Ethereum has a fees problem. It presents a challenge. A dilemma of some sorts. On one hand, supporters are gleeful, excited of this “good problem.”

On the other, actual users of the network are shelling out more. Evidently, it is a utility problem. More are flocking to the network for good reasons. Ethereum is the poster project for autonomy and smart contracting. In the age of dApp development, Ethereum can’t go unmentioned.

The Ethereum Fees Problem: Rollups may mitigate

Most DeFi dApps depend on the security and distribution of Ethereum nodes. Now, as the network plans to shift to the next era of unparralled scalability and security, Vitalik and team are urging users to use zk-Rollups not to congest the network and therefore push prices up.

Vitalik suggest posting complex transactions only on the mainnet to keep prices lower and therefore attract more users. Rollups is but one of the many suggestions put forth with the objective of scaling the Ethereum mainnet.

Rollups is a layer-2 solution where each contract holds a succinct cryptographic commitment of a larger side chain state. Its implementation improves Plasma’s biggest problem: that of data availability.

The Balancer Labs Flub

Meanwhile, another exploit led to a $500,000 loss for a DeFi dApp. Balancer Labs said a skilled smart contract developer with a thorough understanding of trustless market making managed to wipe clean two of its AMM pools on June 29.

Though they were aware of the exploit, the team has now decided to reimburse affected liquidity providers and pay out the white hacker who first noted of the weakness the maximum bounty reward he truly deserved.

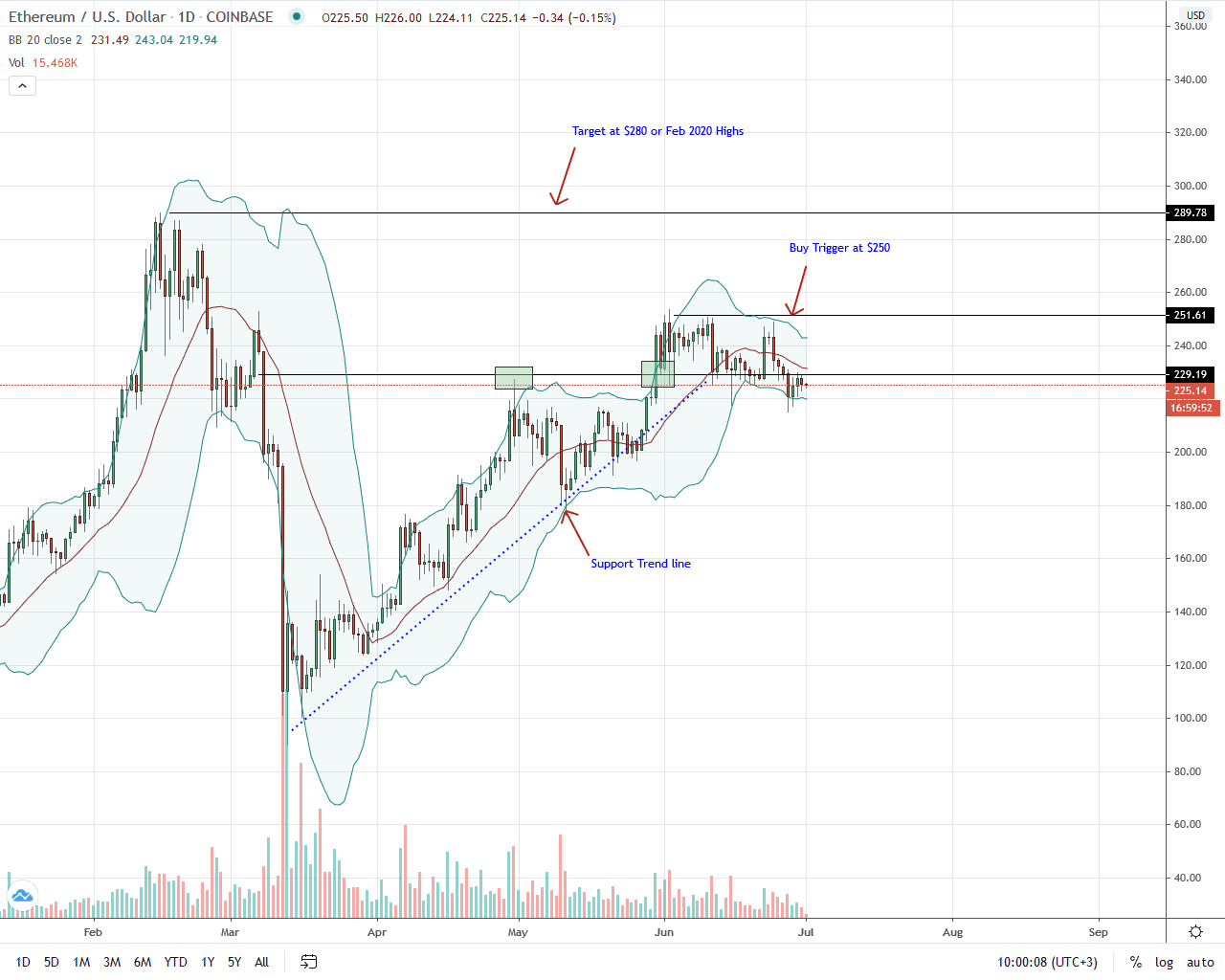

Ethereum Price Analysis

Week-to-date, ETH is down, sliding seven percent in the past trading week. Good news is that the second most valuable coin is fairly stable against BTC, dropping roughly two percent in the same period.

Though there is optimism from the larger trading community, candlestick arrangement point to weakness a possible degradation of price in coming days. Specifically, ETH is solid below $230, a previous support level and now support. Bears have also reversed gains of June 22, 2020, in a reflection of strong sell pressure of June 11, 2020.

At the time of writing, ETH is oscillating below the three-month support trend line though there is a low-level consolidation in smaller time frames.

As it is, aggressive traders can sell the rebound with targets at $200. A full-blown liquidation will be triggered if bears drop below $215, setting the pace for a possible break below $200 towards $170-$180 zone in coming weeks.

On the reverse side, a correction back above $230 and a rally towards $230 may spur demand, reinvigorating ETH bulls.

Disclaimer: This is not investment advice. Opinions expressed here are those of the author and not the view of the publication.

If you found this article interesting, here you can find more Ethereum News