TL;DR

- Bitcoin failed to break above $90,000 and retraced to $87,830, triggering $250 million in liquidations, almost $200 million of which were long positions.

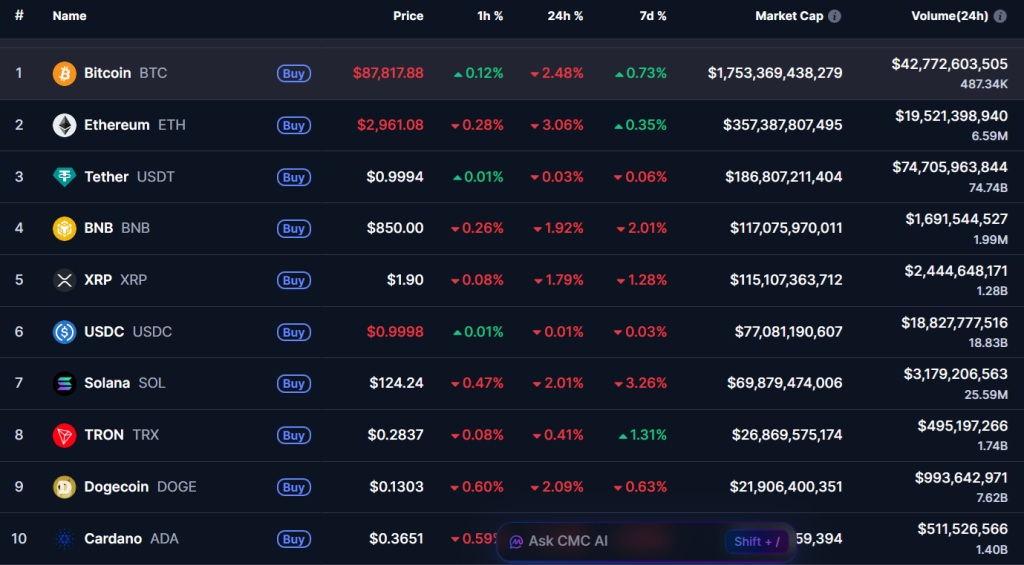

- Altcoins felt the pressure: Ethereum trades at $2,960, while SOL, TRX, DOGE, ADA, XRP, and BNB fell between 0.4% and 3%.

- Only HASH rose 8.4% and Rain gained 6.5%, while NIGHT dropped 21% and PUMP declined 13%.

Bitcoin failed to surpass $90,000 and pulled back, dragging the broader market down. In the past 24 hours, most cryptocurrencies traded lower amid a period of high volatility and low speculative activity. Attempts by BTC and leading altcoins to reclaim key technical levels failed again just before the end of 2025.

Bitcoin reached a high of $90,536 but could not hold that level and is now trading around $87,830, down 2.5%. Liquidations over this period totaled roughly $250 million, a 27% increase from the previous day. Nearly $200 million of that came from long positions, according to Coinglass data.

This pullback leaves Bitcoin on track to close the fourth quarter with a loss of about 22%, its weakest Q4 performance since the 2018 bear market. The combination of on-chain signals, macro pressure, and reduced speculative activity suggests a fragile short-term outlook.

The Market Faces Bitcoin’s Bearish Pressure

Altcoins follow the same pattern. Ethereum failed to hold above $3,000 and currently trades near $2,960, showing losses similar to BTC. SOL, TRX, DOGE, ADA, XRP, BNB, and other altcoins dropped between 0.4% and 3%.

Only a few assets moved against the trend. HASH from Provenance Blockchain rose 8.4%, followed by Rain with a 6.5% gain. In contrast, NIGHT fell 21% after a bullish month, while PUMP, the native token of Pump.fun, dropped 13% over the same period.

The market shows a weak consolidation pattern with frequent corrections. Bitcoin struggles to hold key psychological levels, and the effect extends to altcoins, generating significant liquidations and limiting market recovery. Current figures indicate that, despite occasional rallies, selling pressure and volatility could persist at least through the final days of the year.