The crypto market plunged back into the red during the early Asian trading day on Wednesday ahead of the US Fed’s monetary policy due later today.

Bitcoin Slips Below $26K

Amid mounting pressure owing to macroeconomic conditions, SEC crackdown on digital assets along with other regulatory duress, the crypto market is floating mixed with Bitcoin (BTC) slipping below $26K. According to CoinMarketCap, the flagship token is down 1.06% in the last 24 hours to trade at $25,922. Meanwhile, over the past seven days, BTC has tanked more than 3% with the token’s dominance slipping 0.11% over the day to 47.62%

Over the past few days, Bitcoin had been changing hands between the $25,900 and $26,010 levels with no significant price movements. The downward trend comes shortly after the United States released its Consumer Price Index (CPI) data which increased just 0.1% for the month and 4% from a year ago. It seems the inflation rate cooled in May to its lowest annual rate in more than two years, taking pressure off the Federal Reserve to continue raising interest rates.

Experts Anticipate Rate Hike Pause

It is likely that investors and traders are keeping a close eye on the Federal Open Market Committee (FOMC) meeting scheduled for today before jumping into the market. Market experts anticipate a breather from the consecutive rate hikes is on the cards owing to the lagged effects of 10 rate hikes since March 2022.

Analysts at Wrightson ICAP said in predicting the Fed’s benchmark overnight lending rate would sit pat at 5-5.25%, citing, “the Fed will likely leave rates unchanged but warn that additional tightening is still possible in the months ahead.”

On the other hand, Bitcoin’s largest peer, Ethereum (ETH), was also down, crept marginally but remained under $1,750 levels. As per the data from CoinMarketCap, the second-largest digital asset dropped 0.36% in the last 24 hours to trade at $1,745. Over the past week, ETH spiraled down more than 6% amid heightened market turbulence.

Altcoins Trade Mixed

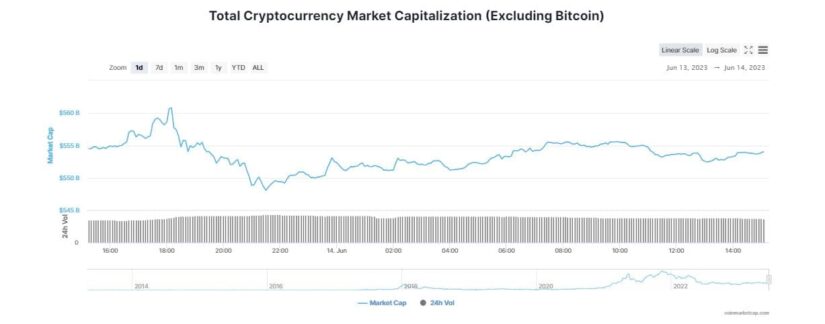

Along with the two poster boys of crypto – Bitcoin and Ethereum, the global crypto market cap decreased 0.41% over the past 24 hours to $1.06 trillion. However, the total crypto market volume over the last 24 hours increased more than 9% to $31.26 billion. In tandem with the broader crypto market, altcoins traded mixed with most of the digital tokens swimming in red.

Cardano (ADA) and Solana (SOL) plunged in the range between 2.38% and 2.84% in the last 24 hours to currently trade at $0.27 and $15.12, respectively. XRP shed a whopping 4.73% overnight. Similarly, Litecoin (LTC), Polkadot (DOT), and Dogecoin (DOGE) also trade with cuts over the past 24 hours.

Among the gainers, BNB surged more than nearly 4%, while Tron (TRX), Polygon (MATIC), Shiba Inu (SHIB), and Avalanche (AVAX) also surged marginally. Responding to the current market scenario, Shivam Thakral, CEO of BuyUcoin said in a statement,

“The crypto market may react sharply to the outcome of the FOMC meeting today as any relaxation in monetary policies will prove beneficial for the financial markets in the long term.”