The Ethereum price remains bullish but under pressure. This may stem from development around Eth2 and news that miners may after all unloading their holdings.

According to a Santiment observation, Ethereum miners are dumping their digital assets in droves, heaping pressure on the Ethereum price which is now stuttering above $400.

Weakness originates from the impact on miners on price and how the trajectory of prices in the medium term is largely dependent on the action of miners.

Ideally, the more miners hold and accumulate their holdings, the more positive they are on future prices. They may therefore, depending on the prevailing state of the market, opt to stay out and accumulate in expectation of cashing out later when prices are higher and better for higher profits.

On the flip side, their dumping, notably when analysts fear of an over-extension and a probable over-heating market, may signal the lack of confident despite steps made by developers in the multi-stage rollout of Eth2.

In the coming days, the price of ETH is still at the hands of miners and the pace of their liquidation. If they accelerate their dumping, odds of ETH prices cratering back below $400 towards $320 will be higher.

Aside from the state of price and the influence of miners, Eth2 could be days away or months from now. The BLST library is being audited by the NCC Group.

Meanwhile, Vitalik Buterin, the co-founder of Ethereum, is telling off client developers, eager for a quick launch of the revamped version of the dominant smart contracting platform.

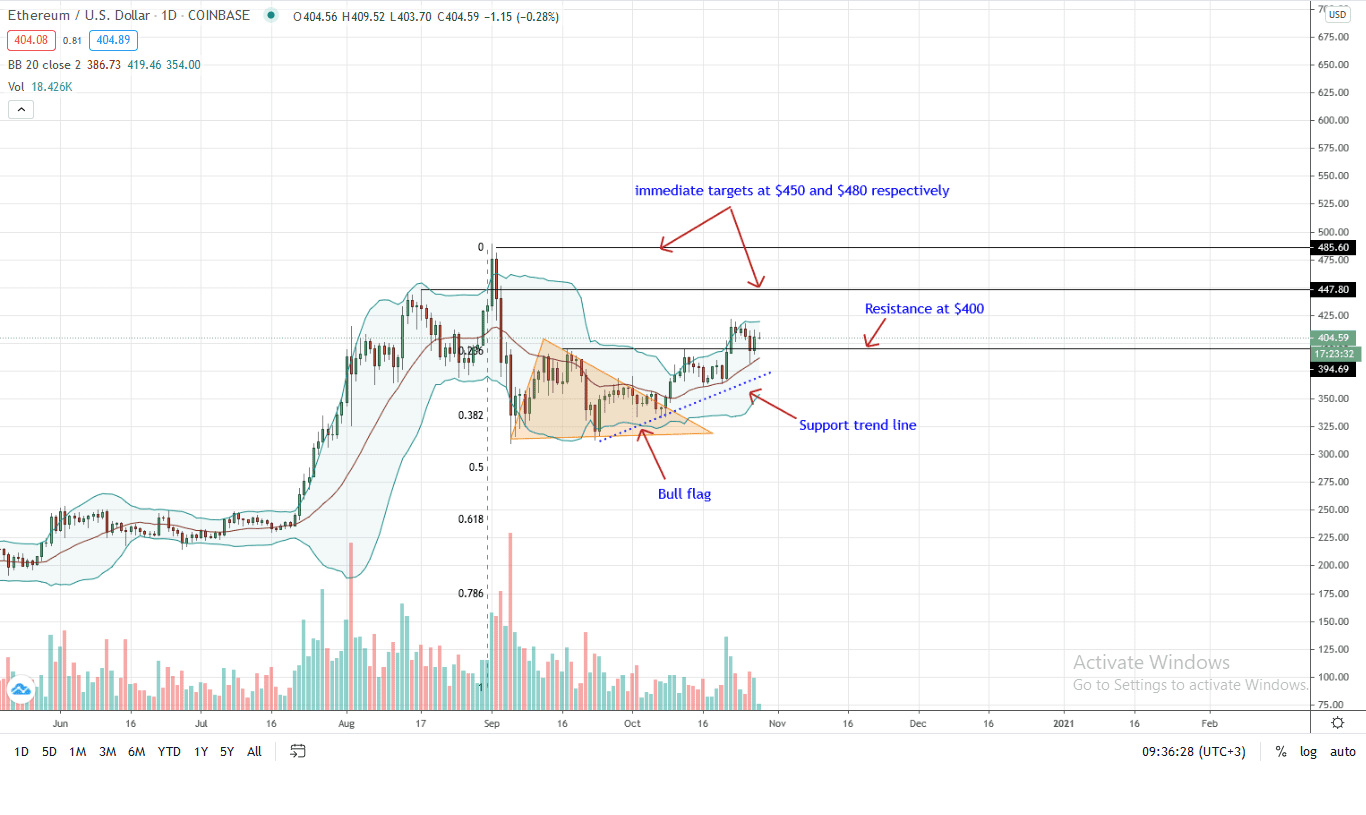

Ethereum Price Analysis

The Ethereum price is recovering but trails the BTC. It is up nine percent against the greenback in the last week of trading, bouncing off from critical support level.

The Ethereum price is recovering but trails the BTC. It is up nine percent against the greenback in the last week of trading, bouncing off from critical support level.

From the daily chart, candlestick arrangement points to strength. Although prices may be wavy a few days after the close above the bull flag, it is imperative that bulls push prices above last week’s highs towards $480. This will confirm the bullish breakout pattern of early Oct and put to rest talks of bears.

On the flipside, sharp losses below the middle BB and the support trend line of the last few weeks could trigger a massive selloff towards $320 or worse in a retest.

For neutral traders, immediate term price trajectory depends on the reaction of ETH prices at around $380—on the downside, and $420—if bulls have the way. Before then, price trajectory is indeterminate even though buyers have the upper hand from a top-down analysis.

Chart courtesy of Trading View

Disclaimer: Views and opinions expressed are those of the author. This is not investment advice. Do your research.

If you found this article interesting, here you can find more Ethereum News