TL;DR

- The crypto market crash, triggered by Trump’s 25% tariffs on Canada, Mexico, and China, led to a record $2.29 billion in liquidations, with Ethereum dropping 33% to a low of $2,100.

- Over $600 million worth of Ethereum was liquidated, contributing to the overall market chaos, while Bitcoin also faced a downturn, dropping 7% to $91,000.

- Investor concerns over a potential global trade war and retaliatory measures from Canada, Mexico, and China heightened anxiety, leading to significant losses in the crypto market.

The crypto market has been rocked by a historic crash, with Ethereum (ETH) suffering a significant blow. The market turmoil was triggered by President Donald Trump’s 25% tariffs on Canada, Mexico, and China, leading to a record $2.29 billion in liquidations.

Details of the Liquidation Event

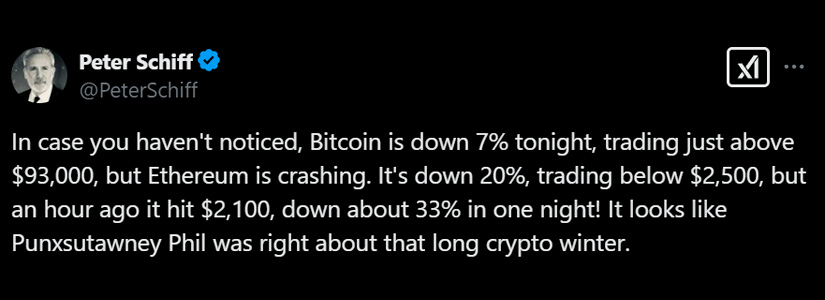

Ethereum experienced a dramatic decline, dropping as much as 33% within a few hours, a day now referred to as ‘Black Sunday’ in the market. The cryptocurrency plummeted to a low of $2,100, trading under $2,500, representing its most significant decline in almost four years.

Over $600 million worth of Ethereum was liquidated, contributing to the overall market chaos. Bitcoin also faced a downturn, albeit less severe, with a 7% drop to $91,000.

Impact of Trump’s Tariffs

The market crash mainly happened because investors were worried about a possible global trade war after Trump’s tariffs. Canada, Mexico, and China have said they will respond with their own measures, which increased investor fear and led to a move away from riskier investments like cryptocurrencies.

The tariffs made an already unstable market worse, leading to many long positions being sold off, with Ethereum and Bitcoin suffering the biggest losses.

Market Reaction and Future Outlook

Following the announcement of the tariffs, Ethereum’s price found its local bottom just above the $2,100 mark before recovering slightly to around $2,600. Within an hour, major altcoins like Ethereum (ETH) and Cardano experienced significant double-digit drops.

Joe Consorti, Bitcoin head of growth and analyst at Theya, highlighted that the $2.29 billion liquidation event triggered by Trump’s tariffs surpassed the liquidations seen during the COVID-19 pandemic and the FTX collapse.

As of February 3, investor sentiment in the crypto market is marked by “fear,” according to data from CoinMarketCap. This indicates growing concerns among crypto investors about their holdings. Historically, such extreme fear sentiments have often been viewed as buying opportunities by many investors.