TL;DR

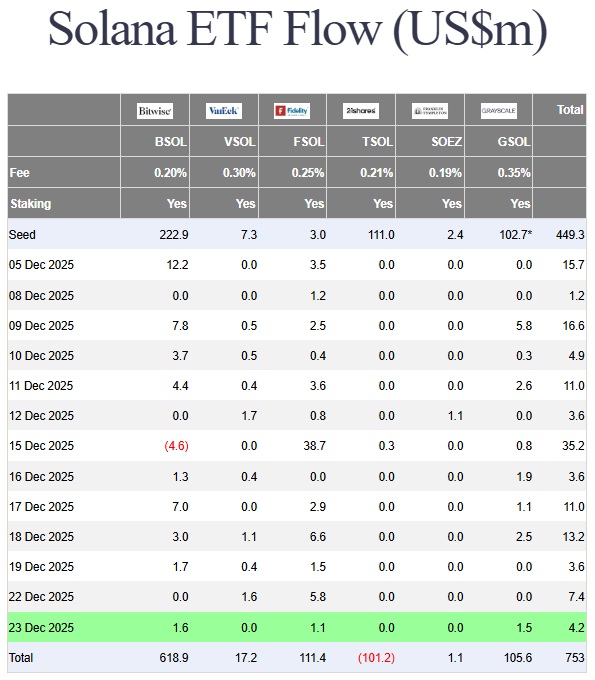

- XRP and SOL ETFs maintain consistent gains: XRP has accumulated $1.13 billion and SOL $754 million since November and December, respectively.

- Bitwise BSOL is the largest SOL fund with nearly $620 million in net inflows.

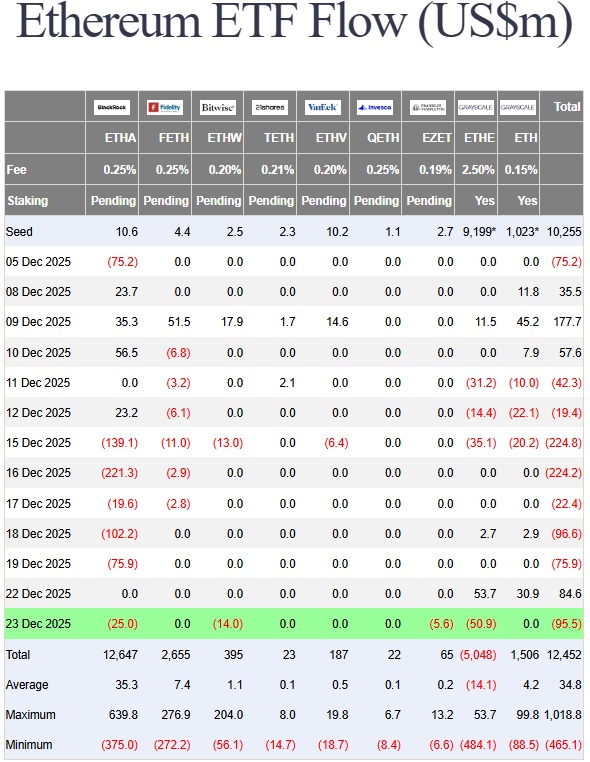

- BTC and ETH funds continue to register outflows: BTC has lost nearly $6 billion since October and ETH almost $3 billion.

Cryptocurrency ETFs show opposing dynamics as 2026 approaches. XRP and SOL funds maintain a streak of gains, while Bitcoin and Ethereum funds continue to see significant net outflows.

Since the debut of the first spot XRP ETF on November 13, Canary Capital XRPC, net inflows have never been exceeded by outflows. On December 23, XRP ETFs added $8.19 million, and the previous Monday they received $43.89 million. According to SoSoValue data, the total accumulated net inflows in these funds reached $1.13 billion. The consistency of the flow demonstrates investor interest, who see XRP as a more stable product.

Solana has also achieved success. The eight spot SOL ETFs were last in the red on December 3 and have since accumulated over $130 million in net inflows. The total accumulated reaches $754 million, behind XRP. Bitwise BSOL is the largest, with nearly $620 million in cumulative net inflows, while 21Shares TSOL remains in negative territory, showing that investor appetite varies across different funds.

Divergence Between Alternative and Established ETFs

In contrast, Bitcoin and Ethereum ETFs have lost significant momentum. Spot BTC funds peaked at $62.77 billion in net inflows on October 9, but have since fallen nearly $6 billion, reaching $57.08 billion as of yesterday. That same day, an additional $188.64 million left the funds. BlackRock IBIT, the largest Bitcoin fund, continues to register outflows, a sign of reduced interest in the industry’s more established products.

Spot ETH ETFs follow a similar pattern. Since December 11, only December 22 showed positive inflows of $84.59 million, while yesterday net outflows reached $95.53 million. From their October peak of $15.09 billion, Ethereum funds have lost nearly $3 billion.