TL;DR

- The September CPI will be released during a government data blackout, giving the report unusual influence over risk assets.

- The Federal Reserve meets five days later, so any inflation surprise could directly shape expectations for further rate cuts.

- Crypto markets may still react positively to a slightly hotter reading if traders believe the Fed will stay accommodative.

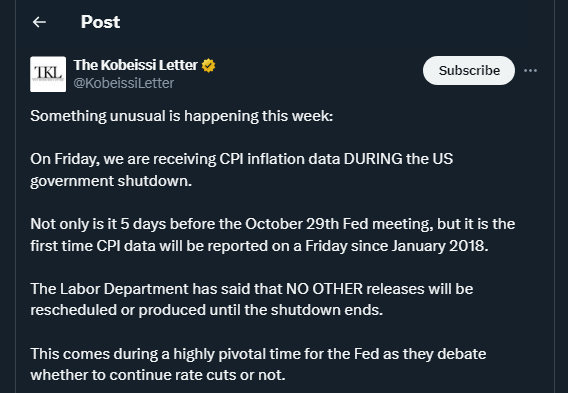

The release of September’s CPI this Friday has become a central focus for investors positioning around liquidity trends. The Bureau of Labor Statistics confirmed the data will go ahead despite the shutdown, a rare exception that underscores its weight. With the Federal Open Market Committee set to meet days later, the compressed timing leaves little room for policy recalibration and heightens the chance of rapid repositioning across futures and spot markets.

Inflation data from the summer showed a mixed path. Headline CPI climbed 0.4% in August and reached 2.9% year over year, while core inflation held at 3.1%. Traders now treat this week’s figure as a key driver of how aggressively the Fed may cut before year-end. Derivatives markets are still pricing in another rate reduction, but confidence depends on Friday’s reading and how policymakers interpret secondary indicators like wage growth.

Market Sensitivity Builds

Crypto has consistently shown that liquidity expectations move pricing more than isolated headlines. When real yields fall and financial conditions ease, Bitcoin and other large-cap assets tend to attract inflows. Analysts say even a slightly above-consensus print could be tolerated if policymakers reinforce a dovish stance. Sentiment data and PMI numbers due later that same day may add traction to whichever direction markets choose, especially for leveraged traders seeking short-term volatility.

Because most federal data releases are paused, Friday’s CPI commands disproportionate attention. With no other official figures to counter it, traders are likely to dissect every section of the report looking for policy signals and momentum cues.

Implications For Digital Assets

Recent capital rotation has favored large-cap coins and DeFi-linked tokens. Supportive policy expectations could carry that strength into November. A hotter inflation surprise might trigger a temporary dip, but investors appear ready to re-enter on weakness if rate-cut bets hold.

Global crypto market capitalization remains above $3.5 trillion, and the upcoming session is widely seen as a test of sentiment and faith in continued monetary support. How markets respond on Friday could set the tone for the rest of the month, shaping trading flows and volatility across derivatives, spot holdings, and institutional allocations.