Puntos claves de la noticia:

- Bitcoin trades at $92,693, targeting a breakout toward $97,000-$100,000.

- On-chain data shows strong long-term holder accumulation and reduced selling.

- U.S. Bitcoin ETFs see massive $1.5 billion weekly inflows from institutions.

The current price of Bitcoin (BTC) is around $92,693 USD, showing a +1.92% rise over the past 24 hours, with a market capitalization of $1.85 trillion and a 24-hour trading volume exceeding $50.6 billion. BTC continues to hold dominance over the cryptocurrency market, supported by a surge in institutional inflows and bullish derivatives positioning.

From a technical perspective, Bitcoin is trading above its short-term moving averages, with the 20-day EMA near $90,500 USD acting as immediate support and the next resistance target at $94,000 USD.

The RSI remains in a strong bullish range around 68 points, confirming positive momentum, while the MACD histogram continues expanding on the positive side, suggesting potential for a continued upward trend. Traders are now watching for a breakout above $93,800–$94,200, which could trigger acceleration toward $97,000 USD.

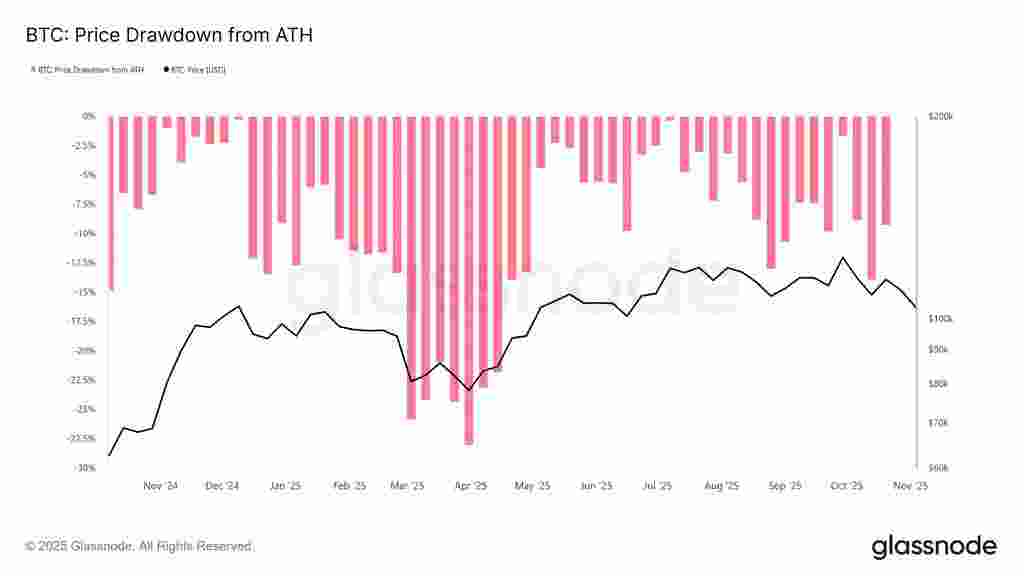

On-chain data further strengthens the bullish narrative. Metrics from Glassnode and CryptoQuant show that long-term holders (LTHs) have reduced their exchange deposits to the lowest levels since mid-2023, reflecting strong conviction and accumulation.

The Realized Cap has reached a new record high above $550 billion, suggesting that capital inflows continue entering the network at higher price levels.

Meanwhile, the supply last active over 1 year has reached 69.4%, reinforcing that investors are locking up BTC for the long term. Miner behavior remains stable, with the hashrate posting new all-time highs, signaling network security confidence ahead of the next halving event in April 2028.

On the fundamental side, Bitcoin’s upward momentum is driven by ETF inflows, macroeconomic stability, and increased global adoption. According to CoinMarketCap and recent reports from Bloomberg Crypto, the U.S. Bitcoin ETFs have experienced inflows exceeding $1.5 billion over the past week, primarily from institutional investors reallocating funds from traditional equity ETFs.

The European Central Bank’s latest monetary stance—which kept rates unchanged amid slowing inflation—has strengthened investor interest in digital assets as a hedge against long-term currency devaluation.

Recent Bitcoinnews highlights several key developments

- The launch of a new Bitcoin futures ETF in Japan under the Osaka Digital Exchange has sparked Asian demand.

- El Salvador announced its second Bitcoin bond issuance, attracting more than $600 million in pre-sale commitments.

- A major update to the Lightning Network protocol has been successfully integrated, significantly improving transaction throughput and lowering fees—boosting real-world adoption potential.

- Finally, institutional accumulation wallets continue to grow, with addresses holding over 1,000 BTC increasing by 3.8% in November, according to on-chain trackers.

Overall, Bitcoin’s technical and fundamental outlook remains robust. On-chain indicators point to accumulation and limited sell pressure, while macroeconomic and regulatory trends favor continued institutional participation. If BTC maintains support above $91,000 USD, the short-term projection targets $97,000–$100,000 USD by mid-December 2025.