TL;DR

- Aave Labs is preparing a savings app that combines high yields, instant liquidity, and balance protection of up to $1 million.

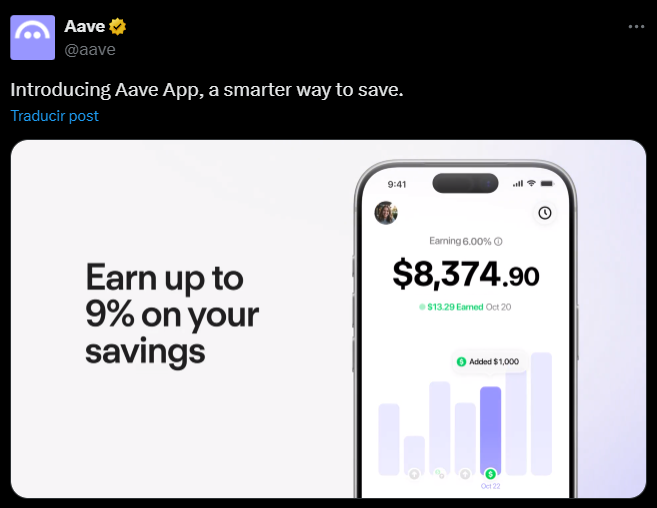

- The app offers up to 9% APY and allows deposits through bank transfers, cards, or stablecoins.

- The launch on the Apple App Store will bring this model to users who need a simple way to save at competitive rates without interacting with onchain protocols.

Aave Labs is developing a savings product designed to challenge traditional accounts through a structure built around high yields, accessibility, and transparency.

The company built an application that integrates per-second compounding interest, support for bank and stablecoin deposits, and balance protection that reaches $1 million.

Aave Puts an End to Banks’ Abuse of Retail Users

This group of features addresses a problem faced by any saver: banks pay between 0.4% and 4% APY while keeping the higher returns they generate and imposing restrictions such as withdrawal limits. Those limits make access to money more expensive and erode purchasing power during periods of high inflation.

Aave App offers up to 9% APY when the user verifies their identity, activates automatic deposits, or invites contacts. The app shows interest accruing in real time and removes fixed terms, delays, and penalties. Users can deposit from more than 12,000 banks and cards or use stablecoins, without opening new accounts or switching financial institutions. The experience mirrors a savings account but with instant liquidity that does not exist in traditional banking products.

The app includes a simulator that lets users project deposits and goals across different time horizons. They adjust amounts, frequency, and duration and see exactly how their capital evolves. The Auto Saver module moves funds automatically from the bank to the Aave App and adds an extra 0.5% APY for every recurring deposit commitment. This mechanism maintains steady accumulation and removes friction from managing short- and long-term goals.

Coming Soon to the Apple App Store

Aave Labs will expand this approach by launching the app on the Apple App Store, where it will set a minimum yield of 5% for retail users. This will broaden the product’s reach and make it accessible to people who are unfamiliar with onchain tools but want higher returns without dealing with complex protocols.

Finance is shifting toward onchain systems, and products like Aave App make basic actions such as saving, lending, and earning interest simple for anyone