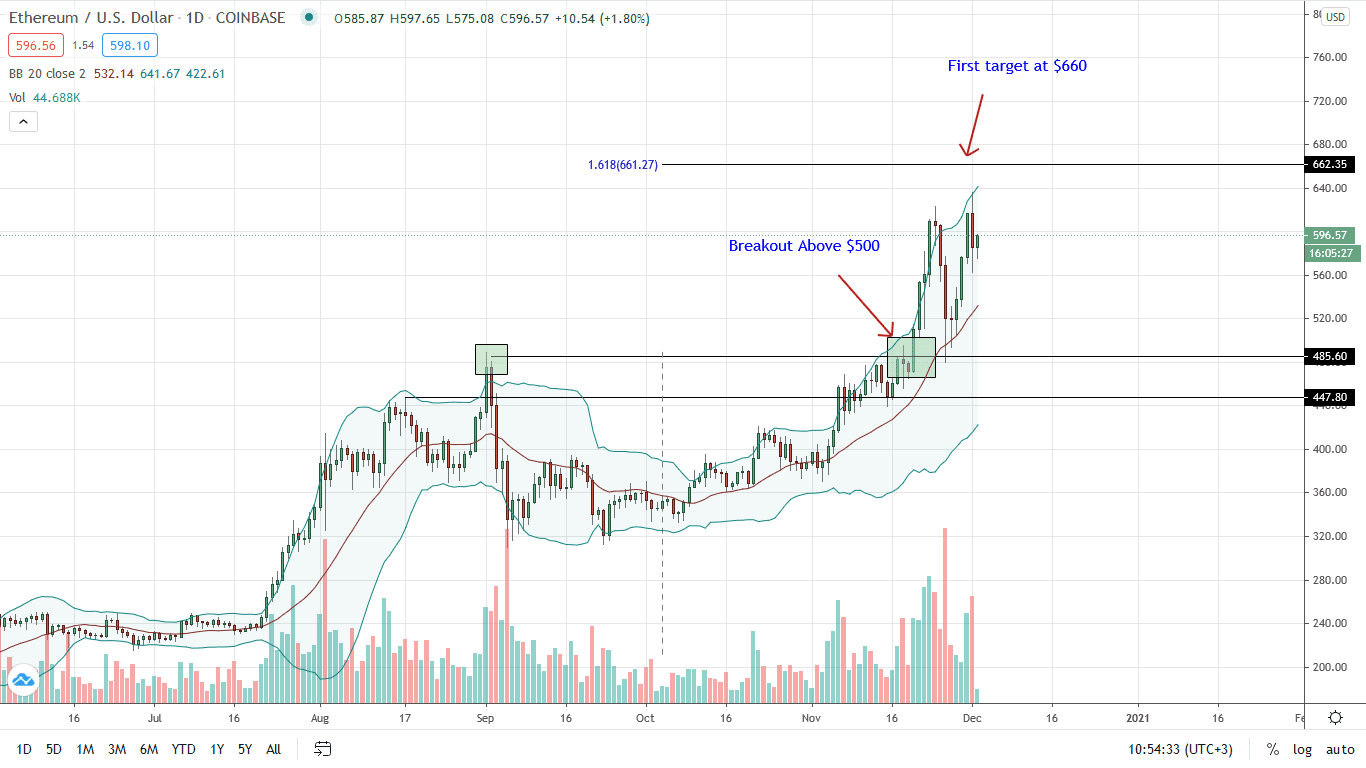

The Ethereum price is trading within a bullish breakout pattern. At the time of writing (Dec 2), the coin was slightly down versus the USD in the last week of trading but had recouped some of last week’s losses.

However, for trend continuation, there must be further higher highs above the consolidation. Notably, the ETH/USD pair is within a breakout pattern.

After choppy price movement of last week marked by contraction and correction of Nov 23 and 24 over-extension, the reversal from the 20-day moving average with an increase in trading volumes hints of buyers.

As the Ethereum price enters what is possibly the second wave, the first bull target is at $660. It is the 161.8 percent Fibonacci extension level based on the July to August trade range.

The break above Aug highs and $500 was, as aforementioned, marked with high participation levels—a significant hint.

The previous resistance now support is the divide between bears and bulls. Yesterday’s rejection of bears—resulting in the long lower wick, suggests high demand in lower timeframes. Therefore, every low could be a loading opportunity with immediate targets at $660.

A reversal back to early last week’s consolidation could pour cold water on bulls’ ambitions.

Disclosure: Views are Those of the Author and are Not Investment Advice. Do Your Research.

If you found this article interesting, here you can find more Ethereum News