TL;DR

- Market Surge: Bitcoin climbed to $96,867, lifting Ethereum, XRP, and Solana as nearly $700 million in short positions were liquidated.

- Liquidation Wave: CoinGlass recorded $789 million in total liquidations, with Bitcoin at $382 million and Ethereum at $231 million as bearish traders were hit hardest.

- Macro and Policy Boost: Momentum grew around the Clarity Act while steady U.S. inflation and $754 million in Bitcoin ETF inflows strengthened bullish sentiment.

Bitcoin’s latest surge is sending shockwaves through the derivatives market, with short sellers absorbing heavy losses as prices climb across major cryptocurrencies. Nearly $700 million worth of short positions have been liquidated in the last 24 hours, reflecting a sharp reversal in market momentum and renewed optimism following key macro and regulatory developments.

Bitcoin Leads a Broad Market Rebound

Bitcoin recently traded at $96,867, marking its highest level since November 14. The asset is up nearly 5% over the past day and just over 5% on the week, although it remains about 23% below its early October peak above $126,000. Ethereum, XRP, and Solana also posted strong gains, rising almost 7%, nearly 5%, and almost 4%, respectively. The synchronized move across top assets underscores a decisive shift in sentiment after weeks of mixed performance.

Short Sellers Absorb Heavy Losses

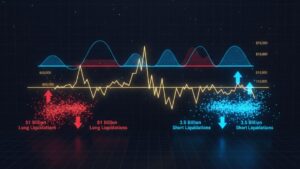

The rapid upswing has punished traders positioned against the market. CoinGlass data shows about $690 million worth of short positions liquidated over the last day, contributing to a total of $789 million in liquidations. Bitcoin accounted for $382 million of that figure, followed by Ethereum at $231 million and Solana at $33 million. While bears had enjoyed periods of relief in recent months, the latest rally has flipped the script decisively.

Regulatory Momentum Fuels Optimism

Part of the renewed enthusiasm stems from growing traction around the Clarity Act, a U.S. crypto market structure bill currently being drafted and revised ahead of a planned Senate Banking Committee markup on Thursday. The prospect of clearer regulatory frameworks has helped lift prices, reinforcing the broader recovery across digital assets as traders anticipate potential structural improvements for the industry.

Macro Tailwinds Strengthen the Rally

Tuesday’s CPI report added further fuel, showing steadying inflation in the United States. Bitcoin ETFs in the U.S. recorded $754 million in inflows on the same day, their strongest performance since October. Traditional safe havens like gold and silver also reached new highs this week. Meanwhile, users on Myriad have grown increasingly bullish, assigning Bitcoin a nearly 89% chance of hitting $100,000 before falling to $69,000, a jump of nearly 13% in just 24 hours.