Since undergoing the “Merge”, Ethereum (ETH) staking has taken the world by storm enabling users to lock in tokens to validate transactions and get paid. But why is Ethereum Staking gaining prominence and how do people benefit from it? How can you stake Ethereum on different platforms? To answer all these questions, we have prepared this article to provide you with an in-depth knowledge regarding the Ethereum (ETH) staking ecosystem.

Cryptocurrency investors have raked in a lot of moolah using the process of staking to increase their holdings without having to sell their digital assets. Similar to keeping money in the bank, crypto staking refers to putting up one’s own cryptos, in order to earn the right to get a share of the rewards and vouch for the accuracy of transactions on an underlying blockchain network.

In a nutshell, it is a way of earning passive income, and it can be seen as the crypto world’s equivalent of earning interest or dividends while holding onto your underlying assets. The process also helps the network to remain decentralized by spreading the consensus to thousands of validators that ensure the transactions. However, it’s important to note that not all crypto networks use staking.

Digital tokens such as Ethereum (ETH), Solana (SOL) Cardano (ADA) among many others that run on a Proof-of-Stake (PoS) blockchains offer staking. Under this system, network participants who want to support the blockchain by validating new transactions and adding new blocks must “stake” set sums of their digital tokens.

What is Ethereum (ETH) Staking?

To understand what ETH staking is, let us take a look at what the original Ethereum looked like and what the transition to Ethereum 2.0 involves. The Ethereum blockchain was initially launched on the proof-of-work (PoW) consensus mechanism just like Bitcoin (BTC).

This means the miners of its native currency Ether (ETH) would have to devote an astonishing amount of computing power to decrypt users’ transaction data and validate them. The decrypting process was complex requiring massive gas fees and extravagant hardware costs.

In order to make the network more energy-efficient, the Ethereum blockchain underwent the Merge upgrade, in 2022, transitioning to a proof-of-stake (PoS) consensus mechanism. The new consensus required validators to pledge a certain amount of cryptocurrency to the blockchain, making them transaction authenticators.

This, in turn, reduced the money being consumed in gas fees and hardware costs as compared to the earlier used PoW mechanism. Following the transition of Ethereum (ETH), staking has become an increasingly important part of its ecosystem.

Ethereum staking refers to the process of transaction validation on the Ethereum blockchain network allowing users to lock in, or stake the platform’s native coin, ETH, to qualify for validation privileges in order to earn rewards and help secure the network.

People who do this are known as “validators” or “stakers,” and are tasked with processing transactions, storing information and adding blocks to the Ethereum blockchain. As a reward for their active involvement in the network, validators can receive rewards and interest on their staked coins.

How does Staking Ethereum work?

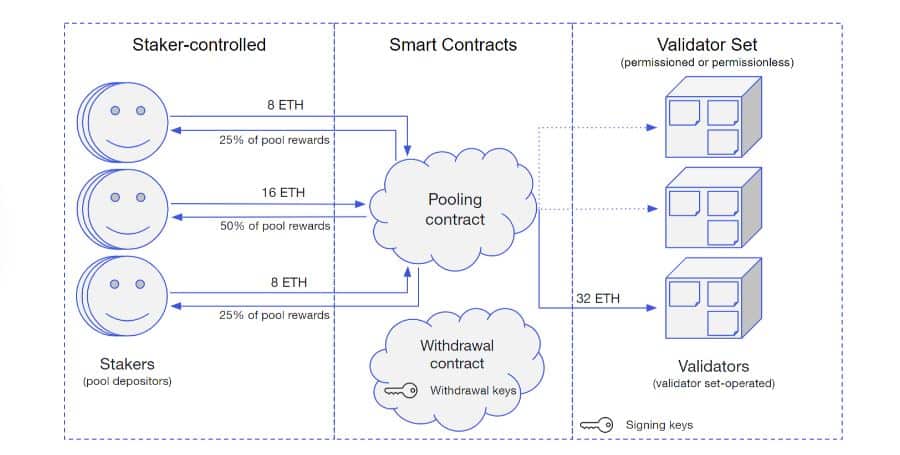

In order to become a validator, users need to deposit 32 ETH or join a collective staking pool, where they stake only a portion and receive rewards respective to their contribution. The users then have to gain validation privileges and program their node accordingly. Once set up, the validator must wait to be selected to authenticate a transaction in part of the block production process.

During each round of validation, the Ethereum blockchain bundles 32 blocks of transactions, lasting 6.4 minutes on average. These bundles of blocks are known as “epochs”. At the same time, stakers are also randomly grouped into “committees” of 128 and assigned to a particular shard block.

These 128 members are randomly elected to the committee from the general pool of Ethereum validators, fixed for the epoch duration. Once a committee is assigned to a block, one random member of the group is granted the exclusive right to propose a new block of transactions while the remaining 127 members vote on the proposal and attest to the transactions.

Once a majority of the committee has attested the new block, it’s added to the blockchain and a “cross-link” is created to confirm its insertion. Only then does the Ethereum staker who was chosen to propose the new block receive their reward. The process gets repeated in entirety, ranging from a few seconds to several hours depending on network congestion.

How much ETH do I need to stake?

Each individual on the Ethereum blockchain is required to have at least 32 ETH staked in order to become a validator. However, validators can also provide the ability for smaller ETH holders to delegate their tokens to them and thus earn a part of their staking rewards.

If a user simply wants to stake ETH for a profit and have no interest in becoming a validator, they can always join a staking pool. In a staking pool, they can combine a much smaller amount of ETH with other pool members to increase the chance of verifying a block and earning rewards.

How much do you earn by Staking ETH?

On-chain ETH staking yields are currently around 4%-5% annual percentage yield (APY). It means that for investors with $1,000 worth of Ethereum (ETH), they can expect around $43 per year. Consecutively, with an investment worth $5,000 of ETH, users can expect nearly $220. As a matter of fact, if Ether price rallies, the total value the users have staked will also increase, thereby increasing their return.

Is it possible to Stake Ethereum with Metamask?

MetaMask has recently launched its staking functionality, allowing users to lock up their Ethereum (ETH) tokens through the new feature via Lido or Rocket Pool to earn financial rewards. While the rewards rates vary, MetaMask claims users can earn a yield of about 5.22% per year on ETH deposits with Lido, and 4.59% with Rocket Pool.

WEN STAKING?

We are extremely happy to announce that you can now stake ETH with Lido or Rocket Pool through the Portfolio Dapp🎉

🔗https://t.co/HVLvcSDbw6 pic.twitter.com/9VkiU5jlsw

— MetaMask 🦊💙 (@MetaMask) January 13, 2023

Though the Metamask app, users can stake ETH on Lido and Rocket Pool and view their corresponding tokens, stETH and rETH. They can also convert their stETH and rETH back to ETH through MetaMask Swaps.

Best Places to Stake Ethereum (ETH)?

Staking Ethereum is a great way to earn rewards but it’s important to know which platforms offer the best experience and benefits for users before they put up any of their precious assets. In this segment, let’s look at the best platforms for ETH staking.

Rocket Pool

It is one of the most popular Ethereum (ETH) liquid staking platforms where users can either stake ETH in a pool or stake independently while operating as a node. Here, the users don’t need 32 ETH to stake independently on Rocket Pool. As a matter of fact, an individual requires only 16 ETH, half of the typical requirement.

If a user wants to stake and run a node using Rocket Pool, they can currently earn a reward rate of up to 6.36% APR. On the other hand, If they want to stake without running a node, they can still earn a reward rate of around 4.03% APR. However, the users have to lock up their ETH in the staking process when using Rocket Pool.

Lido

Unlike Rocket Pool, Lido is an Ethereum-based liquid staking platform which is also a decentralized autonomous organization (DAO) that lets users stake any amount of Ethereum (ETH). The platform uses staked ETH (stETH), an ERC20 token pegged to Ethereum, within its pools. This is given to users in the staking process to represent the Ethereum, they have deposited. Lido currently offers an annual returns rate of 3.7% for Ethereum staking and charges a 10% fee.

Ankr

Ankr’s ETH liquid staking enables stakers to mint new tokens such as aETHb and aETHc that they can immediately trade or use for the purpose of increasing earnings on decentralized finance (DeFi) platforms. This way, stakers avoid locking up the value of their ETH so they can earn in more places simultaneously. Ankr offers a return of around 4.36% APY.

Best Wallets to Stake Ethereum (ETH)

In order to take part in the Ethereum ecosystem and securely store, send, receive and stake Ether (ETH), users need an Ethereum wallet. While all leading cryptocurrency wallets provide a high level of security, we have compiled the top three wallets that are best for Ethereum (ETH) staking.

Atomic Wallet

This is a crypto wallet that allows users to directly engage with the ETH ecosystem and stake ETh tokens in return for APY rewards. Users can earn up to 5.5% APY on the atomic wallet making it easier for people to stake ETH holdings as all users need to do is deposit the crypto and choose the validator to stake ETH.

In addition, users can also estimate how much ETH they are going to earn on Atomic wallet’s official website. Overall, this wallet provides a great option for staking for who don’t want to pay the upfront costs that come with a hardware wallet.

Guarda Wallet

This is the second best wallet option in our list, Guarda offering up to 3% APY for staking Ethereum. Guarda wallet is a multi-asset crypto wallet that enables users to securely store, send, and receive Ethereum (ETH) and Ethereum-based tokens. The minimum staking amount on this wallet is 0.1 ETH. This wallet offers top rated security features enabling users to earn, borrow, and swap digital assets.

Metamask

Last but not the least, MetaMask is one of the most popular blockchain wallets today that is available as a browser extension to help users store tokens, interact with (dApps) decentralized applications and trade Ethereum (ETH) based tokens. It is a non-custodial wallet, which means that users have full control over their private keys and can access their wallet from any browser.

Institutions that make use of MetaMask’s institutional-grade wallet and custody service now have the ability to handle their Ether (ETH) staking via a total of four different vendors such as ConsenSys Staking, Allnodes, Blockdaemon, and Kiln. As stated earlier, although Ethereum staking rewards rates vary, MetaMask claims users can earn a yield of about 5.22% per year on ETH deposits with Lido, and 4.59% with Rocket Pool.

Conclusion

Thus, it can be said that Ethereum (ETH) staking is similar to a stock that pays dividends. It may not be much in the short term, but consistency over the long run is where true gains can be made. Although the payout might feel minuscule in the beginning, one day it could turn into a significant source of income, especially if Ethereum continues to rise in value as it has over the past few years. Habeeb Syed, a senior associate attorney at Vicente Sederberg LLP said,

“Staking Ether is a low-risk way to put your tokens to work. If you don’t want to go through the trouble of setting up your own validator, you can always use a centralized exchange or other platform which offer easier alternatives.”

This article is for information purposes only. You should not make any decision, financial, investment, trading or otherwise, based on any of the information presented here without undertaking independent due diligence and consultation with a professional broker or financial advisory.