TL;DR

- Crypto investors are facing difficulties monetizing locked digital assets, which is forcing them to turn to complex selling methods.

- Companies like Wintermute, Flowdesk, and Caladan are facilitating transactions with locked tokens through secondary markets outside traditional exchanges.

- While these solutions help manage risks, ethical and legal issues arise, as some transactions are made without the approval of the issuing projects.

Cryptocurrency investors are facing new challenges when attempting to monetize locked digital assets, meaning tokens that cannot be sold due to release schedules.

To circumvent these restrictions, venture capital funds and other investors are using complex methods, collaborating with firms specializing in market making. These firms act as intermediaries to allow investors to “cash out” their positions before the tokens are officially unlocked.

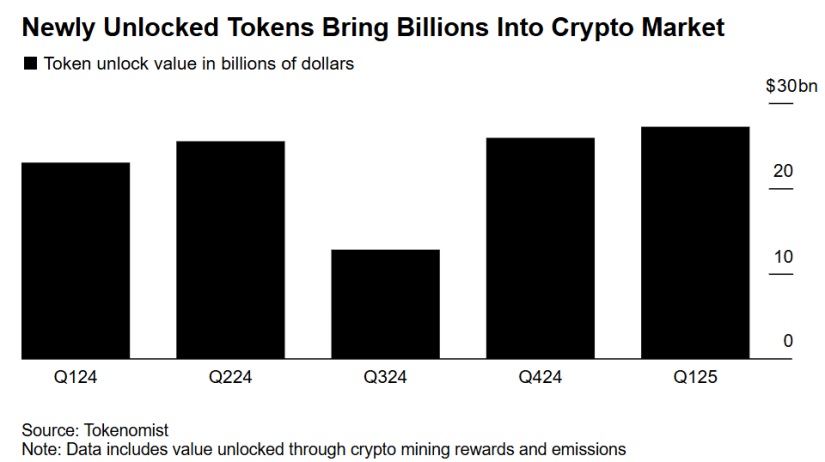

Market-making companies like Wintermute, Flowdesk, and Caladan are providing solutions to this problem by creating secondary markets outside of traditional exchanges. In this way, investors can conduct transactions with locked tokens without waiting for them to be released on the market. This type of activity has grown significantly since mid-2023, as there is a growing demand for these types of solutions.

There are several ways in which they can hedge their positions. One of the most common is the “Safe Agreement for Future Tokens” (SAFT), which allows the transfer of rights to the tokens to a buyer at a discount. Another option is using forward contracts, bilateral agreements that set an exchange price for the tokens once they are unlocked. Additionally, some OTC (Over-The-Counter) platforms like OFFX facilitate these swaps outside of traditional markets, allowing investors to trade their locked assets more flexibly.

Solution for Investors: Problem for Projects?

Although these strategies provide a solution for investors, they also raise ethical and legal concerns. Some of these transactions require approval from the token-issuing projects, but there are ways to execute them without such permission, which creates tensions within the community. Critics argue that these practices can harm the original projects, as they look to secure their profits may sell tokens before the official release, affecting price stability.

Despite the criticism, some defenders believe that these strategies are necessary to manage the risks of funds holding large amounts of locked tokens and should be seen as a legitimate tool for protecting investors’ financial interests