Besides Non-Fungible Tokens (NFTs) and Metaverse, DeFi is another buzzword in the crypto industry. In fact, DeFi was the precursor to NFTs that first gained notable attention in the summer of 2020. It is currently a more than $200 billion market and is expected to grow exponentially in the time to come.

DeFi, short for decentralized finance, is a new kind of blockchain-enabled financial system that removes the need for banks and traditional financial third parties to process all kinds of financial transactions.

To get a loan from a bank, one has to get through a cumbersome process of registration and verifications. On a DeFi protocol, a user can get a loan just by connecting its cryptocurrency wallet, a process that only requires a few taps or clicks.

It is the efficiency, cost-effectiveness, and ease of use of DeFi systems that have made DeFi a multi-billion dollar market in such a short period of time.

While the Bitcoin Protocol laid the foundation for a new era of peer-to-peer financial payments, Ethereum, the first smart contracts-powered blockchain, gave birth to decentralized finance (DeFi). DeFi was almost an unheard word in 2017.

According to DeFi Pulse’s data, the total value locked (TVL) on Ethereum on December 31st, 2017 was $139 million.

The arrival of Uniswap and Compound Finance in 2018 added some fuel, however, the turning point came in the second half of 2020. In September 2020, TVL across all DeFi protocols reached $10 billion for the first time.

As the world has witnessed, 2021 was an unprecedented year for the crypto sector. DeFi went beyond the hype in 2021, with the value of the DeFi economy increasing manifolds. Let’s take a look at some DeFi highlights of 2021.

DeFi in 2021

According to DeFi Llama, the DeFi market started 2021 at around $20 billion locked across defi protocol on all DeFi chains. This amount reached $250 billion in November 2021, representing an astonishing 1150% increase.

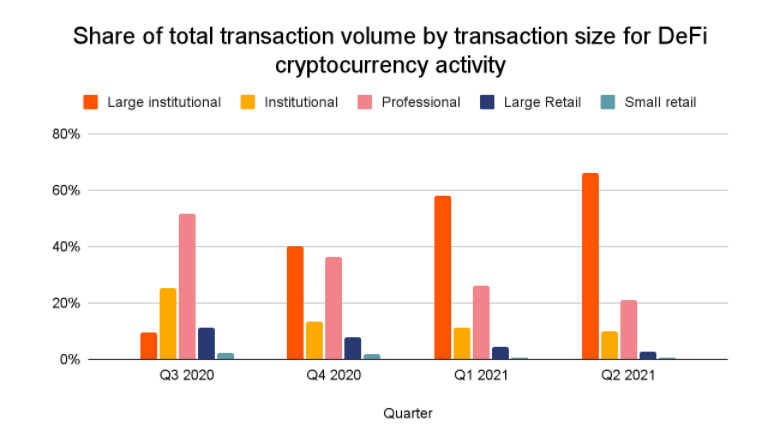

While the initial boost came from retail investors and individual users, industry analysis reveals that it was the institutional interest that helped the market to achieve this meteoric rise.

Institutional DeFi Adoption in 2021

According to ConsenSys’s 2021 review:

“While non-fungible tokens (NFTs) ruled the retail investor’s mind in 2021, it was decentralized finance (DeFi) that was at the forefront of institutional interest last year.”

In 2021, many leading investment firms, asset managers, and retails took meaningful steps into the DeFi and Web3 ecosystem. ConsenSys review notes that part of the attraction of DeFi for institutions are the high yields offered across the sector.

According to data from Chainalysis, large institutional transactions (above $10 million) in Q2 of 2021 accounted for over 60% of all DeFi transactions.

The Rise of Alternative L1 Chains

As everyone knows, Ethereum gave birth to DeFi and many other innovative blockchain applications. As the DeFi activity grew on Ethereum, gas fees became untenable in 2021. At times, a simple token swap on Uniswap cost anywhere from $40 to $100 in total.

This gave space for third-generation of Layer 1 chains to steal market share from Ethereum. Binance Smart Chain (BSC) was the first chain to rival Ethereum’s monopoly on the DeFi market.

Then public blockchain capable of handling thousands of transactions per second (TPS) like Terra (LUNA), Solana (SOL), Algorand (ALGO), Tron (TRON), Avalanche (AVAX), Polygon (MATIC), and Near Protocol hit the market. However, in terms of the total value locked (TVL), Ethereum still dominates the market.

DeFi Protocols and Stablecoins

According to “Nansen’s State of The Crypto Industry Report 2021”, “Uniswap and Aave both saw activity peaking during the first half of the year before cooling as the year progressed.”

Lido, a liquid staking protocol and currently third-largest DeFi protocol in terms of TVL across all chains, saw massive activity from ETH whales as the top 37 depositors are responsible for 50% of all ETH staked.

Aave dominated the DeFi lending protocols list for the most part of the year. Maker and Compound Finance also scored a heavy number in defi lending. Decentralized exchanges (DEXes) ranking was led by Uniswap, Curve Finance, Uniswap clone SushiSwap, BSC-based PancakeSwap.

DeFi protocol generated record revenues in 2021. According to the ConsenSys Q3 report, popular protocols like Uniswap, PancakeSwap, and SushiSwap were generating well over $100 million in annualized revenue.

dYdX exchange realized over $45 million in revenue during the month of September 2021. As Crypto Economy reported, Uniswap became the first DeFi platform in August 2021 that distributed more than $1 billion in fees to liquidity providers on its platform.

Industry analysis further reveals that stablecoins experienced massive adoption in decentralized trades, adding a total of $74B to their market caps in 2021.

Although USDT retained its position as leader, USD Coin (USDC) closed up on USDT as 2nd in stablecoin market cap on Ethereum and flipped USDT just a few days into 2022. Binance USD (BUSD) and DAI also saw significant activity in DeFi.

DeFi in 2022

Since reaching an all-time high (ATH) of more than $250 billion in mid-November of last year, the TVL in the DeFi market has dropped to around $200 billion as the bad luck for the crypto market goes on in 2022.

TVL Drops But DeFi is Getting Strong

While this downtrend can be attributed to the fall of crypto assets prices, other metrics show that the DeFi market is getting strong with each passing day. According to ConsenSys’ DeFi market analysis for January 2022, “adoption continued as the number of DeFi wallets grew to 4.3 million unique addresses” in January.

Despite the drop in market dominance and TVL, Ethereum is still far ahead of other chains by commanding 55.41% of the entire DeFi TVL. While BSC followed Ethereum in 2021, Terra has risen in ranks since the start of the year to become the second-largest chain in DeFi.

ConsenSys analysis for the month of February 2022 says:

“Positive adoption, albeit at a slower rate, continued as the number of DeFi wallets grew to 4.4 million unique addresses this month. Although users may have multiple wallets or addresses, this data point serves as a worthy pulse on the overall health of the DeFi ecosystem.”

Monthly revenue generated by popular DeFi protocols also declined in February. ConsenSys report reads:

“Monthly revenue generated by popular DeFi protocols continued to decline as usage slowed across major DeFi protocols. The total monthly revenue as of February month-end was $189 million. Meanwhile, cumulative DeFi revenue continued to make new all-time highs, growing to be over $4.2 billion since June of 2020.”

Some Prediction For DeFi in 2022

The crypto and the DeFi markets have not yet lifted off on 2022 but they are now too big to ignore. Experts believe that 2022 will bring much more to DeFi.

DeFi will Hit Mainstream in 2022

According to experts, DeFi will see more institutional adoption in the time to come as traditional financial companies are getting comfortable with crypto. Sidney Powell, the co-founder of lending project Maple Finance, in his remarks to Stockhead about DeFi in 2022, stated:

“We’re about to see a big boom of institutional credit flows into the digital economy. DeFi will hit the mainstream in 2022, knowledge will compound, institutional sentiment will continue shifting in favor of crypto, and the strengths of DeFi and TradFi will converge.”

Ethereum 2.0 For DeFi

The much-anticipated Ethereum’s transition from PoW to PoS will solidify Ethereum’s position as the go-to place for using DeFi applications. The market will see the ratio between the TVL on Ethereum and the TVL of all blockchains steadily decrease. Nevertheless, Ethereum will continue to dominate the TVL metric.

Layer-2 Scaling Solutions will Grow

Another relevant development will be roll-ups or Layer 2 protocols, which will enter into a competitive relationship with Layer 1 blockchains. As Crypto Economy reported, Arbitrum One had seen significant DeFi activity on its platform in 2021.

According to L2 Beat, around $6 billion is currently locked on all Ethereum-based L2 platforms and this will continue to grow as they become more efficient in lowering gas fees, TPS, secure.

Layer-0 chains like Polkadot, Kusama, and the Cosmos Inter-Blockchain Communication Protocol (IBC) have also entered the market.

Final Thoughts

The first two months of the year 2022 have not gone particularly well for the crypto and DeFi space. But the industry has become too big to look back.

Predicting exact numbers is not possible, however, seeing the increased institutional involvement, growing number of wallets, the entrance of more innovative DeFi projects to the space, more efficient layer-2 solution will push the market ahead.

Furthermore, upcoming crypto regulations, friendly or not, will impact the overall crypto landscape.

The most important number to be looked at for DeFi is the total value locked (TVL). In 2021, TVL grew from $20 billion to $200 billion. By the end of 2022, $500 billion in TVL is quite an achievable target for DeFi.