TL;DR

- An advanced methodology has been developed to identify seller exhaustion across different timeframes in he crypto market.

- The creation of the Breakdown Metrics tool was carried out by a team of professionals from UkuriaOC, CryptoVizArt, and Glassnode.

- It utilizes on-chain metrics to evaluate both unrealized and realized losses of investors, focusing on MVRV Ratios, SOPR, and Realized Loss.

Recently, a group of experts has developed an advanced methodology to identify seller exhaustion across different timeframes, which could have a considerable impact on how investors operate in the crypto market.

This new tool, known as Breakdown Metrics, was designed by a team of professionals from UkuriaOC, CryptoVizArt, and Glassnode. Its main objective is to provide a precise and effective framework for identifying critical points of unrealized loss and investor capitulation across various timeframes.

Using our new #Bitcoin Breakdown Metrics, we are now able to discretely isolate points of severe unrealized loss, and investor capitulation.

In this article, we introduce a new framework to assess seller exhaustion across multiple timeframes and investor cohorts.

Discover more… pic.twitter.com/jJaBneoZuU

— glassnode (@glassnode) May 14, 2024

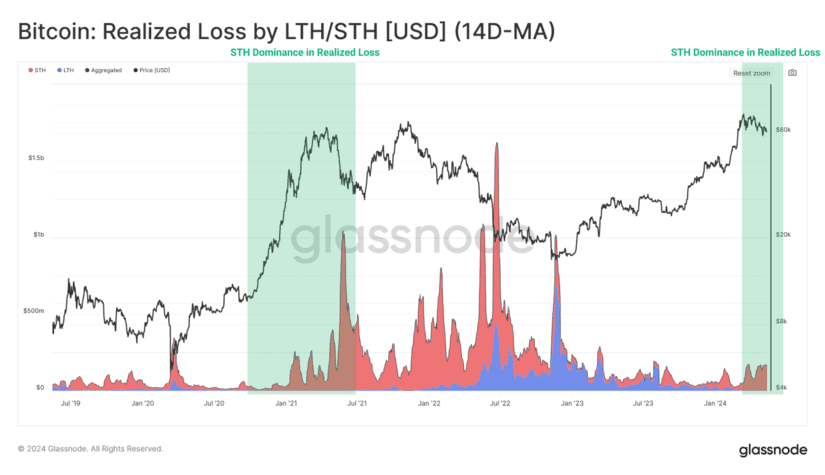

Essentially, this methodology utilizes on-chain metrics to evaluate both unrealized and realized losses from different investor groups. During bullish market periods, long-term investors are often highly profitable, while short-term investors may be the main source of realized losses.

The concept of seller exhaustion refers to a point where the majority of sellers have sold their assets, often indicating a potential change in market direction. Identifying these points of exhaustion can be crucial for traders looking to enter or exit the market at opportune times.

A New Approach to Analyzing the Crypto Market

To conduct this analysis, three main metrics are utilized: the MVRV Ratio, which evaluates unrealized losses of investors within a cohort; the SOPR, which assesses the average magnitude of gains or losses locked in by the cohort; and the Realized Loss, which isolates the magnitude of USD-denominated losses locked in by the cohort.

The methodology also distinguishes between different investor groups, such as daily traders and weekly-monthly swing traders. This allows for a deeper understanding of how different types of investors react to market changes and how this may influence future price direction.

The Breakdown Metrics will offer investors a new tool to understand and anticipate movements in the crypto market. By providing greater transparency and detailed analysis of investor behavior, it could help improve decision-making and optimize trading strategies.