TL;DR

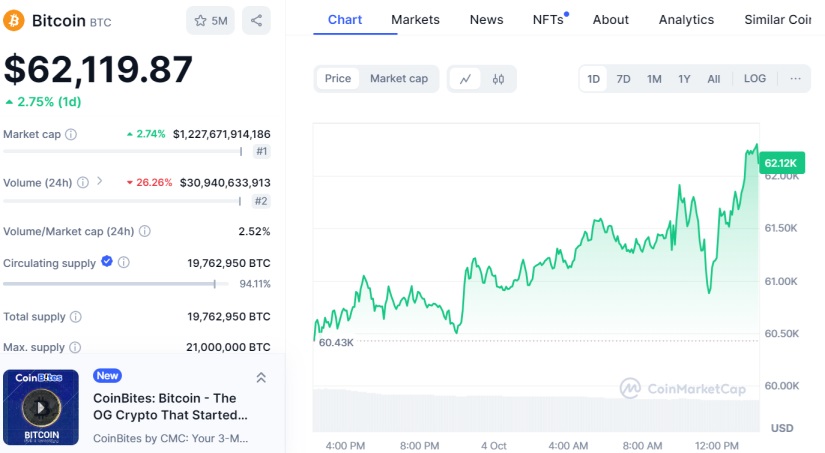

- The cryptocurrency market experiences a surge following the U.S. jobs report in September, with Bitcoin rising 2.75% to $62,119 and Ethereum up 3.6% to $2,425.

- The U.S. economy added 254,000 jobs, exceeding the expectation of 150,000, which could lead the Federal Reserve to adopt a more gradual approach to interest rate cuts.

- Daily liquidations in the market fell from $300 million to $128 million, reflecting lower selling pressure.

The cryptocurrency market has seen an excellent rebound after the release of the September jobs report in the United States, which exceeded analysts’ expectations. Bitcoin (BTC) has appreciated 2.75%, reaching a price of $62,119, while Ethereum (ETH) has risen 3.6%, settling at $2,425.

The report from the U.S. Department of Labor revealed that the economy added 254,000 jobs in September, a number significantly higher than the forecast of 150,000 jobs. This solid figure is a positive indicator that could lead the Federal Reserve to adopt a more gradual approach to interest rate reductions, providing a favorable environment for the crypto market.

Daily Liquidations Fall

As a result of the bullish trend, daily liquidations in the market have decreased, falling from $300 million to $128 million in a single day, demonstrating that there is less selling pressure in the sector.

Among the altcoins, the FTX token (FTT) performed the best, with a 17.7% increase in the last 24 hours, reaching a price of $2.34. Aave (AAVE) experienced a 6% rise, reaching $150 per unit. Sui (SUI) initially fell and then rebounded, rising 4.75% to $1.74.

Performance of Major Cryptocurrencies

In terms of major cryptocurrencies, Solana (SOL) surpassed $143.5 after a 5.23% increase. BNB (BNB) reached $555 thanks to a daily increase of 2.15%. Dogecoin (DOGE) rose to $0.1087 after climbing 4.5%. Shiba Inu (SHIB) achieved very good results, rising nearly 10% to reach a value of $0.00001751, and Avalanche (AVAX) rose to $26.24 thanks to a 7.6% increase.

Despite geopolitical tensions in the Middle East impacting Bitcoin’s performance and the market in general, trading firm QCP maintains an optimistic outlook, anticipating that the October rally, known as “Uptober,” will continue.

On the other hand, the landscape for exchange-traded funds (ETFs) was not as favorable. Bitcoin ETFs reported net outflows totaling $54 million, with the Ark Bitcoin ETF highlighting $58 million in withdrawals. The situation for Ethereum ETFs was not better, reporting $3.2 million in net outflows, although BlackRock’s iShares Ethereum Trust attracted $12.08 million in inflows, partially offsetting the losses.

Regarding Bitcoin investors’ positions, data from Glassnode indicates that many are moving their coins into long-term storage, signaling a growing level of confidence in the asset’s future. Additionally, the recent recovery of BTC, which reached $66,000, marked a new high since its historical peak in March, consolidating an accumulation trend among long-term holders. U.S. stock markets also reflected this positive trend, with increases in the Dow Jones, S&P 500, and Nasdaq indices.