TL;DR

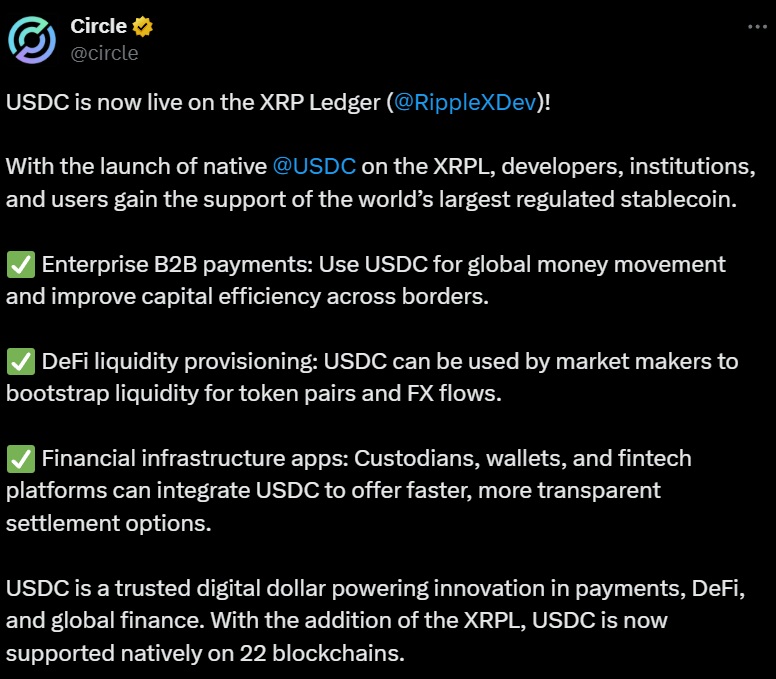

- XRP Ledger adds USDC to its mainnet and enables direct issuance and operations through Circle’s Mint and API platforms.

- The blockchain plans to launch an EVM-compatible sidechain in 2025, allowing Ethereum contracts to run without leaving the XRPL environment.

- USDC now holds 25% of the stablecoin market, and its arrival on XRPL boosts liquidity for payments, decentralized apps, and DeFi services.

XRP Ledger officially integrated USDC into its main network, just a week after Circle’s stock market debut. From now on, the Mint and API platforms can issue and manage USDC directly on XRPL, improving available liquidity and making it easier to integrate the stablecoin into applications and services running on the network.

With this addition, XRP Ledger expands its range of supported assets and enables transactions using one of the world’s most widely circulated stablecoins. This gives users more options for payments, transfers, and decentralized applications that require liquidity and fast settlement, without leaving the XRPL ecosystem.

The blockchain is also preparing to launch a sidechain compatible with the Ethereum Virtual Machine in the second fiscal quarter of 2025. This solution will allow Ethereum-based smart contracts to run on a faster, lower-cost infrastructure, without affecting the liquidity or speed of transactions on the main network.

Can Circle Steal Market Share from Tether?

The news follows Circle’s stock market debut on June 5, after several unsuccessful attempts since 2021. The company opened at $30 per share and soared to $90 on its first day, marking a gain of nearly 200%. Today, USDC accounts for 25% of the $240 billion stablecoin market, second only to USDT, which holds 65%.

Meanwhile, XRP remains the fourth-largest cryptocurrency by market capitalization, with a total value of $131.8 billion. At the time of the latest update, its price stood at $2.24, after a 3.41% daily drop and with $2.2 billion traded in 24 hours.

The integration of USDC will strengthen XRP Ledger’s infrastructure for financial applications and position it to compete in markets where instant liquidity and Ethereum compatibility will be decisive