TL;DR

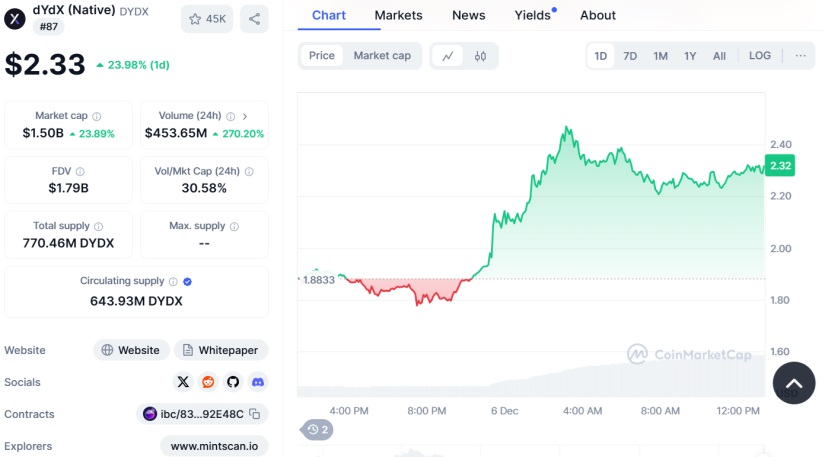

- dYdX price rises 24% after David Sacks is appointed as AI and crypto “Czar” at the White House.

- Trading volume increases by 270%, reaching $453 million, and its market capitalization rises to $1.5 billion.

- Craft Ventures’ investment in dYdX and Sacks’ appointment as “Czar” generate strong bullish sentiment, with net investment flows surpassing $2.2 billion.

dYdX (DYDX) price has experienced a significant 24% increase following the appointment of David Sacks as the AI and cryptocurrency “Czar” at the White House.

The rally took the cryptocurrency to $2.33 per unit. Its growth has been accompanied by an outstanding increase in daily trading volume, which surged by 270%, reaching $453 million. The market capitalization also skyrocketed to $1.5 billion, driven by strong interest in the native cryptocurrency of the decentralized trading platform.

One of the key factors behind this surge has been Sacks’ connection to Craft Ventures, his venture capital firm, which made a major investment in dYdX. This connection has generated a strong bullish sentiment among investors, who have responded with increased token purchases.

Additionally, the exchange’s net flows have seen a drastic shift, moving from a net outflow of $766,000 to a net inflow of over $2.2 billion in just two days. The rise in demand from large investors has been another key factor driving the cryptocurrency’s price increase.

dYdX Could Experience a Rally of Up to 300%

Technical analysis supports expectations of a promising future for DYDX. Experts have pointed out that if the coin manages to break its current downward trendline, it could experience a rally of up to 300%, potentially driving its value to $7 or more in the medium term. This forecast is supported by whale activity and the increase in the total value locked (TVL) on the DeFi platform, which has surpassed $445 million, doubling its value from November.

Sacks’ appointment as “Czar” by Donald Trump is set within a context of clearer and fairer regulations for the crypto industry in the United States. Sacks has promised to work on a legal framework that allows the sector to grow, generating a positive reaction from both institutional and retail investors