TL;DR

- Bitcoin and Ethereum prices have shown weakness this week, with declines of 4.5% to 5%, and the overall cryptocurrency market has seen a 4.4% decrease on the day.

- The put/call ratio for Bitcoin is 0.59, and for Ethereum it is 0.50, indicating that there are twice as many long contracts as short ones about to expire.

- On August 30, 2024, Bitcoin and Ethereum options will expire, with a notional value of $3.65 billion and $1.35 billion, respectively.

On August 30, 2024, the expiration of Bitcoin and Ethereum options will take place, which could influence market dynamics. About 62,000 BTC options contracts are expiring, with a notional value close to $3.65 billion.

The event is notable for its size and its coincidence with the end of the month. Additionally, it is often an indicator of market sentiment rather than a direct trigger for movements in spot markets.

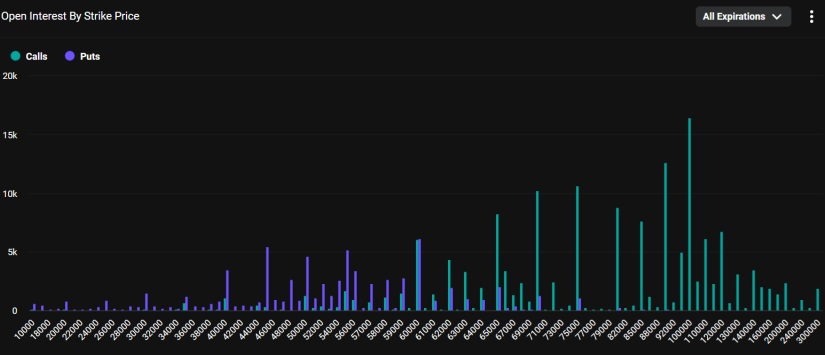

The put/call ratio for Bitcoin options is 0.59, which indicates that there are nearly twice as many long contracts as short ones about to expire. Open interest at strike prices of $70,000 and $75,000 remains high, with values of $793 million at the $90,000 strike price and $987 million at the $100,000 strike price, according to Deribit. These contracts represent a significant portion of the market and could influence short-term volatility.

Additionally, today Ethereum options with a notional value of $1.35 billion are expiring, distributed across 536,000 contracts. The put/call ratio for Ethereum is 0.50, suggesting that there are twice as many long contracts as short ones. Open interest is highest at the $4,000 strike price, which has $373 million in open contracts.

On the other hand, cryptocurrency prices have shown signs of weakness this week. The total market capitalization has dropped by approximately $330 billion, standing at $2.04 trillion, following a 4.4% decline on the day. Bitcoin, which had reached an intraday high of $61,000, was rejected at that resistance and has fallen back to $58,100. Ethereum, which approached $2,600, also failed to break its resistance, dropping to $2,450.

How Did the Crypto Market React?

The two most important cryptocurrencies in the industry show losses of between 4.5% and 5%. The rest have followed the same trajectory. BNB (BNB) fell by 3.3% and is trading at $525. Solana (SOL) is trading at $133.5 after losing 8.9% of its value in the last 24 hours. XRP (XRP) fell by 4% and is around $0.5505. Dogecoin (DOGE) is down 3% and trading at $0.099 per unit. Cardano (ADA) and Avalanche (AVAX) have also been significant losers of the day, with values of $0.3417 and $22.47 respectively, suffering losses of 6.5% and 8.5%.

The impact of this options expiration event is particularly relevant given the volume involved, and while the direct effect on spot markets is usually limited, the increase in volatility of Bitcoin and Ethereum prices could provide clues about the market’s future direction.