The Ethereum price is relatively firm at the time of writing. Week-to-date, the second most valuable crypto project is up 10 percent versus the greenback, reversing slight dumps posted over the weekend. Technically, this is supportive of buyers.

Ethereum Bulls Upbeat

It explains why traders are optimistic about what lies ahead, maintaining that the coin could surge not only above the immediate resistance at $4k and all-time highs at $4.4k but soar to over $6.5k by the end of the quarter.

Overall, this is a bullish, encouraging outlook for ETH. This could be the case because BTC is already tracking higher following the nod of approval by the SEC of a Bitcoin Futures tracking ETF.

Crypto ETF Mark Peaks

Even amid the positive news, Jim Cramer of CNBC‘s Mad Money has revealed that he sold a portion of his ETH holding. Per his prediction, the approval of the Bitcoin ETF marked peaks for the crypto market, which has been in a rampant upswing for the better part of the last two years.

Cramer said cryptocurrencies have become unstoppable, and the launch of the crypto ETF marks the market peaks:

“You could argue they’re roaring because people want insurance against inflation, but I think they’re roaring because a crypto ETF is launching tomorrow, and people want in ahead of time. If I’m right, then tomorrow very well could be the peak for crypto, and that’s why I sold off one-eighth of my Ethereum position today.”

Ethereum Price Analysis

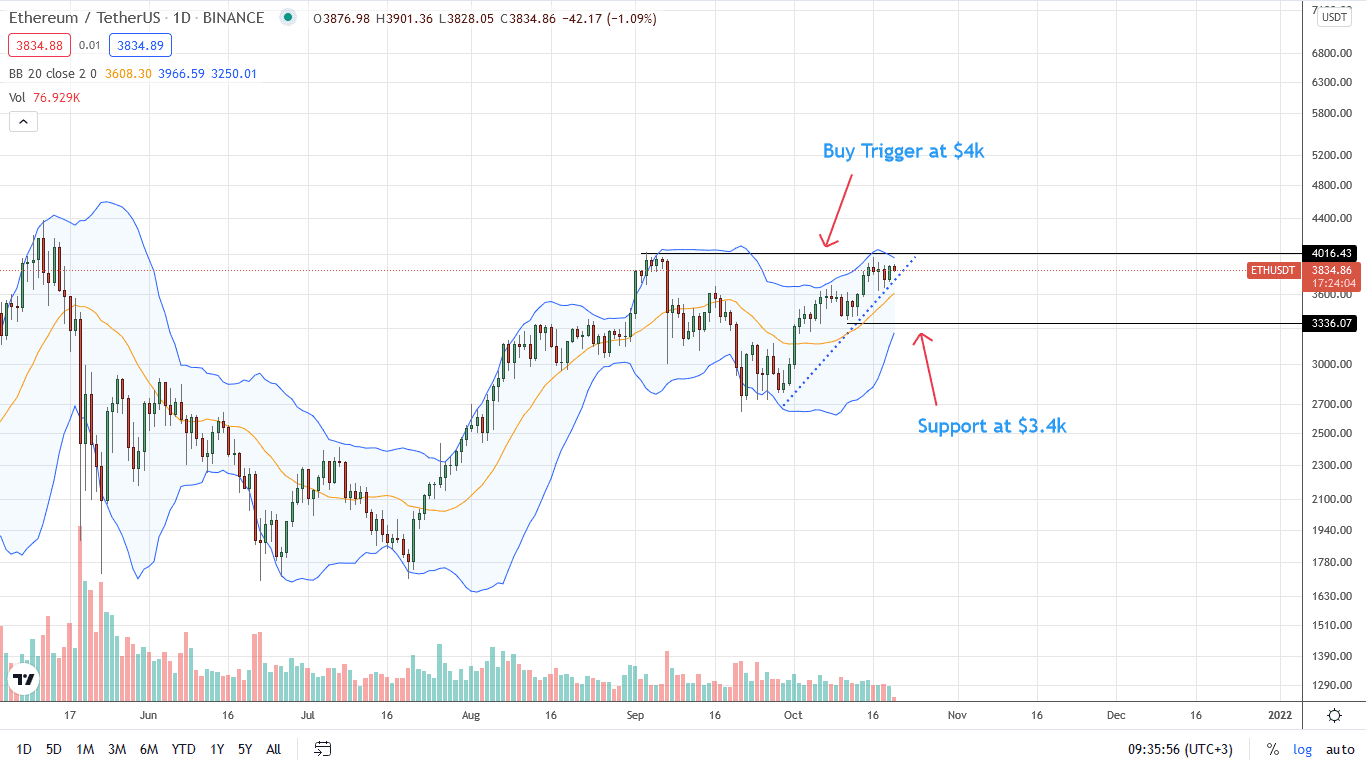

From the ETH/USDT daily price chart, bulls are subdued but the uptrend firm. Although ETH prices are up 10 percent week-to-date, they have been in range mode in the last 24 hours.

ETH buyers may find entries in lower time frames above the primary support trend line, loading the dips in anticipation of the break above the $4k psychological level.

Meanwhile, risk-averse traders may remain non-committing in the current consolidation. Instead, there might be more opportunities once there is a close above the $4k liquidation line.

To increase the odds of buy trend continuation, the upswing would ideally be with high trading volumes. This may be the base for a race to all-time highs at $4.4k.

Conversely, if there are sharp losses below the primary support trend line and the wedge, ETH prices may crash below the middle BB to $3.4k in a resumption of the September 2021 bears.

Technical charts courtesy of Trading View

Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Ethereum News