TL;DR

- Crypto investment products saw net outflows of $352M and lower trading volumes despite expectations of a rate cut.

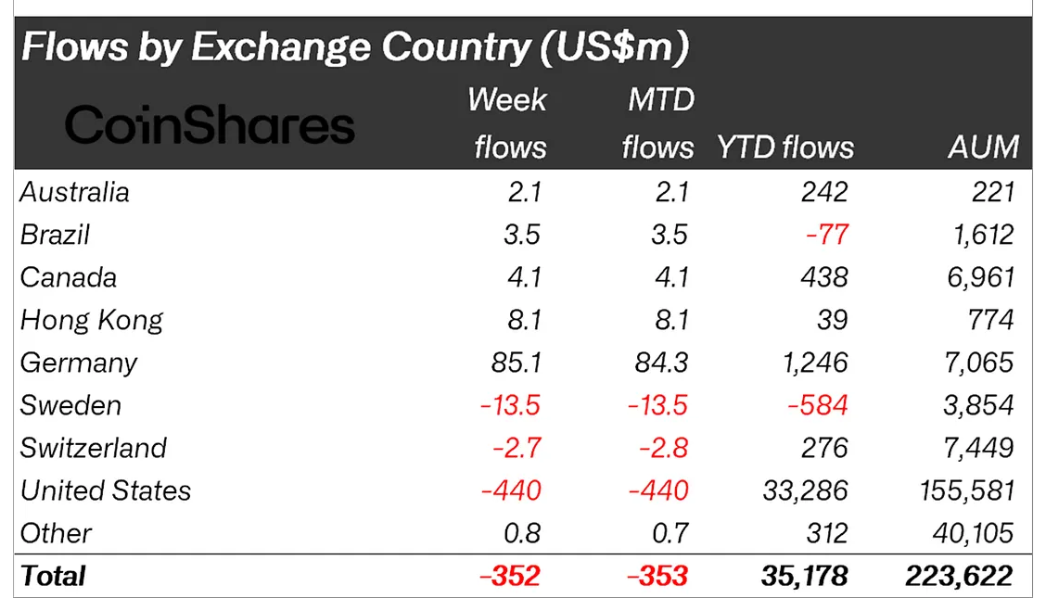

- The United States led withdrawals with $440M, while Germany added $85.1M and Hong Kong $8.1M in inflows.

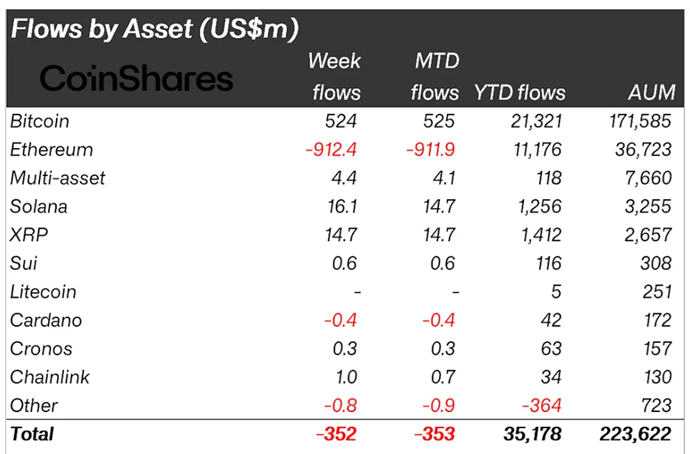

- Bitcoin attracted $524M in positive flows, Ethereum lost $912M over seven days, and Solana extended its streak of weekly inflows to 21 weeks, totaling $1.16B in 2025.

Crypto investment products recorded net outflows of $352M last week, amid weak U.S. employment data and expectations for a September rate cut. Despite conditions that might have boosted interest in digital market, investor appetite declined, and trading volumes fell 27% compared to the previous week.

Year-to-date inflows remain strong at $35.2B. Projected over twelve months, this figure exceeds 2024’s $48.5B by 4.2%, indicating that while caution dominates in the short term, the overall trend continues to favor crypto-linked products.

Regional performance varied. The U.S. accounted for $440M in outflows, while Germany attracted $85.1M and Hong Kong $8.1M in new inflows. Markets move differently depending on regulatory frameworks and the composition of investors in each region.

Shifts to New Cryptocurrencies and Markets

Bitcoin drew $524M in new inflows, showing that part of the funds exiting other products migrated to BTC. Ethereum drove most of the outflows, losing $912M across seven consecutive trading days and across multiple ETP issuers. Despite this negative streak, Ethereum’s year-to-date inflows remain strong at $11.2B.

Solana continues to stand out for its consistency, reaching its 21st consecutive week of inflows and totaling $1.16B in 2025. XRP also maintained positive flows, accumulating $1.22B over the same period. Both tokens indicate that investors are seeking diversification beyond BTC and ETH, favoring projects that have gained traction in use cases and liquidity.

The market reflects an adjustment in short-term expectations but retains solid foundations that support ongoing interest in crypto investment products over the medium term