Ideally, blockchain is meant to by-pass middle men and usher in efficiency. Still, centralized solutions reign supreme and are popular.

Regulators are in, Crypto as shield against Turmoil

What could explain this is user education and the low adoption levels. Also, there is the influence from governments and regulators. As they roll out policies, they cite their need to fulfil their mandate and protect the investors.

Good news is that their acceptance has improved thanks to the community’s dedication to compliance and relentless education. End users, especially in areas ravaged by hyperinflation and war, realize the importance of crypto.

It may be an option for south Africans now that the country has slumped into a recession amid cases of Coronavirus being reported across the sub-Saharan.

Ethereum [ETH] is Not Money

However, the question that has been brought to the fore is whether crypto and this case Ethereum [ETH] can substitute money.

As an improvement of Bitcoin which serves as a medium of exchange as well as a store of value, Ethereum platform brings about diversity and another degree of complexity. Its diversity is its richness and perhaps a reason why the co-founder of Morgan Creek Capital, Antony Pompliano doesn’t agree with the idea of ETH being money.

He’s an influencer and therefore his position has been met with different views with some arguing that he’s hellbent to bash a project that even Andreas Antonopoulos is fond of. Others are supportive, saying that Pompliano came to this conclusion after digging deeper about the project.

ETH/USD Price Analysis

As the debate rages, Ethereum [ETH] price is steady and signals are flashing green.

After a horrid week, the coin has barred losses and is back to break even against the greenback. Still it is down 9% week-to-date but encouragingly up 19% in the last month.

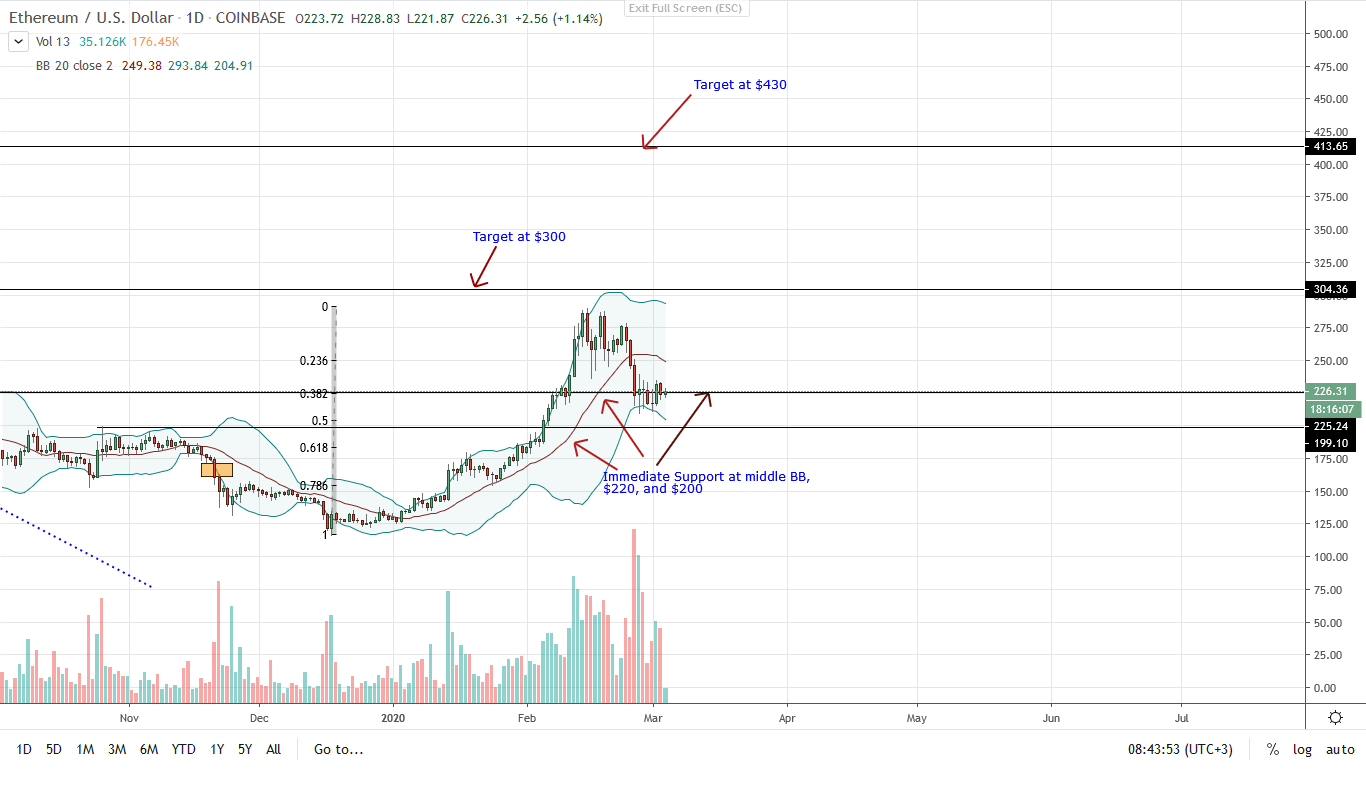

From the daily chart, the coin found support at Sep 2019 highs and is still dangling precariously above $200, just $20 shy from the psychological level.

Again, it is trending below the middle BB. However, candlestick arrangement suggests that ETH can if bulls maintain prices above $200 and within the 50-61.8% Fibonacci retracement level. Already, there are hints of support.

March 2, 2020 bar is bullish and conspicuous, rebounding from the $220 minor support. Regardless, sellers are still in control from an effort versus results point of view.

This is so because prices are trending inside Feb 26 trade range and as long as prices are below Feb 26 highs of $250, ETH can crater below $220 to $200 or worse in days ahead.

As such, it will be ideal for conservative traders if bulls rally above $250 as a three-bar bullish reversal pattern prints, signaling bulls. This will open doors for Feb 2020 highs of $280 and even $360.

Chart courtesy of Trading View-Coinbase

Disclaimer: Views and opinions expressed are those of the author and is not investment advice. Trading of any form involves risk. Do your research.