TL;DR

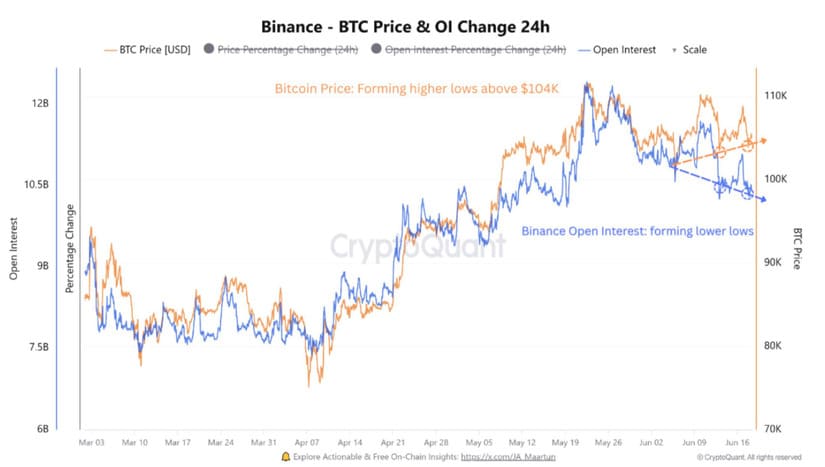

- Bitcoin holds support above $104,000 while open interest on Binance drops, clearing weak positions and lowering liquidation risks.

- The Fed’s rate pause and derivatives exhaustion could open the door for a quick surge if the price breaks nearby resistance levels.

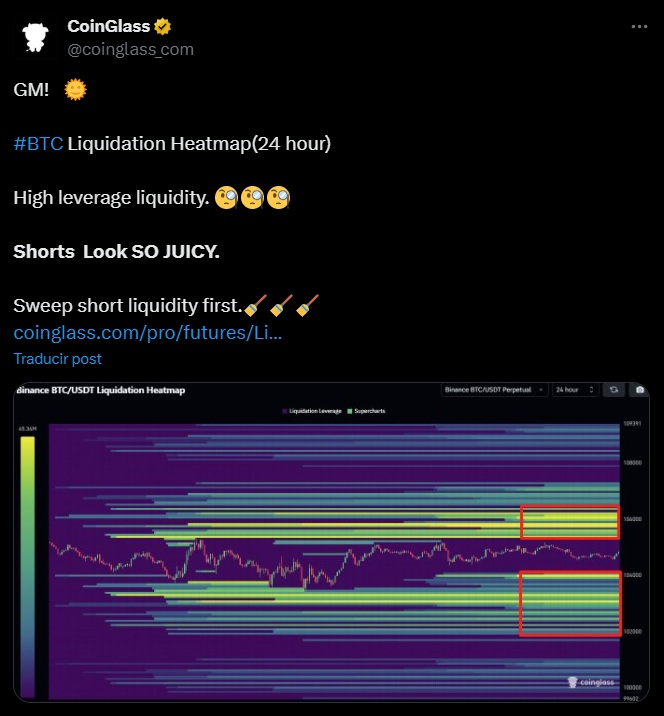

- Sell orders clustered at $106,000 raise the chances of a short squeeze if buying volume picks up in that range.

Bitcoin is going through a consolidation phase following the Federal Reserve’s recent decision to leave interest rates unchanged.

This scenario, historically favorable for higher-risk assets, is starting to build expectations within the crypto market. According to CryptoQuant data, the combination of macroeconomic stability and adjustments in the derivatives market could trigger a bullish rally for BTC in the short term.

In recent sessions, Bitcoin’s price has consistently held above $104,000, a zone that absorbed selling pressure through several breakdown attempts. Meanwhile, open interest on Binance showed a steady decline, marking successive lower lows that reflect a process of reducing leveraged positions. This cleanup in derivatives signals market stabilization, clearing out weak positions and reducing the risk of sharp liquidations in tight ranges.

Is a Bitcoin Short Squeeze Coming?

CryptoQuant warns that this phase aligns with a monetary backdrop that typically acts as a catalyst for speculative assets. In previous cycles, Bitcoin tended to move higher after extended interest rate pauses, especially when derivatives activity showed signs of exhaustion. The report also notes that, in this context, the risk of sharp pullbacks diminishes as long as current technical support holds.

On another front, data from CoinGlass identified a growing concentration of sell orders around the $106,000 mark. This liquidity buildup could trigger a short squeeze if the price clears minor resistance levels and forces short positions to close. The behavior of buy and sell orders in that zone suggests that, if significant volume emerges, Bitcoin could quickly climb toward $107,000.

Technical indicators support this cautiously bullish scenario. The RSI remains in neutral territory, with no signs of overbought or oversold conditions. Meanwhile, the MACD is starting to flatten out, hinting at a possible short-term trend shift.

At the time of writing, Bitcoin (BTC) is trading around $104,500, showing a modest 0.6% decline in the last 24 hours. Trading volume has dropped 17% and currently stands at approximately $42.6 billion