TL;DR

- The crypto market has experienced a wave of forced selling after the liquidation of more than $920 million in long positions over the past three days.

- The situation is exacerbated by the financial pressure on Bitcoin miners and the sale of BTC by the German government, as well as the reimbursement to creditors of the Mt. Gox exchange.

- Daily miner revenues have decreased by 75% since the halving, and transaction fees now represent only 3.7% of their total revenue.

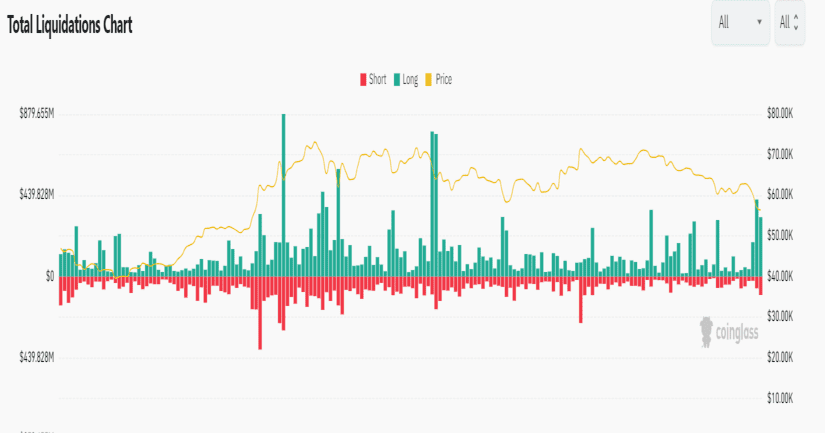

The crypto market has experienced a strong wave of forced selling after the liquidation of more than $920 million in long positions over the past three days, around $446 million in the last 24 hours, according to CoinGlass data.

The massive liquidation was the largest since April and coincides with a process of widespread sales that have led to the total market capitalization dropping by more than $400 billion in the last month and $65 billion in just the last 24 hours. Bitcoin fell to a low of $53,700 before starting a slight recovery, standing at $56,300 at the time of writing this article. Ethereum, on the other hand, has fallen 4% and broke the $3,000 floor, now trading at $2,987.

Regarding the weekly drop in the rest of the crypto market, BNB (BNB) fell 13% and is trading at $495.3. Solana (SOL) dropped 5.7% and its price is $133.7. XRP (XRP) is trading at $0.4235 after falling 11%. Dogecoin (DOGE) lost 17.6% of its value and its current price is $0.1029.

At the same time, the situation is aggravated by the financial pressure on Bitcoin miners following the last halving. Some have been forced to sell part of their BTC reserves. In addition, the German government has been moving funds from a wallet with more than 46,000 BTC to various exchanges.

A Tough Test for the Crypto Market

On the other hand, the Mt. Gox exchange has begun reimbursing its creditors, concluding a ten-year waiting period for users to recover their assets. Mt. Gox dominated Bitcoin trading volumes before suffering a hack in 2014 that resulted in the loss of approximately 740,000 BTC and its subsequent bankruptcy. Part of these BTC was recovered and is now being returned to creditors, who analysts believe will likely sell their holdings on the market.

According to data compiled by CryptoQuant, daily miner revenues have decreased by 75% since the halving, currently sitting at $26.5 million. Transaction fees have also dropped drastically, representing only 3.7% of their total revenue compared to a peak of 75% in April.

Le Shi, head of trading at the market-making and algorithmic trading firm Auros, stated that the price range between $51,000 and $52,000 is critical, as many Bitcoin miners are reaching their breakeven point for profitable mining. With all these factors on the table, the crypto market is facing a significant test of resilience.