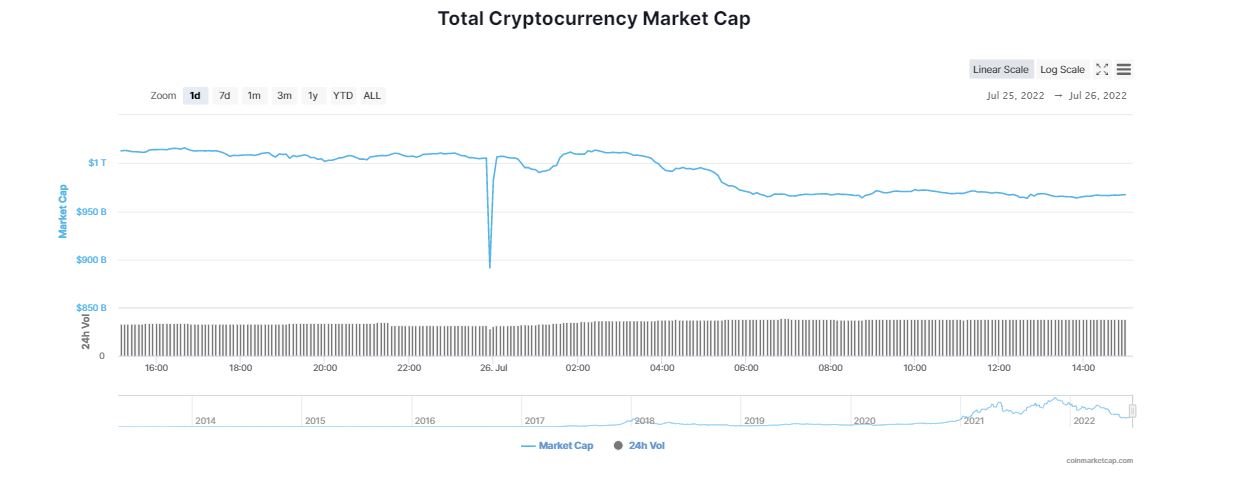

After a brief spell of respite, the global cryptocurrency market cap plunged below the $1 trillion mark indicating a minor pullback resulting in capital outflows. Bitcoin (BTC) grappled on to the $21K mark while Ethereum (ETH) slipped below $1,500. All the top crypto tokens were trading in red over the past day.

The global cryto market cap dipped over 4.50 per cent over the last 24 hours to $967.29 billion. Rising interest rates and high-profile meltdowns like that of crypto hedge fund Three Arrows Capital, one of the biggest crypto lenders, Celsius Network and Voyager Digital have pummeled digital tokens this year. According to CoinmarketCap, the crypto sector witnessed an outflow of over $40 billion in the last 24 hours. However the total crypto market volume gained 14.13 per cent over the day to $76.79 billion.

Bitcoin Price Uncertainity Over Upcoming FOMC Meeting

Bitcoin (BTC) increased over 3.95 per cent in the past 24 hours to trade at $21,145. The falgship token sank to a one-week low on Tuesday, triggered by nervousness ahead of a looming Federal Reserve interest-rate hike and amid harsher regulatory scrutiny of the cryptocurrency sector. BTC tanked nearly 3.40 per cent in the past one week lingering between $21,000-22,000 price level.

Edul Patel, CEO at crypto platform, Murudex, explained that Bitcoin (BTC) started the week on a weary note as the sentiment in the crypto market turned bearish. This could be due to the uncertainty over the upcoming Federal Open Market Committee’s (FOMC) meet up, which can impact the prices in the market. Patel went on to continue,

“A decisive move below the current level may take BTC to US$19,000. But, if buying interest rises, we may see BTC trading at the US$23,000 level soon.”

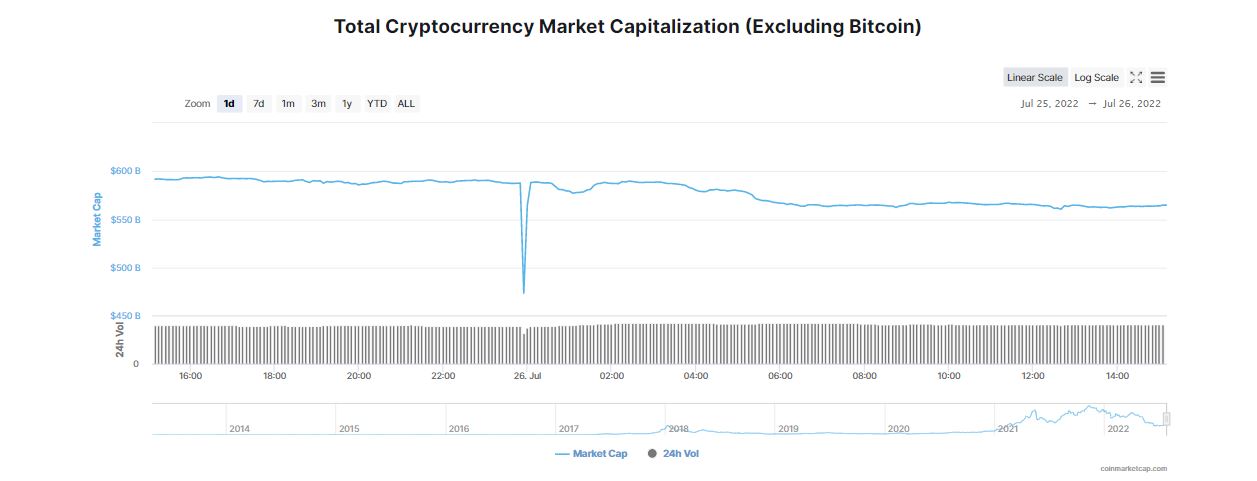

Major Altcoins Swimming in a Sea of Red

Ethereum (ETH) fell more than 7 per cent in the last 24 hours to hover at $1,419. As per data from CoinMarketCap, ETH, has noted a decline of nearly 7.31 per cent in the last 7 days. It seems rising fears of economic slowdown continue to haunt the riskier assets. Meanwhile, other major altcoins continued to plummet over the last 24 hours.

In the same time frame, Solana (SOL) and Polkadot (DOT) lost 7.22 and 6.23 per cent respectively. Cardano (ADA), XRP and Avalanche (AVAX) were trading with cuts in the range between 4.26 and 6.29 per cent. Patel said,

“Crypto and global financial markets are poised for increased volatility and turbulence as we have significant macroeconomic events in the week ahead in the form of the FOMC meeting.”