TL;DR

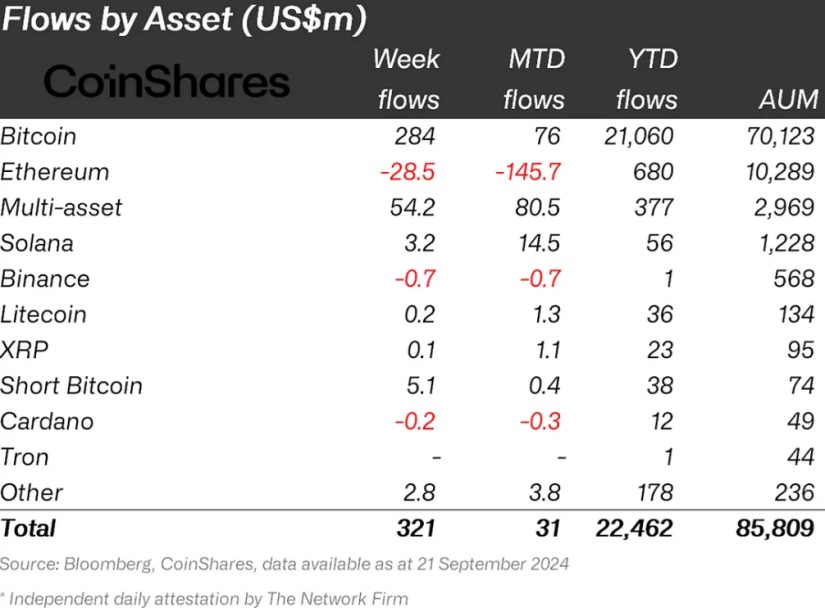

- Investment products in the crypto market have seen inflows of $321 million in the last week, driven by a 50 basis point interest rate cut.

- Bitcoin has captured the majority of the flows with $284 million, while short products have received $5.1 million.

- The U.S. led the inflows with $277 million, and Switzerland reached $63 million, while Germany, Sweden, and Canada experienced outflows of $9.5 million, $7.8 million, and $2.3 million, respectively.

The weekly report on digital asset flows has revealed that investment products in the crypto market have experienced a significant increase, reaching a total of $321 million in inflows during the last week.

This increase occurs in a context where the Federal Reserve of the United States has adopted a more dovish stance by cutting interest rates by 50 basis points, which has generated a positive effect on the crypto market. This has contributed to a 9% growth in total assets under management, now amounting to $9.5 billion.

Bitcoin has been the main player in the surge, capturing the majority of the flows with $284 million. The recent volatility in BTC prices has also led to an increase in investments in short products, which have received $5.1 million.

Despite the success in the Bitcoin market, Ethereum has had poor performance, registering outflows for the fifth consecutive week, totaling $29 million. This phenomenon is attributed to the persistent outflows from the Grayscale Trust and the lack of flows into the new exchange-traded funds (ETFs) that have emerged.

The Crypto Market Recovers in the U.S.

From a regional perspective, the flows have shown varied behavior. The United States has led the inflows with $277 million, while Switzerland has recorded the second-largest weekly inflow of the year with $63 million. In contrast, countries like Germany, Sweden, and Canada have seen outflows of $9.5 million, $7.8 million, and $2.3 million, respectively.

Regarding other assets, investment products in Solana have continued with a trend of small but steady inflows, accumulating $3.2 million last week. This outlook suggests that despite the volatility and outflows in certain assets, interest in cryptocurrency investment remains present and could strengthen as macroeconomic conditions adjust and new products are introduced to the market.