TL;DR

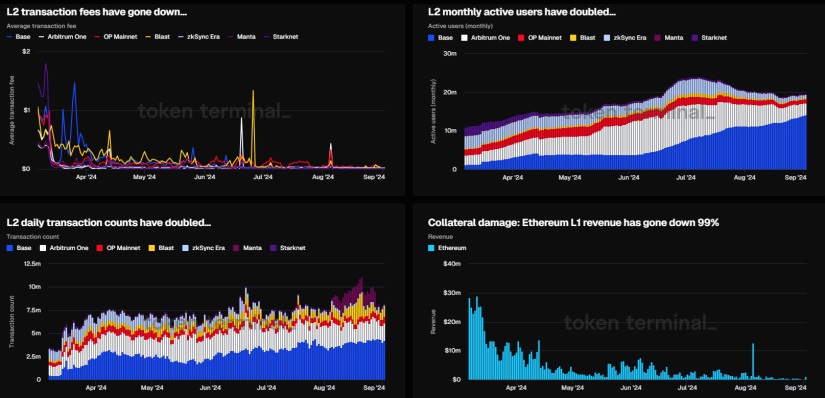

- Ethereum is facing a revenue crisis due to a 99% drop in Layer 1 transaction fees, affecting validator returns.

- The reduction in fees has led to an 11% decrease in Ethereum staking income over the past month, with the current return at just 2.05%.

- Validators have turned to Maximum Extractable Value (MEV) to increase their income, with yields reaching up to 2.89% due to transaction optimization.

Ethereum is facing a challenge in its role as a Layer 1 (L1) network due to the recent decline in transaction fees. In recent weeks, Ethereum fees have plummeted, directly impacting validator earnings and reducing returns generated by network activity.

This change is significant as, in the recent past, ETH was one of the primary sources of fees, surpassing competitors like TRON in terms of revenue.

The reduction in fees has led to an 11% decrease in Ethereum staking income over the past month. Currently, the return for validators has dropped to 2.05%, significantly below previous estimates. For a single-node with 32 ETH, the daily yield is around $8, with high volatility risks and potentially inadequate returns compared to the initial investment.

MEV: The Savior for Ethereum Validators

In response to this situation, Ethereum validators have started resorting to Maximum Extractable Value (MEV) as a strategy to boost their income. MEV allows for the ordering of transactions within a block to maximize revenue from gas fees and priority payments. Thanks to this strategy, the yield can reach up to 2.89%, in contrast to the base yield of only 0.29% when MEV is excluded.

Despite the decrease in direct income, Ethereum remains essential for rollup networks like Arbitrum, Optimism, and Base. These networks rely on ETH to secure activity on their Layer 2, although direct fees are no longer a primary source of income.

ETH maintains a notable number of daily active wallets and continues to be relevant in the blockchain ecosystem, especially for assets like USDT, which remain more widely accepted in their ETH version.