The recent weekly report from CoinShares reveals a significant inflow of funds into cryptocurrency investment products, reaching $176 million.

The recorded influx marks the highest level since the launch of a U.S. futures-based ETF in October 2021. While Bitcoin is surpassing the $41,000 mark after an extended bullish period that saw it break the $40,000 barrier and continue to climb, investor interest in cryptocurrency investment products is steadily increasing, generating high expectations.

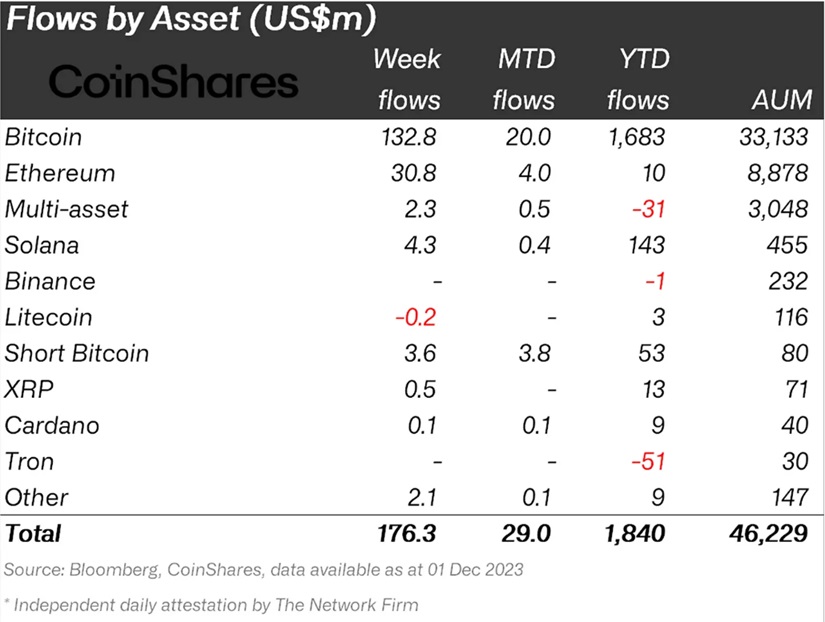

Bitcoin remains the primary focus of investment, with an inflow of $132.8 million, contributing significantly to the overall investment products in cryptocurrencies. Ethereum (ETH), the most important alternative to BTC, also maintains continuous interest, with an inflow of $30.8 million. This results in a net positive flow of $10 million for the first time this year, indicating a shift from a prolonged period of negative sentiment.

In addition to Bitcoin and Ethereum, other altcoins also exhibit varied investment patterns. Solana (SOL) attracted an inflow of $4.3 million, Cardano (ADA) had $0.1 million, and XRP recorded $0.5 million in inflows. However, Litecoin (LTC) experienced a minor outflow of $0.2 million.

It is relevant to note that the Bitcoin Short fund, linked to the decline of BTC, had an inflow of $3.6 million, indicating investors’ interest in both long and short positions in the market.

When examining regional fund flows, Canada leads with a significant inflow of $79 million, followed by Germany with $56.9 million, and the United States with $53.5 million. These regional trends reflect the growing global interest in digital asset investment products.

The Inflow of Assets is Booming Thanks to Bitcoin

The market is currently experiencing a significant bullish sentiment due to the momentum generated by Bitcoin. Speculation is rife that the SEC may finally approve at least one Bitcoin ETF in January, triggering a massive influx of institutional capital and potentially causing the price of BTC to skyrocket, lifting the entire cryptocurrency market, as is happening now solely based on expectations of this potential outcome. Additionally, the upcoming Bitcoin halving also plays a crucial role in bullish predictions for BTC.

According to experts, there is a 90% probability that ETFs could see the light of day before January 10. While these are optimistic forecasts, it is essential to monitor how events unfold as the impact they could produce will be fundamental for the future of cryptocurrencies.