TL;DR

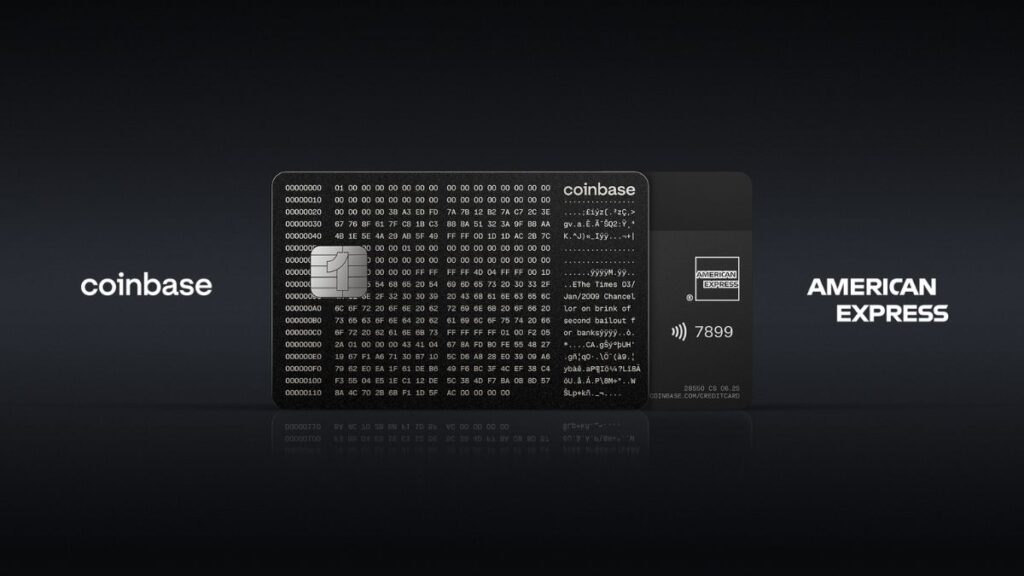

- Coinbase has removed the waitlist for the One Card, giving access to hundreds of thousands of users in the United States.

- The card, developed in partnership with American Express, offers between 2% and 4% Bitcoin cashback and allows bill payments with crypto or linked bank accounts, with no international transaction fees.

- Available exclusively to subscribers, the card aims to integrate Bitcoin into everyday financial use.

Coinbase has removed the waitlist for its Coinbase One Card, opening access to hundreds of thousands of U.S. users.

The card, created in collaboration with American Express, offers up to 4% Bitcoin cashback depending on how much crypto the user holds on the platform, with a minimum of 2% for all cardholders. Bills can be paid either from a linked bank account or directly with crypto on the exchange, with no international transaction fees.

COSTS OF THE COINBASE ONE CARD

The card is available exclusively to subscribers of the premium Coinbase One service, which costs $49.99 per year or $29.99 per month. The company also offers a basic plan with fewer benefits for $5 per month or $49.99 per year. The exchange reported that early cardholders have deposited over $200 million on the platform to boost their rewards and have spent an average of $3,000 per month.

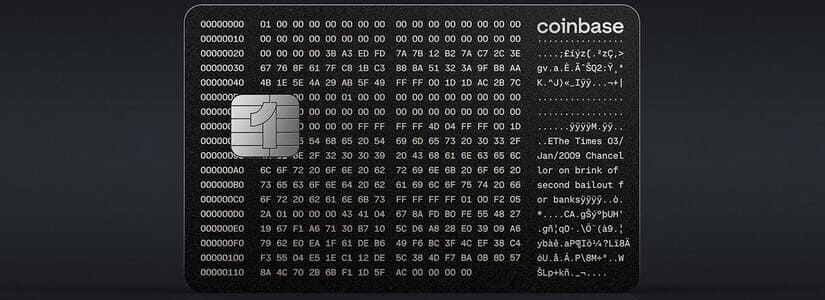

The physical card includes data from the Genesis Block, the first block created by Satoshi Nakamoto, and its name references the coinbase transaction—the initial record through which new bitcoins are created and assigned to miners. The product focuses solely on Bitcoin, with rewards calculated on all purchases regardless of spending category. Users receive their benefits directly in BTC.

Bitcoin In Everyday Finances

The card features a variable accumulation mechanism, allowing users to increase their rewards as their crypto balances grow. Initial data shows consistent usage, driven by user confidence and growing adoption of the product. The exchange aims to generate subscription-based revenue and strengthen relationships with customers seeking a direct integration of Bitcoin into their daily finances.

With this card, Bitcoin could position itself as a practical, spendable asset in everyday life, offering simple access and direct rewards