TL;DR

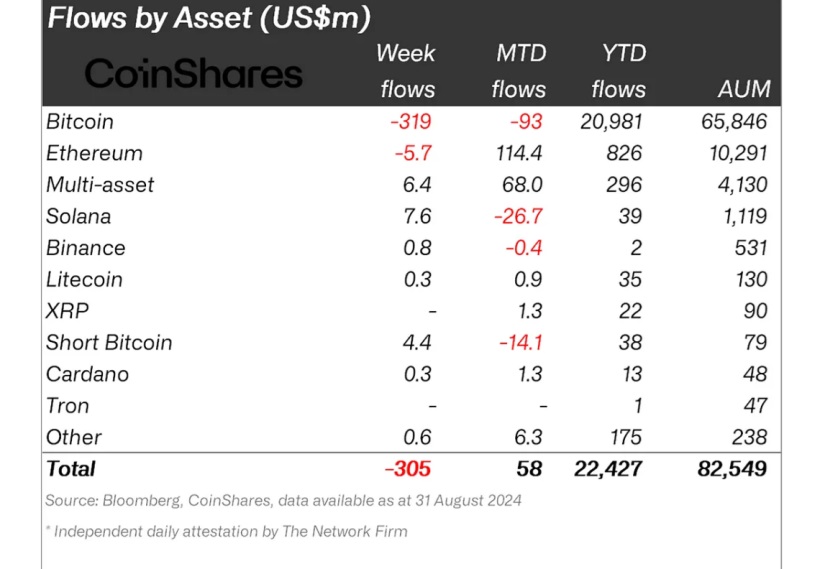

- Digital asset investment products experienced outflows totaling $305 million, driven by strong macroeconomic data in the U.S.

- Bitcoin suffered the largest outflows with $319 million, although short BTC investment products saw inflows of $4.4 million, the largest positive flow since March.

- Ethereum experienced outflows of $5.7 million and stagnant trading volumes, while Solana saw inflows of $7.6 million. Regionally, the U.S. led the outflows.

Over the past week, digital asset investment products saw a sharp decline in inflows, with a total of $305 million in outflows. This trend has been influenced by stronger-than-expected macroeconomic data in the United States, which has reduced expectations for an interest rate cut by the Federal Reserve.

Negative sentiment has been particularly focused on Bitcoin, which recorded outflows of $319 million. However, short BTC investment products have experienced a second consecutive week of inflows, totaling $4.4 million. This positive flow in short investment products is the largest recorded since March of this year, indicating a growing interest in strategies that benefit from declines in Bitcoin prices.

Ethereum has also been in decline, with outflows of $5.7 million. Trading volumes in Ethereum have stagnated, reaching only 15% of the levels observed during the U.S. ETF launch week, reflecting reduced activity similar to pre-launch levels. In contrast, Solana has seen inflows of $7.6 million, demonstrating marked interest in the cryptocurrency despite the general outflows in the market.

Assets Suffer and Blockchain Infrastructure Grows

Regionally, the U.S. has been the epicenter of outflows, totaling $318 million. In Europe, Germany and Sweden also saw smaller outflows, with $7.3 million and $4.3 million, respectively. On the other hand, Switzerland and Canada recorded smaller inflows, with $5.5 million and $13 million, respectively.

Despite the overall negative trend for assets, blockchain-related equities have countered the decline by recording inflows of $11 million, particularly into Bitcoin mining-specific investment products. Persistent interest in the blockchain infrastructure sector is becoming evident.