TL;DR

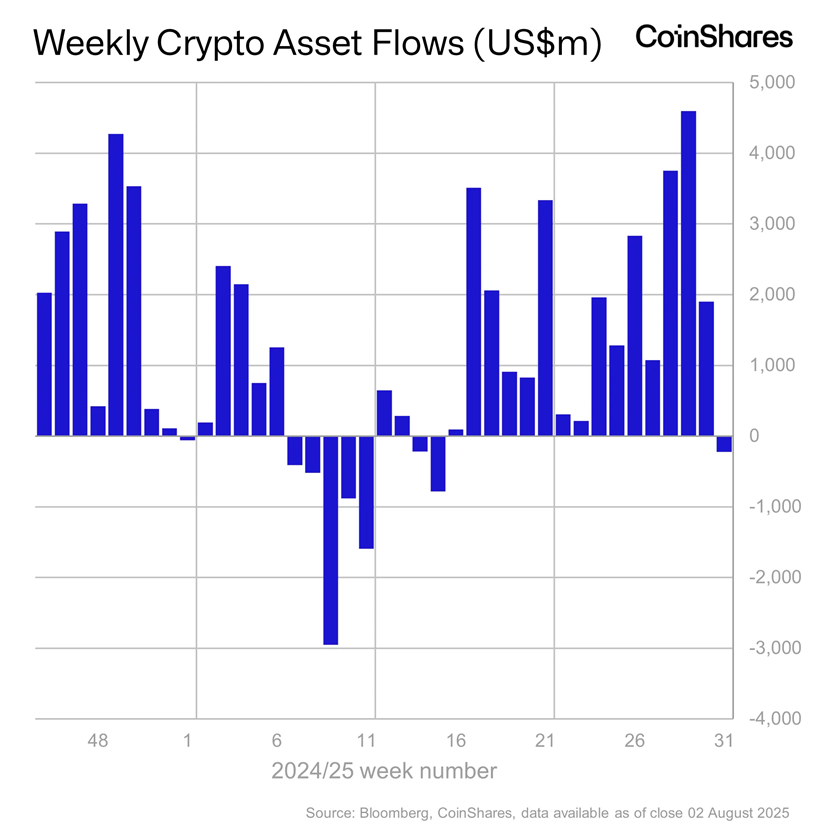

- Crypto investment products saw $223 million in outflows after 15 straight weeks of inflows, driven by uncertainty over interest rates.

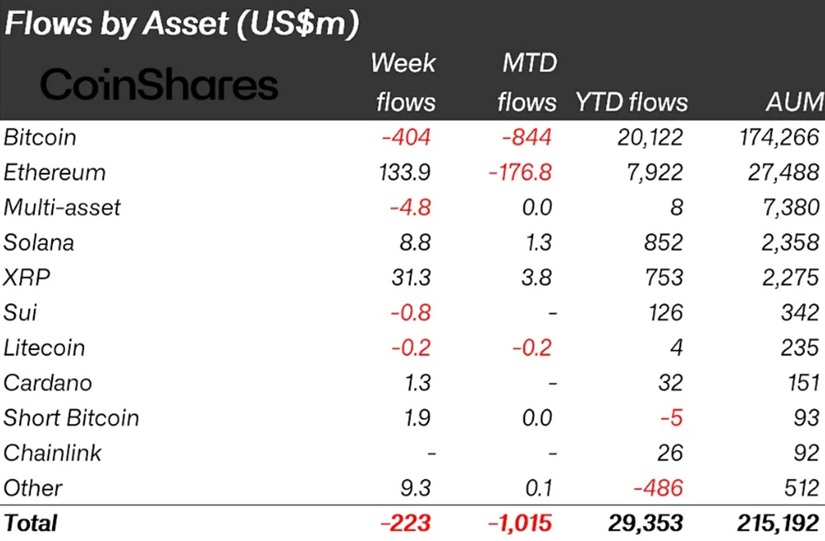

- BTC posted $404 million in outflows, while ETH brought in $133 million and marked its 15th consecutive week of positive flows.

- Despite the weekly pullback, net inflows over the past month reached $12.2 billion—half of the total accumulated so far in 2025.

Crypto-linked investment products broke a 15-week streak of capital inflows and recorded net outflows of $223 million, according to the latest CoinShares report.

The shift came after the Federal Reserve signaled it may keep interest rates elevated for longer, following economic data that showed a strong labor market and persistent inflation in the U.S.

During the first half of the week, inflows remained positive and reached $883 million. However, things changed after the Federal Open Market Committee (FOMC) meeting. On Friday, there was a sharp reversal, with over $1 billion pulled from the market, driven by a shift in institutional investors’ risk perception.

Bitcoin accounted for the largest share of the withdrawals, with $404 million in outflows. Despite this short-term setback, BTC has accumulated $20 billion in net inflows so far this year. Ethereum, on the other hand, continued to attract capital, with $133 million in new inflows and 15 straight weeks of positive momentum—highlighting ongoing interest even amid broader market caution.

30 Days of Massive Inflows for the Crypto Market

Other cryptocurrencies also managed to attract funds. XRP saw $31.2 million in inflows, Solana took in $8.8 million, and Sei added $5.8 million. In the case of Aave and Sui, inflows were more modest, with $1.2 million and $800,000 respectively. These figures show that despite the overall decline, some investors are still betting on tokens with specific fundamentals or medium-term prospects.

Over the last 30 days, crypto investment products have seen $12.2 billion in inflows, accounting for half of the total recorded so far in 2025. While last week marked a pause, the overall volume remains high. The report attributes part of the recent outflows to profit-taking after several weeks of strong inflows, rather than a full-scale retreat from the market. Macroeconomic volatility has once again weighed on sentiment, but hasn’t yet reversed the broader capital trend toward cryptocurrencies.