TL;DR

- The Bitcoin network lost nearly 31% of its hash rate in one week, falling to 876.4 EH/s after the shutdown of large-scale mining operations in China.

- The focus was on Xinjiang, where the coordinated shutdown of roughly 400,000 ASIC machines removed between 80 and 100 EH/s.

- Bitcoin is trading around $89,930, with the $90,000 level remaining a key reference.

The Bitcoin network recorded a sharp drop in computing power following a series of concentrated shutdowns in China. Hash rate fell to 876.4 EH/s on December 15, down from 930 EH/s the previous day. Over the past week, the contraction was far more severe: from levels near 1.27 ZH/s, the network lost roughly 31% of its capacity.

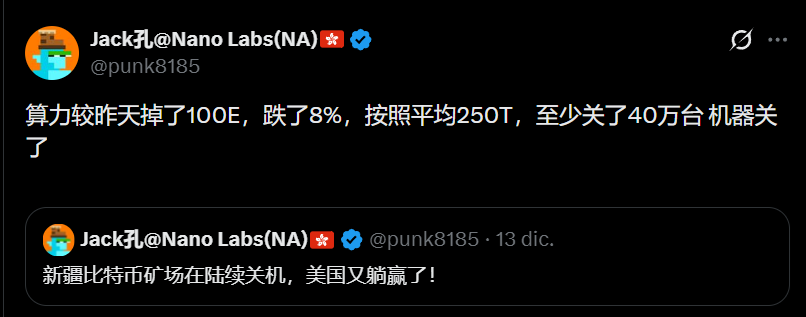

All available data points to a specific regional event rather than scattered technical failures or weather-related issues. The focus is on Xinjiang, where Jianping “Jack” Kong, founder of Nano Labs and former Canaan executive, linked the decline to renewed regulatory enforcement. According to his estimate, around 400,000 ASIC machines were shut down in a short period, removing between 80 and 100 EH/s from the system.

Local crypto media reported coordinated closures at large mining farms located in industrial parks across the region. China’s mining ban has been in place since 2021, but enforcement has been uneven for years. In this case, the simultaneity of the shutdowns indicates an organized action rather than a minor administrative adjustment. Major mining pools also reported double-digit week-over-week declines, consistent with the scale of the outage.

Bitcoin’s Resilience Is Tested Once Again

In the short term, reduced competition for blocks alters BTC’s economic dynamics. Block production may slow, and profitability for active miners tends to improve until the difficulty adjustment takes effect. That mechanism will rebalance the network and restore block times toward the ten-minute average. The structural impact on protocol security remains limited if the drop does not persist.

Bitcoin’s price currently hovers around $89,930, with minimal daily movement and a weekly decline of more than 2%. The $90,000 zone serves as the immediate reference level. Reclaiming it would help stabilize the short-term outlook amid operational uncertainty.

This episode highlights that a meaningful share of hash rate can still be affected by concentrated regulatory decisions. At the same time, it confirms that the network absorbs large-scale shocks without altering its core rules. The signal for the market is not an imminent collapse, but another stress test that reinforces the resilience of Bitcoin’s structure