TL;DR

- Prediction markets are emerging as a structural arbitrage arena for crypto traders, offering payouts that exceed the returns of holding spot assets.

- Competition between retail participants and professional traders creates extreme information asymmetries.

- These markets replicate well-known institutional strategies, allowing participants to capture structural spreads.

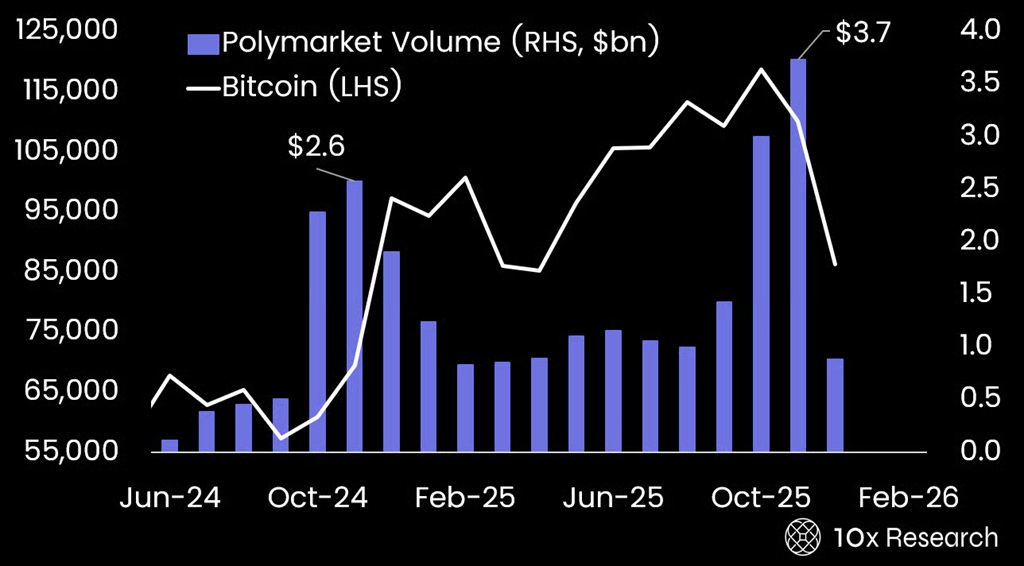

Prediction markets are gaining prominence as a structural arbitrage space for crypto traders. These platforms allow users to bet on future events, ranging from sports outcomes to the performance of tokens like Bitcoin or BNB, and offer returns that surpass simply holding assets in the spot market.

The mechanics of these markets generate extreme information asymmetries. Casual retail participants compete against professional traders, often backed by advanced data and algorithms, creating arbitrage opportunities. According to a report by 10X Research, prediction markets provide asymmetric payouts that compare favorably with spot token gains. For example, on Polymarket, betting that BNB will reach $1,500 by year-end could yield a 100x return, while a BNB holder would see only a 1.65x gain if the token reaches that level.

The Battle Between Retail and Professional Traders

The appeal of these markets has led some traders to employ advanced strategies, including artificial intelligence. One account, “AlphaRaccoon,” earned $1 million in a single day by winning 22 out of 23 bets.

Another user, “ilovecircle,” made over $2.2 million in two months with a 74% win rate on bets spanning politics, sports, and crypto, suggesting the use of machine learning bots for cross-niche arbitrage and auto-trading. However, these cases have raised insider trading concerns and highlight the divide between retail and professional participants.

Prediction Markets That Mirror Institutional Strategies

This phenomenon mirrors dynamics seen previously in crypto markets. Bitmex in 2015 and Grayscale GBTC in later years showed how institutions could capture structural spreads against retail flows, regardless of price direction. Prediction markets replicate this logic, offering profit opportunities based on market mechanics and structure rather than the movement of the underlying asset.

With significant expansion projected for 2026, these markets could deepen liquidity and consolidate arbitrage margins before easy returns disappear. For institutional and high-volume traders, they represent a strategic ground for capturing consistent profits. For retail participants, they demand careful analysis and awareness of algorithms and accounts with substantial advantages.

Prediction markets are moving beyond a minor experiment and are establishing themselves as a critical component of the crypto ecosystem, where understanding market mechanics and information is as valuable as the capital invested