There is a concerning disconnect. That of improper valuation, perhaps given the widening gap between Ethereum’s tokens and the Ethereum protocol’s overall valuation. It was last week when it was eventually revealed that the total valuation of the top five ERC-20 tokens eclipsed ETH’s. This, in all honesty, was only but a matter of time.

The crypto world is rapidly evolving and the preference of Ethereum over competing protocols mean there are project’s based on the platform that truly solve real-world problems and tag higher valuations. It isn’t about vapor power and investment in vanity like in early 2017 when ICO literally pumped the crypto market and Bitcoin to mega valuations.

The disconnection–as it is now is the worrying stagnation (in the midst of optimism) of ETH at the time when DeFi tokens are soaring, printing new highs. This, as per analysts’ view, is because most of them are literally piggy-riding on Ethereum and drawing no real value despite the “heavy use” of Ethereum as recent data shows that the protocol transacts more value than Bitcoin.

Messari, on July 20, said Ethereum is now the most on demand network thanks to the proliferation of stablecoins and open finance applications that drawing in more users than the singularity of Bitcoin.

BTC though the most valuable is only used for moving value. Meanwhile, Ethereum has repeatedly shown that it is quickly moving towards its goal of becoming a world computer as it serves more than just being money like Bitcoin is.

Ethereum Price Analysis

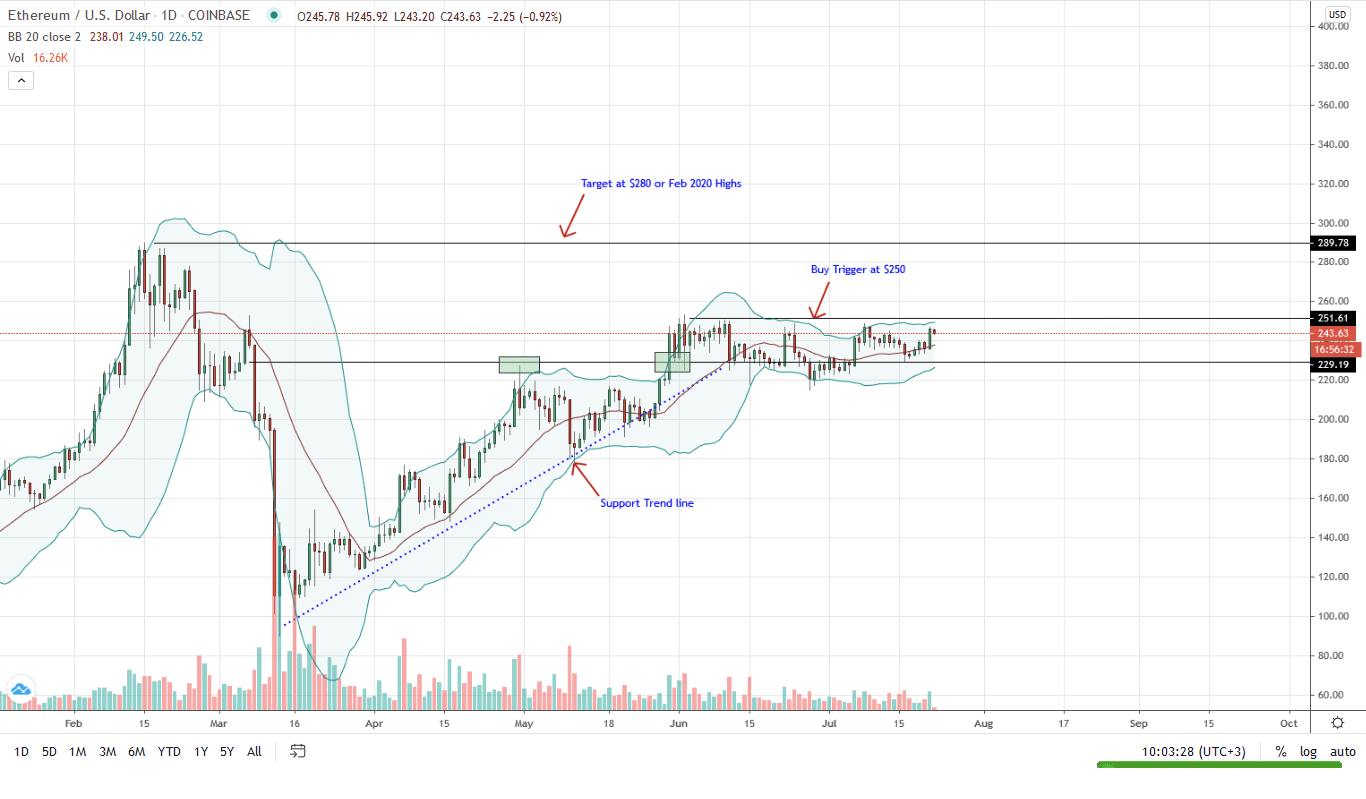

After July 21, 2020 up-thrusts from support, ETH has posted small gains against both BTC and USD. Specifically, ETH price is up roughly two percent against the greenback in the last trading week. And there are chances that ETH will soar higher if candlestick arrangement and related exchange statistics are anything to go by.

From the daily chart, there is a double-bar bull reversal pattern as bulls reject lower prices. There is a clear bounce from the $230 support and the middle BB flexible support inside July 6-8, 2020 trade range.

With increasing volumes, any close above $250 will spark demand and build a case for a possible rally to February 2020 highs of $280. In that case, risk averse traders can search for suitable entries on pullbacks with fitting stop losses around $230-$235 support zone.

A sharp reversal below $230 invalidate this bullish projection.

Chart courtesy of Trading View

Disclaimer: Views and opinions expressed are those of the author and is not investment advice. Trading of any form involves risk. Do your research.

If you found this article interesting, here you can find more Ethereum News