TL;DR

- The creation of new Ethereum addresses has dropped to its lowest level of the year, reflecting a cooling demand for the digital asset.

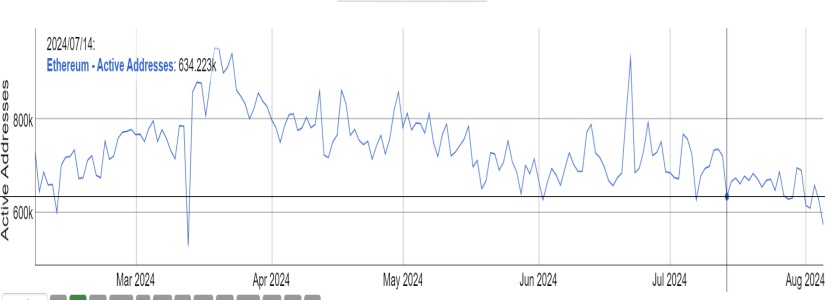

- ETH network activity has significantly declined, with a notable decrease in active addresses over the past few months.

- The approval of ETH spot ETFs and the lack of an expected price increase may be contributing to the decreased interest in Ethereum.

Interest in Ethereum has seen a considerable decline in 2024, despite the much-anticipated approval of spot exchange-traded funds (ETFs) in the United States. The most recent data indicates that the creation of new Ethereum wallet addresses has reached its lowest point of the year, reflecting a clear cooling in the demand for the digital asset.

Currently, the seven-day moving average of new addresses stands at 82.15K, the lowest level since December 2023. This decline adds to the drop in active addresses on the network during the month of July, which indicates reduced activity on the ETH blockchain.

The number of active addresses has significantly decreased, dropping from 931.8K in June to 564.8K in August, a fall that approaches a six-month low. This slowdown in network activity occurs at a time of success for other rival blockchains, such as Solana and Bitcoin, which have seen an increase in the creation of new addresses. Solana, often dubbed the “Ethereum killer,” has experienced growth in its decentralized exchange (DEX) ecosystem, partly driven by the popularity of memecoins.

Ethereum Is Not Seeing the Expected Success

One possible explanation for the drop in new Ethereum addresses could be related to the recent launch of its spot ETFs in the United States. It seems that some investors are opting for these funds instead of buying the cryptocurrency directly, which has affected the demand for ETH. Additionally, the Dencun upgrade, carried out in March 2024, which reduced the total supply of ETH, did not achieve the expected price increase, likely dampening investor enthusiasm.

Ethereum is facing a widespread market crisis. It is currently trading around $2,240, representing a 23% drop in the last 24 hours and a loss of more than 28% in the last week. ETH’s market capitalization has also seen a sharp decline, standing at $288 billion. Since its all-time high of $4,891 reached in November 2021, Ethereum has fallen by 55%.