Ethereum is slowly grinding higher, much to the excitement of the broader crypto trading community. There are signs of strength reading from price action in the daily chart.

For example, at the time of writing, the ETH price is up double digits week-to-date, printing 19 percent and fanning demand for the world’s most active smart contracting platform.

Ethereum Settles $6.2 Trillion Year-to-Date

While the primary focus currently revolves around NFTs and DeFi, the expansion of the sub-sphere and the quest to decentralize further finance and art would all benefit Ethereum.

According to Messari, Ethereum has so far settled over $6.2 trillion worth of value year-to-date. This, however, is just the beginning.

Probably nothing.

In the past 12 months Ethereum settled $6.2 trillion in transactions. pic.twitter.com/vkQemnhz4p

— Julien Bouteloup (@bneiluj) October 4, 2021

Ethereum will “Eat the World” as it Becomes Ultra-Sound Money

One observer notes that Ethereum would grow to “eat the world” as its solution would anchor disruptive developments in the next five years.

My 5-10yr crypto "investment thesis":

– ETH

– DeFi

– Layer 2's/scaling

– Privacy-focused tech

– Cross-L2/chain bridges

– NFT infrastructure (+ some NFTs like punks)

– Crypto-gamingI know 5-10yrs is forever in crypto but I'm confident that Ethereum is going to eat the world.

— sassal.eth 🦇🔊 (@sassal0x) October 5, 2021

He notes the evolution of NFTs and subsequent development of NFT-focused infrastructure, the rise of cryptocurrency gaming riding on the success of layer-2, DeFi, cross-L2 bridges, and the inevitable expansion of ETH prices resulting from this demand.

The more the active Ethereum network becomes, the more ETH are destroyed through EIP-1559. Over $1 billion of the coin has now been sent to irretrievable addresses.

Altogether, this helps accelerate the path of ETH being ultra-sound money, eventually replacing BTC as a choice store-of-value digital asset.

Thus far, EIP-1559 is burning 27 ETH every minute, helping mop out more supply from circulation, solidifying prices.

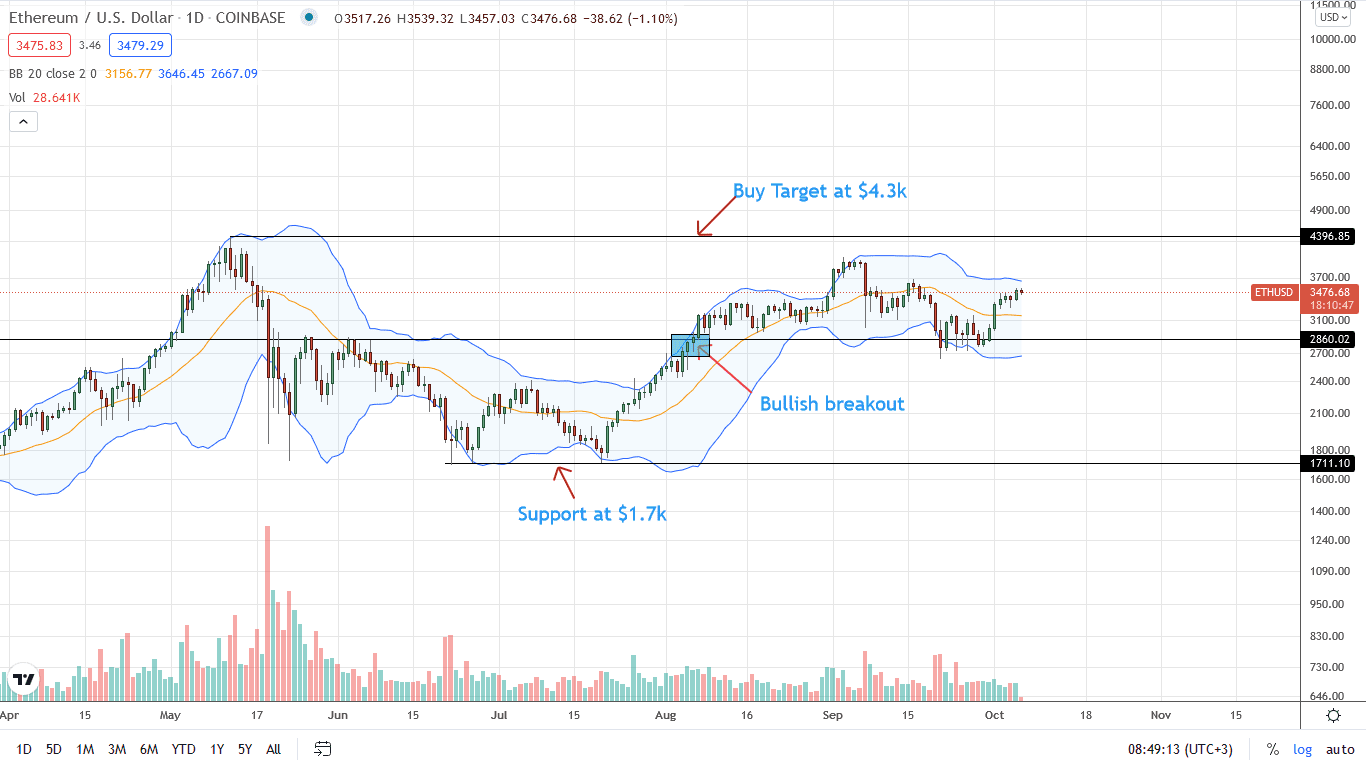

Ethereum Price Analysis

The Ethereum price is up double-digits on the last week of trading, adding 19 percent.

From the performance in the daily chart, ETH/USDT prices have completed the retest from around the 50 percent Fibonacci retracement of the July to August 2021 trade range.

The bounce back from late last week spilling into the new month provides the necessary impetus for the next wave higher towards $4k—or better.

As it is, aggressive ETH traders might load the dip on pullbacks with the demand picking up, especially once there is a close above $3.7k.

Even so, a pullback below $3.2k may destabilize the uptrend, calling into question the strength of buyers and the longevity of the early October 2021 revival. This is because of the bear bar of September 2021 and the series of lower lows relative to the upper BB in the weekly chart.

Technical charts courtesy of Trading View

Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Ethereum News